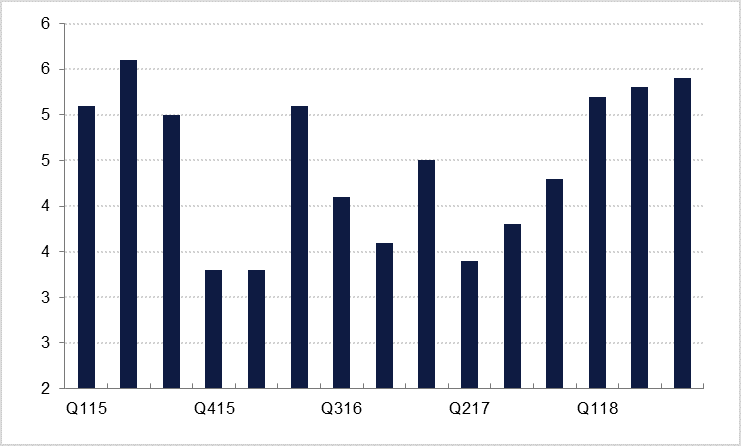

- Growth outlook: Egypt’s pick-up in growth has slowed a little in recent quarters, as the authorities have pursued macroeconomic stability at the cost of a more rapid expansion in the economy. According to the communique from the Central Bank of Egypt’s latest MPC meeting on June 28, real GDP growth in the third quarter of fiscal 2017/18 was 5.4%, compared to 5.3% the previous quarter and 3.8% in Q3 FY2016/17.

- Fiscal policy: Egypt achieved a primary budget surplus equivalent to 0.2% of GDP in the 2017/18 fiscal year ended in June, the first time this has been achieved in over a decade. In 2018/19 we anticipate that this surplus will expand to 1.9% of GDP as further progress is made on fiscal reforms. However, the overall budget deficit will remain wide at 8.5% as the cost of servicing the country’s considerable debt load will weigh on public finances.

- Balance of payments: Egypt ran a balance of payments surplus of USD 11.0bn over the first three quarters of 2017/18, matching the surplus recorded over the same period a year earlier. This has seen the Central Bank of Egypt’s FX reserves climb to a record USD 44.6bn in June, compared to USD 31.3bn in June 2017 and just USD 17.6bn in June 2016. The robust balance of payments surplus has contributed to greater macroeconomic stability, a steadier currency, and improved investor confidence. However, the pace of reserves accumulation has slowed markedly over the three months not yet covered in the recent balance of payments data release.

- Monetary policy: As was widely expected, the Central Bank of Egypt kept its benchmark interest rates unchanged at its meeting on June 28, namely 16.75% for the overnight deposit rate and 17.75% for the overnight lending rate. The CBE’s cutting process has been put on hold as a number of key factors have led the bank to adopt a more cautious approach to monetary loosening.

- Egyptian pound: We hold a slightly more bearish view on the Egyptian pound as compared to last quarter, now forecasting a year-end exchange rate of EGP 18.00/USD, from current levels of EGP 17.89/USD.

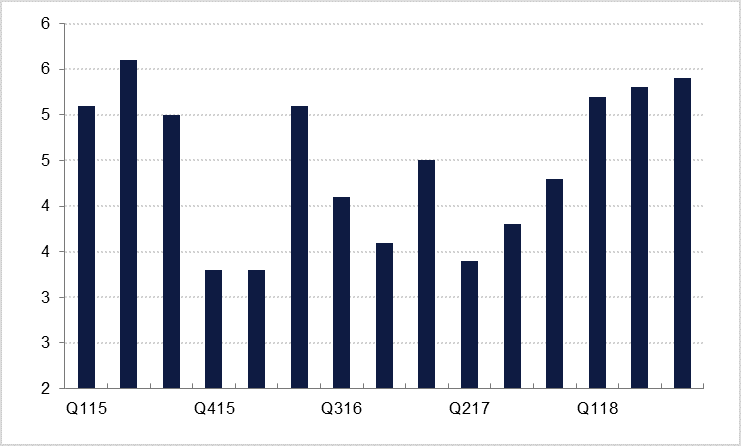

Real GDP Growth, % y/y

Source: CBE, Emirates NBD Research

Source: CBE, Emirates NBD Research

Click here to Download Full article