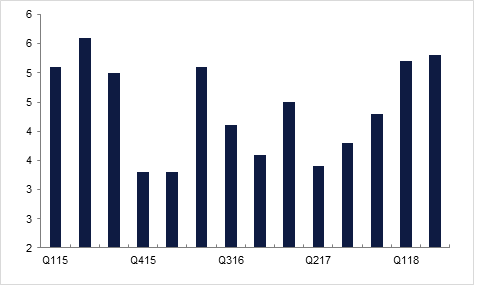

- Growth outlook: The Egyptian economy continues to improve. Real GDP growth has strengthened over the past four consecutive quarters, climbing to 5.3% y/y in Q2 2017/18, and we expect that the expansion will remain robust, forecasting an annual 5.2% this year, and 5.5% in 2018/19 (compared to an average of just 3.3% over the previous seven years).

- Fiscal policy: The budget outlined for fiscal 2018/19 shows a commitment by the Egyptian government to economic reform and steadily reducing the budget deficit, but this process will be slow nonetheless. We forecast that the shortfall will be equivalent to 8.5% of GDP, compared to a projected 9.5% this year.

- Balance of payments Egypt’s current account deficit has narrowed significantly on the back of its recent economic reforms, and its currency float in particular. According to the most recent data from the CBE, Egypt’s current account deficit narrowed to just USD 1.8bn in Q2 2017/18, compared to USD 4.7bn in the same period a year earlier.

- Monetary policy: The Central Bank of Egypt (CBE) enacted the second of what we expect will be a total of four 100bps cuts to its benchmark interest rates on March 29, taking the overnight lending rate to 17.75% and the overnight deposit rate to 16.75%.

- Egyptian pound: We anticipate that the Egyptian pound will remain fairly stable over the remainder of 2018, appreciating modestly from its current levels of EGP 17.7219/USD to around EGP 17.0000/USD by year-end.

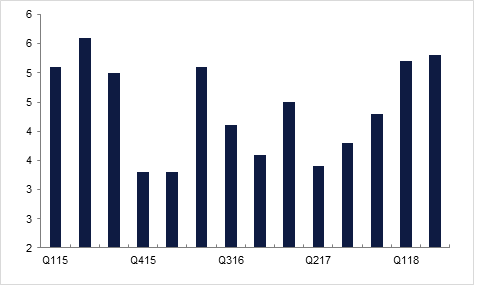

Real GDP growth, % y/y

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Click here to Download Full article