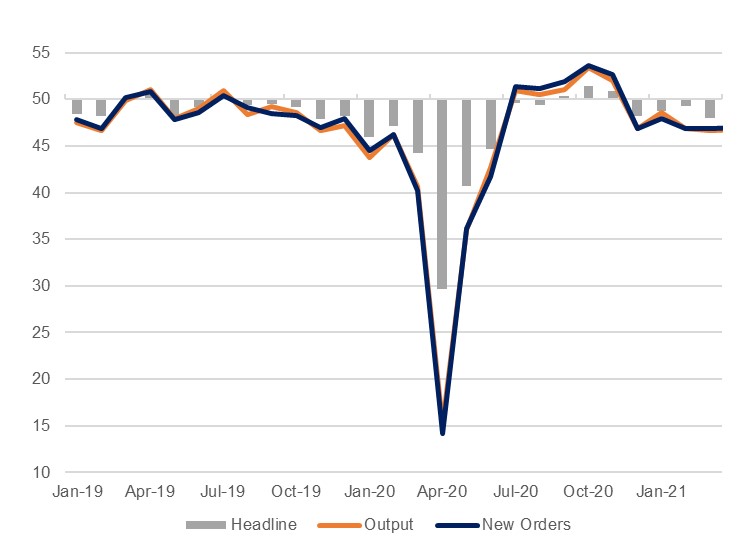

Egypt’s headline PMI number slipped to 47.7 in April, down from 48.0 in March. This was the lowest level since June last year, and the fifth consecutive sub-50.0 reading, indicating a contraction in the non-oil private sector. Export orders picked up again after a modest decline the previous month but new orders on the whole were down and output declined at a similar pace to that seen in March, reflective of difficult domestic conditions.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

With the Covid-19 pandemic continuing to weigh on Egyptian activity, we see little scope for a rapid turnaround in the PMI survey over the coming months. While vaccinations have begun, these are fairly limited to date and daily new case numbers have been ticking upwards for several months. This has led to renewed restrictions being imposed this week, with shops, cafes, and restaurants ordered to operate limited hours until May 21, closing at 9pm. The rise in coronavirus cases and related uncertainty has led to a dip in business optimism in April, which had improved in March as vaccinations began – although it remains positive, with 31% of respondents expecting increased output in 12 months’ time. Given these headwinds to growth we anticipate that public investment will be the key driver of real GDP expansion over the coming quarters.

In common with the GCC PMI surveys released earlier in the week, global supply constraints led to a rise in input prices in April, with the sub-component hitting its highest level in a year and a half. Purchase prices in particular were driven higher as global commodity prices and shipping costs rose, but staff also secured a more modest rise in wages. This was passed on in part to consumers as output prices rose at the fastest pace in six months which could see the MPC now decide to end its cutting cycle at current levels if this manifests in higher headline inflation over the next several prints.