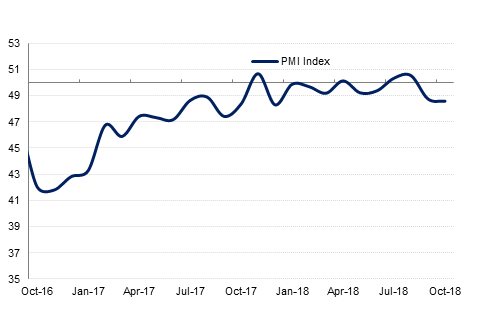

The Emirates NBD Purchasing Managers’ Index (PMI) for Egypt fell modestly to 48.6 in October, compared to 48.7 in September

. This is a second consecutive month of contraction for the index after having enjoyed a brief period in expansionary 50-plus territory in July and August. It is also the lowest reading of 2018, and the data suggests that private sector firms remain under pressure as Egypt’s IMF-sponsored economic reform programme continues. That being said, the reading is still far higher than those seen at the start of the process in November 2016, and future expectations remain robust; 33% of firms expect that output will be higher in 12 months’ time, with some respondents hoping that stronger investment would bolster economic activity.

Although at 59.7 input prices rose at the slowest pace since June, they are still high and will remain a source of pressure for firms. A new round of subsidy cuts at the start of the fiscal year, combined with higher global oil prices, has led to rising purchase prices for businesses at 59.8 in October. Meanwhile, staff costs remained expansionary, albeit to a lesser degree at 53.0. On the other hand, output prices expanded at the slowest pace in 10 months at 51.3, with around 5.0% of respondents saying that they had raised prices.

The squeeze on firms’ margins has impacted employment, which fell back below 50.0 at 48.2 this month. Companies attributed much of this to employees seeking new opportunities and higher levels of retirement, which would tally with the fact that official unemployment statistics have shown a decline to 9.9% in Q2 2018, compared to 12.0% a year earlier.

On a positive note, both output and new orders scored higher this month than last. Output registered at 48.0, a slightly slower contraction than the 47.8 seen in September, while new orders improved from 47.7 to 48.2. New export orders also improved, rising to 49.2 compared to 48.1 the previous month.