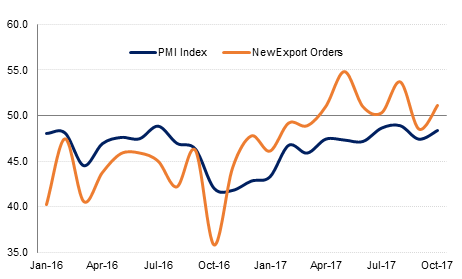

After declining in September, the headline Egypt Purchasing Managers’ Index (PMI) recovered to 48.4 in October. While this still signals a contraction in the non-oil private sector, the downturn was less severe than in September. Output and new orders declined at a slower rate in October, and new export orders increased on average, which is particularly encouraging after a modest contraction the previous month. Firms reported increased demand from neighbouring economies in October, with Jordan and Sudan mentioned anecdotally.

Inflation continues to weigh on domestic demand in Egypt, and average input prices increased sharply again in October, although at a slightly slower rate than in September. The main driver was the higher costs of goods purchased. Although staff costs increased again in October, the rate of increase was the slowest in five months. Firms passed on some of their higher input costs, but the rate of increase in selling prices was the weakest since February 2016.

Employment declined further in October, but at a slower rate than in September. This index has been below the neutral 50-level since June 2015. In recent months, firms have reported workers leaving to pursue other opportunities or retiring, and not being replaced.

Despite the squeeze on margins and weak domestic demand, firms were the most optimistic about the coming year than they have been since August 2015. More than 70% of survey respondents expect their volume of output to be higher in twelve months’ time, compared with less than 50% in June and July. Purchasing activity increased marginally in October after four months of declining purchases. However, overall stocks of inventories continued to decline on average last month.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research