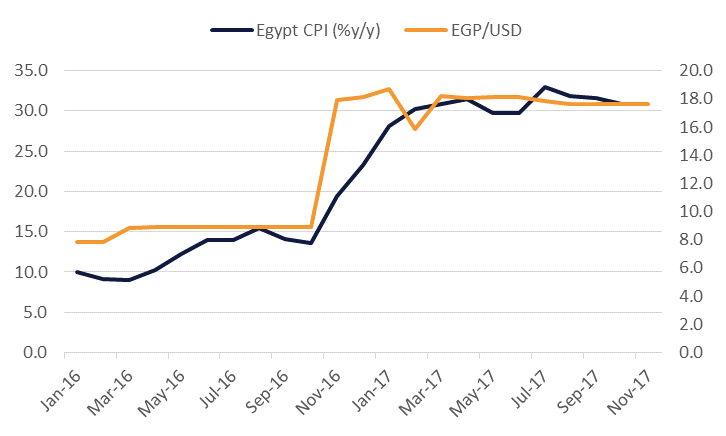

The Central Bank of Egypt (CBE)’s Monetary Policy Committee held rates on Thursday November 16, as was widely expected, with the overnight deposit and lending rates staying static at 18.75% and 19.75% respectively. This marked the third consecutive meeting in which the CBE held, after an aggressive hiking cycle which followed the economic reforms undertaken in November 2016 when Egypt entered into an IMF programme. The free float of the Egyptian pound that month, a key requirement of the deal, prompted a 50% depreciation and inflation to rise to over 30% through most of 2017, in turn leading the CBE to raise its key policy rates by a cumulative 700bp from November to July.

While it is clear that the hiking cycle is over, the key question now is when the CBE will begin loosening monetary policy in a bid to boost weak consumer demand, which has been hit hard by the very high price growth. There is one more MPC meeting scheduled for 2017, on December 28, but we do not expect that the MPC will cut before the end of the year, rather waiting until the first, or even second, meeting of 2018. All eyes will be on the inflation print for November, when the base effects of the currency drop will have fed through, and a clearer picture of other inflationary pressures emerges. Aside from the currency-driven price growth, there have also been a slew of tax hikes and subsidy cuts driving price growth, not least the latest utility tariff rises which took place at the end of June. We expect inflation to remain well within double-digits, forecasting 15.0% at year-end.

Even if inflation falls more rapidly than we currently anticipate, we believe that the CBE will remain cautious in its monetary loosening, with an initial rate cut of 100bp. Portfolio inflows into Egypt have seen extraordinary growth since the economic reforms, with foreign investors attracted by 91-day T-bill yields which topped 22% in July, leading foreign ownership to exceed pre-2011 levels. While there has also been an uptick in fixed investment, these hot money inflows have been instrumental in shoring up the pound in recent months, and the CBE will be careful to prevent capital flight through cutting rates too quickly. On November 7, foreign holdings of T-bills fell for the first time since the previous November’s currency float.

Further, adhering to its IMF Extended Fund Facility programme will also forestall dramatic cuts, given that the body has been vocal in its support of Egypt’s focus on tackling inflation. Egypt was on November 10 granted staff-level agreement following its second review. Assuming this is approved by the IMF’s Executive Board, the country will receive the third tranche of its funding, taking the total received so far to USD6bn of a scheduled USD12bn over three years.

Source: CBE, Bloomberg, Emirates NBD Research

Source: CBE, Bloomberg, Emirates NBD Research

Click here to download the full report.