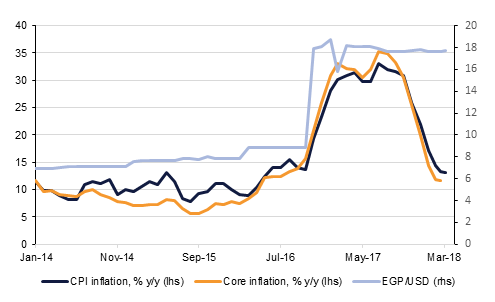

Egypt’s headline inflation rate fell to 13.1% y/y in April, down from 13.3% in March. This marked the slowest price growth since May 2016, and is a far cry from the levels of 33.0% seen at the recent peak in July 2017. The removal of the Egyptian pound’s US dollar peg in November 2016, and the subsequent sharp devaluation of the currency, led to very high inflation, and forced the Central Bank of Egypt (CBE) to enact a cumulative 700bps of hikes to its benchmark interest rates. With the Egyptian pound’s depreciation now in the base, inflation levels have steadily normalised over the past six months, and this has enabled the Central Bank of Egypt (CBE) to enact two 100bps cuts to its benchmark rates already in 2018. This is one of the factors behind our expectation that economic growth in Egypt will strengthen this year.

While the falling inflation story is positive, we believe that much of the slowdown has now passed, and that that the CBE will be fairly restrained in its rate cutting over the remainder of 2018. Indeed, inflation fell by only 20bps this month, compared to nearly four percentage points between November and December, while month-on-month inflation rose from 1.0% in March to 1.5% in April, the highest level since July last year.

Further, there are renewed inflationary pressures looming. The draft budget revealed in March shows plans to cut fuel subsidies by 26.3% to EGP 89bn and electricity subsidies by 46.7% to EGP 16bn. Cuts to subsidies last year saw fuel prices rise by 50%, and electricity by 42%, exacerbating inflationary pressures, and these coming cuts will have a similar effect. While inflation will not spike to the levels seen last year, we anticipate that it will remain around current levels, given that subsidy cuts enacted last year will be in the base.

Nevertheless, this would leave the inflation rate within the CBE’s y/y target of 13.0% ±3% in Q4 2018, potentially giving it the security to further cut rates at its upcoming monetary policy meeting on May 17. Indeed, we expect that there will be a third 100bps cut enacted at the meeting, followed by a hiatus as the effect of this, the two preceding cuts, and the effect of the subsidy cuts, bed in. We then expect one more 100bps cut towards the end of the year.

The inflation rate is not the CBE’s only concern, as it will not wish to prompt a sharp reversal of the portfolio inflows it has enjoyed since it embarked on its reform programme. However, given that foreigner’s t-bill holdings actually increased 10.1% in January (after declining 3.1% in December), despite widespread anticipation of rate cuts, the risks are perhaps overblown. It seems certain that as rates fall, Egypt’s attractiveness will pale, especially when Argentina and Turkey are engaged in rate hiking. However, the greater political and economic stability in Egypt now as compared to last year – and compared to these other markets – will mitigate some of the lower yields. In any case, the CBE is confident that exports and fixed investment inflows will pick up, gradually diminishing the importance of this hot money. Further, equity investment into Egypt will offset a decline in fixed income investment. with the EGX on a bullish uptrend and a number of IPOs in the pipeline – Egyptian Exchange Governor Mohamed Farid said in December that net purchases by foreign investors had been EGP 13bn since the exchange rate liberalisation in November 2016.