The coronavirus pandemic which has stricken the globe has not left Egypt unaffected, derailing the economic recovery which has been in place since beginning its IMF-sponsored reform programme in late 2016. The North African country is, alongside South Africa, the worst affected by covid-19 on the continent in terms of confirmed cases (27,536 in Egypt as of June 3), and the related shut-down as it seeks to bring flatten the virus’ curve has severely impinged economic activity. Egypt’s economy is also subject to the ebb and flow of the virus around the world, through various facets including Suez Canal throughflows, FDI, demand for its goods exports, and tourism. As such, even if the virus’ spread is contained within the country itself, the economic recovery will depend on part on what happens in key trade partners.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

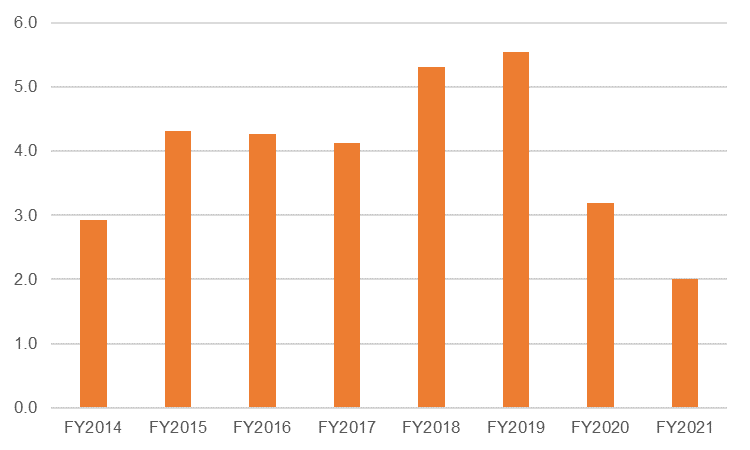

With regards to the virus, while our greatest variable is known, its unprecedented nature and the numerous concomitant parts to it makes it hard to predict its magnitude. Furthermore, the longer the virus forces restrictions to economic activity, the harder-won the global recovery will be. Our outlook for Egypt is predicated on the virus gradually being brought to heel in the third quarter, but that economic weakness in Egypt will extend through the remainder of the calendar year. We forecast real GDP growth of 3.2% y/y in fiscal 2019/20 (ending on June 30) and 2.0% next year.

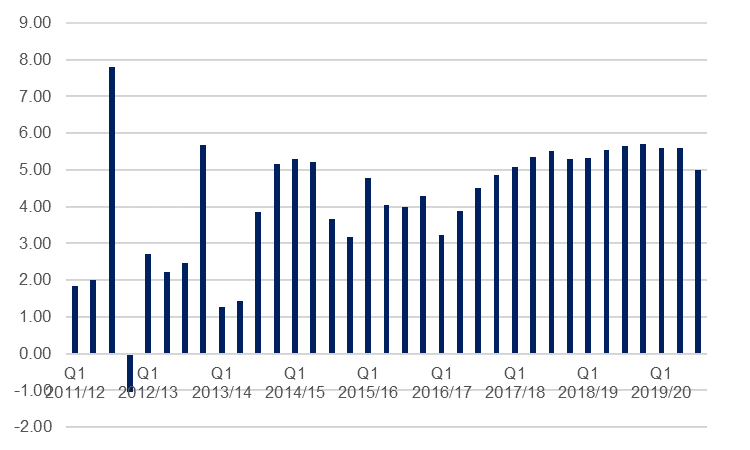

While Egypt’s real GDP growth came in below government expectations of 5.9% in Q3 2019/20 (quarter ended March 31), the 5.0% expansion was nevertheless fairly robust in light of the global coronavirus pandemic, reflecting the relatively late escalation of the crisis in Egypt. Measures to contain the virus did not start in earnest until well into the third month of that quarter, meaning that the real impact will be felt far more starkly in the present reporting period. This current quarter (Q4 of fiscal 2019/20, ending June 30) will likely be a far more sobering reading, and this has already been presaged by the sharp fall in Egypt’s PMI survey, which fell from 44.2 in March to 29.7 in April, the lowest reading in the present series going back to 2011. The May reading, at 40.7, still denotes a fairly sharp contraction in the non-oil sector as compared to the previous month, and is far weaker than the average 49.1 recorded through calendar 2019.

.jpg) Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

There have been some moves to open up the Egyptian economy again in recent weeks, with hotels opening for domestic guests for instance. Nor was the lockdown as harsh as some of those imposed elsewhere in the world. Government and central bank stimulus, through USD 6.3bn of soft loans at 5.0% made available to the manufacturing sector, real estate tax exemptions, USD 3bn for the tourism sector, and a premptory, unscheduled 300bps cut to the CBE’s benchmark overnight deposit rate will all have served to cushion the blow.

Nevertheless, we anticipate a real y/y contraction of -3.5% in Egypt’s GDP in fiscal Q4, with risks weighted to the downside. The previous three quarters of robust growth (5.6%, 5.6% and 5.0%) and Egypt’s reporting by fiscal year serve to keep Egypt’s annualised growth rate positive as compared to contractions all over the world, at a projected 3.2%, but the flipside of this is that the coronavirus weakness will certainly extend into 2020/21.

The Egyptian government has been fairly proactive in promising stimulus, and this will certainly help stave off an utter economic collapse through enabling businesses to stay afloat and quickly restart activity once the pandemic has passed. The issue is that it is for now primarily the health crisis that is weighing on activity, and until that has eased, the economy will remain under pressure, with our expectation of an especially weak Q1 2020/21.

Even come the second quarter, we expect that industries such as tourism and aviation will remain under severe strain, with air travel and holidaymaking around the world unlikely to return to pre-pandemic levels for some many months to come. While we would agree with planning minister Hala al-Saeed’s remarks on May 20 that growth next year could hit 3.5% if the crisis ends, we tend to a more bearish outlook with regards its timeline, hence our weaker 2.0% growth projection. Furthermore, the longer the crisis drags on the more businesses will go under even despite government assistance, in turn weighing on jobs and eroding domestic demand.

Supporting the economy in the manner the Egyptian government has done comes at a cost to finances, especially when revenues are diminished, and it has been looking for external funding over the past month. Egypt issued USD 5bn in Eurobonds, which will cover some financing needs related to combating the coronavirus, and also secured a USD 2.8bn rapid financing instrument (RFI) from the IMF. RFIs were designed to aid countries stricken by a rapid deterioration in their external positions, as Egypt has been with reserves falling by a record USD 5.4bn in March and a further USD 3.1bn in April. Many other countries around the world have also been supported with RFIs over the past month, with Jordan within the MENA region receiving USD 396mn.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

What we will be watching with particular interest is the outcome of Egypt’s wider discussions with the IMF with regards to securing a new standby arrangement which could be in the region of USD 5bn- USD 9bn, and which will come with greater reform requirements. We do not anticipate that the reforms will be as sizeable as those introduced with the recently completed 2016 USD 12bn Extended Fund Facility programme (not least the considerable devaluation of the EGP). However, remarks by al-Saeed that the new programme would focus on structural reforms to the benefit of private sector firms is encouraging from a growth perspective, beyond the current crisis.

The private sector has been the laggard in Egypt’s economic recovery to date, with the PMI survey continually struggling to post an expansionary reading above 50.0, while external rebalancing, FDI, and public investment have for the most been responsible for boosting growth. An IMF-supported concerted effort to cut red tape and improve the operating environment for private sector firms would help boost sustainable growth over the longer term, in turn fostering greater job creation and domestic demand.