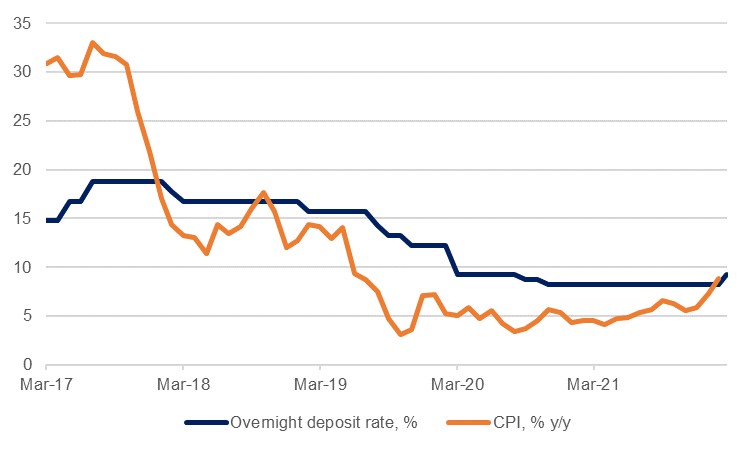

The Central Bank of Egypt implemented an early rate hike to its benchmark interest rates on Monday, pre-empting its scheduled March 24 meeting by three days. The MPC raised rates by 100bps, taking the overnight deposit rate to 9.25%, while the overnight lending rate moved up to 10.25%. The bank’s communique cited the persistent global price pressures related to the reopening frictions from the Covid-19 pandemic and the higher commodity prices driven by the Russian invasion of Ukraine.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Headline CPI inflation in Egypt was already accelerating last month even before most of the fallout from the Ukraine conflict materialised. It rose to a 32-month high of 8.8% y/y, with a 17.6% rise in food prices a significant driver of this. Given Egypt’s reliance on Black Sea wheat exports (Egypt is the world’s biggest importer of wheat, and Ukraine and Russia account for around 80% of that), the conflict there will bring greater pressures in the coming months. Benchmark wheat futures have retreated from recent highs but remain around a third higher than they were just prior to the crisis in Eastern Europe, and so inflation is likely to head higher still in the near term even as the Egyptian government seeks to prevent excessive price rises. Over the weekend the government announced that it would control the price of free market, unsubsidized bread, while discussion of reducing bread subsidies appear to have been curbed for now – the latest budget plan for next year envisages a 16% uptick in spending, which will include greater subsidy spending.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

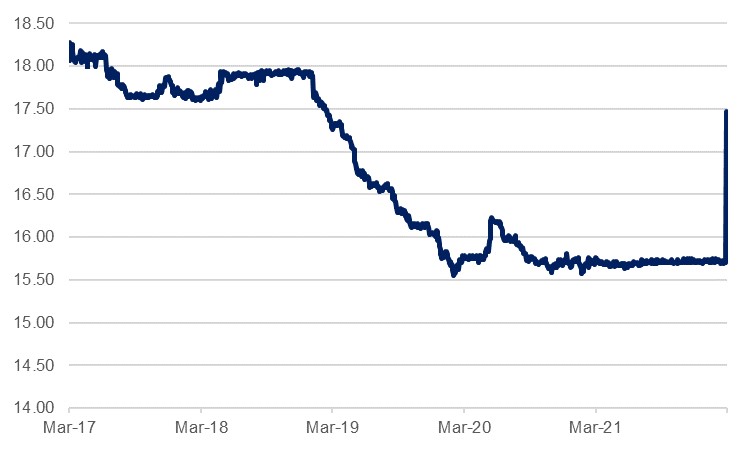

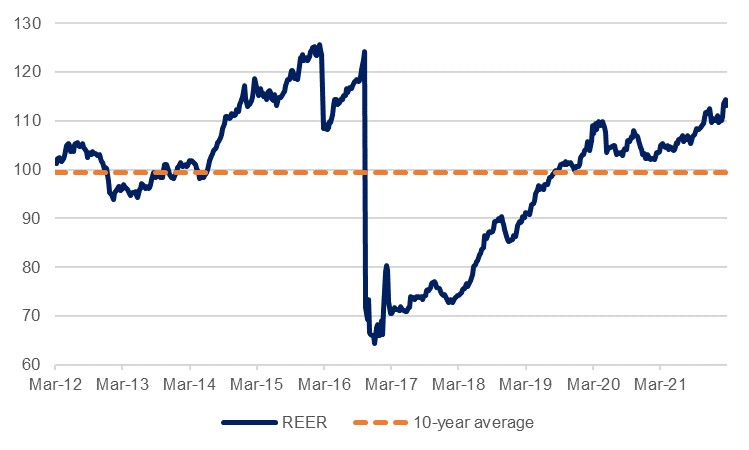

Meanwhile, the Egyptian pound depreciated by 11.2% to EGP 17.48/USD in the wake of the surprise announcement, as the MPC statement stressed ‘the importance of the exchange rate flexibility to act as a shock absorber to preserve Egypt’s competitiveness.’ This depreciation, which followed some 18 months of stable exchange rates around EGP 15.70/USD, will take the currency back closer in line with its long-run REER average, having appeared overvalued on this measure in the run-up to the move.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

These two developments should help shore up positive sentiment towards Egypt. Investor concerns around another potential sizeable move lower by the EGP are likely now alleviated while the rate hike puts real interest rates back into positive territory having slipped into negative after the latest CPI print, and we expect further hikes by the MPC in the subsequent meetings to build rates back up further – we porject that the bank will hike by a further 200bps over the course of the year. The MPC statement stressed that there are exogenous factors at play which are outside the scope of its monetary policy, and that it moves in response to expectations rather than prevailing trends, but between higher food and energy prices the likelihood is that price pressures will remain salient over the coming months even as some of the pandemic-related impacts start to fade.

The moves today increase the likelihood of a new IMF programme being agreed in the coming weeks in our opinion, given that some of the likely prerequisites of renewed financial support from the Fund – a meaningful rate hike and a cheaper currency – have already now been met. Egypt has a fruitful recent history with the Fund, and a new programme would not only offer important monetary support in the near term but would also likely once again provide an important policy anchor for ongoing reforms, and help encourage inflows of both portfolio and fixed investment.

Source: Emirates NBD Research

Source: Emirates NBD Research