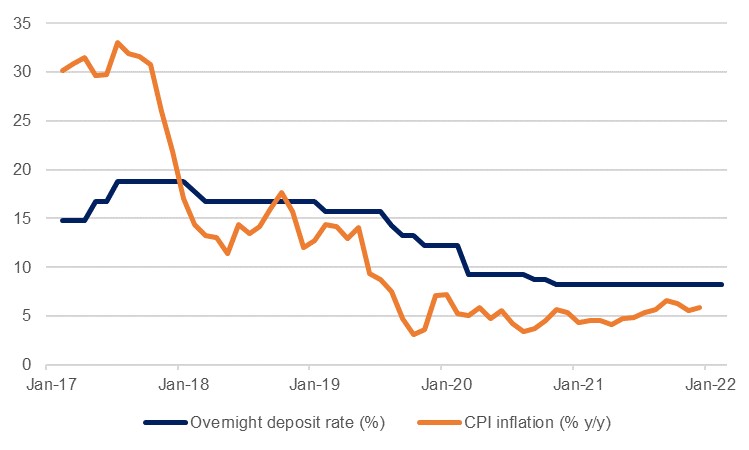

The Central Bank of Egypt kept its benchmark overnight deposit rate unchanged at 8.25% yesterday, the 10th consecutive hold after last cutting rates as the pandemic crisis surged in 2020. Yesterday’s decision was in line with our and market expectations – while it has been clear for some time that the bank has reached the end of its cutting cycle and that its next move will be higher, the conditions did not appear to yet warrant higher rates. Nevertheless, with global tightening moving on apace, especially after the BoE and ECB meetings yesterday, hikes by the CBE this year are looking more likely. We had previously anticipated a first hike in Q1, but on balance we now expect another hold at the March meeting, with a 25bps hike to follow in May, although the risks now look weighted towards a move sooner than later. The MPC statement’s closing lines were changed from December’s, with the emphasis on using all available tools to ‘achieve its price stability mandate’, with the ‘support of the recovery of economic activity’ now missing.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Headline inflation in November and December was lower than the spike seen in the previous two months and at 5.9% at the end of the year remains well with the CBE’s target range of 5%-9%. In these conditions, Egyptian real interest rates remain comparatively healthy when compared with its peers. And while there was an outflow of foreign ownership of Egyptian debt in October and November, this reportedly picked up again in January, ahead of the inclusion of Egyptian bonds in the JP Morgan EM bond index, and the stock of foreign holdings remains relatively high. Nevertheless, the CBE highlighted that the gentler price growth at the close of the year benefitted from favourable base effects related to the tomato issues of the previous year, and core inflation has also been accelerating. PMI surveys continue to highlight the ongoing issues related to input prices, and firms are increasingly passing on these higher prices to consumers.

We will be watching the upcoming February and March inflation prints carefully, and any significant move higher could prompt a more rapid tightening by the CBE, especially in the global context of tightening monetary policy generally. The CBE acknowledged that global ‘monetary policy is expected to normalize sooner than was projected’ and were this to start to exert pressure on portfolio inflows and the currency, the bank would likely err on the side of caution and look to maintain its international attractiveness. That being said, there are other factors which will support Egypt other than a wide real interest rate. The inclusion on the JPMorgan EM bond index will ensure passive inflows, a recovery in the tourism sector should support the current account, and we anticipate that real GDP growth will strengthen this year. The bank’s communiqué noted that real GDP growth was a robust 9.8% y/y in Q3 2021 and that the labour market was stabilising.