The Central Bank of Egypt kept its benchmark overnight deposit rate on hold at 11.25% at its August 18 MPC meeting for the second meeting in a row. This was in line with our expectations, although the surprise departure of long-serving Governor Tarek Amer the day prior to the meeting had added greater uncertainty around the likely outcome. A new interim governor was appointed in the form of Hassan Abdalla in the run-up to the meeting, but in the end there was no significant deviation of policy or moves in the EGP, as had been anticipated in some quarters. That being said, the prospect of greater adjustment remains in play as the country deals with external pressures generated by the conflict in Ukraine, and any requirements the IMF might look to be met before a new deal is agreed.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

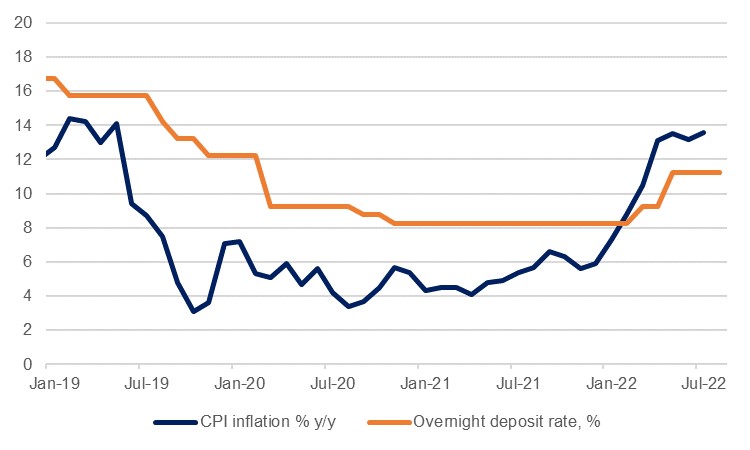

CPI inflation picked up once again in July, rising to 13.6% after dipping modestly to 13.2% in June, so the decision to leave rates on hold once again leaves real interest rates in negative territory, and stands somewhat in contrast to most major central banks which are raising rates at a rapid clip. In its communiqué, the CBE acknowledged the still pertinent inflationary pressures, but laid their blame on the ongoing Ukraine conflict and thereby ‘outside the scope of monetary policy’ while saying that they ‘may lead to transitory deviations from pre-announced target rates.’ Therefore, the CBE is happy to tolerate the elevated annual inflation figure compared to the target 7% ±2 pp for the time being. Nevertheless, we hold to our expectation that there will be further rate hikes to come this year, with a year-end level of 12.25% forecast.

Should a new deal be reached with the IMF under the new governor this would likely entail a more pronounced depreciation of the EGP from its current EGP 19.1460/USD level and higher interest rates. For the time being, however, until there is greater clarity around a new IMF deal, the benefit of hiking is less certain. The direct pass-through effect of monetary policy is arguably limited in the face of the exogenous pressures, as the CBE noted, while higher rates will push up government servicing costs, which are already up 10% y/y and account for over a third of total spending. Meanwhile, international investment in local debt (down to USD 8.2bn in May, from USD 21.3bn at the start of 2022) is unlikely to return in a meaningful way prior to any new IMF deal given the global risk-off tone more generally. Finance minister Mohamed Maait’s earlier comments that ‘now is the time for Egypt to concentrate more on the increase of exports and foreign direct investments rather than the carry trade’ suggest that attracting portfolio inflows might not be the priority it once was in any case.

While IMF support has not yet materialised and international investors have been more wary, Egypt has received significant support from GCC economies this year. On Tuesday, the bank released a report stating that the GCC had deposited USD 14.9bn at the CBE between them in Q1, with the UAE depositing USD 5.7bn, Saudi Arabia USD 5.3bn and Kuwait USD 4.0bn.

The CBE’s statement also highlighted that real GDP growth in the 2021/22 fiscal year to June came in at 6.2%, higher than our estimate of 6.0%. The bank said that the private sector was the primary generator of growth over the first three quarters, with non-petroleum manufacturing, tourism and trade performing especially well. The bank noted that growth was likely to slow more than previously anticipated now, however, in part due to the ongoing spillover from the Ukraine conflict. We forecast real GDP growth of 4.1% this fiscal year.