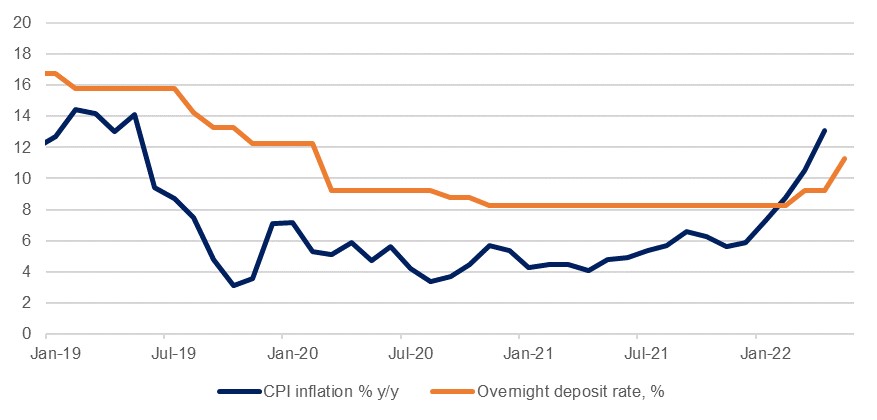

The Central Bank of Egypt hiked its benchmark interest rates by 200bps yesterday, taking the overnight deposit rate to 11.25%. This was a bigger move than the consensus expectation (100 bps), but smaller than our prediction (300bps) as we had anticipated more rapid tightening from the CBE following the 13.1% y/y inflation print for April . With the CBE taking a less aggressive stance than we had anticipated we have pared our expectation for June’s meeting to a hike of 150bps, from 200bps previously. Nevertheless, the direction of travel will remain towards tighter monetary policy with inflation set to remain high over the next several months and the US Federal Reserve signposting a series of 50bps hikes itself.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

In its communiqué the CBE cited the inflationary pressures emanating from the war in Ukraine (to which Egypt is particularly exposed given around 80% of the country’s wheat imports come from the Black Sea region) and the ongoing disruption to supply chains from lockdowns in China. Core inflation has also been accelerating, rising to 11.9% in April, and the depreciation of the EGP which took place in March will continue to exert pressure over the coming months even as some other pressures start to ease. This will keep real interest rates in negative territory for the time being, in contrast to the recent period of wide positive margins that have encouraged international investors to purchase domestic debt.

The bank’s statement said that ‘the elevated annual inflation rate will be temporarily tolerated relative to the CBE’s pre-announced target of 7 percent (±2 percentage points) on average in 2022 Q4, before declining thereafter’, suggesting that aggressive hikes to get ahead of inflation are less likely to materialise over the next several meetings. Nevertheless, we still expect further tightening from the central bank. CBE Governor Tarek Amer spoke at the Arab Banking Conference in Cairo yesterday where he stressed that the bank would take any necessary steps to curb inflation, and the MPC communiqué reiterated that the bank ‘will not hesitate to utilize all available tools to achieve its price stability mandate.’

Moreover, aside from the domestic inflation question the international backdrop – with the FOMC hiking at a more rapid pace than expected several months ago and other DM central banks signposting tighter policy – will also strengthen the case for more rate hikes if the CBE wishes to encourage renewed inflows of portfolio investment.