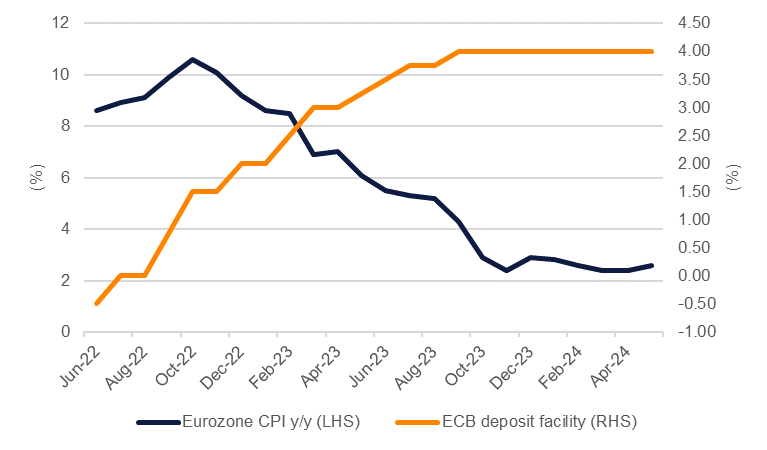

The European Central Bank looks set to begin easing policy when it meets on June 6 and we expect a 25bps cut in policy rates, which will bring the deposit facility rate to 3.75%. Inflation in the Eurozone economy has slowed substantially, from a peak of near 11% in October 2022 to less than 3% at present. A strong disinflationary pull from energy prices, which turned lower in the final quarter of 2023 and are flat now, has helped to moderate price growth across the eurozone while the impact of higher goods and services prices is now in the base and only minimally contributing to inflation.

However, while price growth has slowed, the push toward the ECB’s target of close to 2% CPI inflation is proving difficult. The most recent Eurozone-wide CPI print for May was faster than expected at 2.6% and was the highest reading in the last three months. Inflation accelerated across the major economies of Germany, France and Spain while Italy’s inflation prints remain the lowest among the major economies at just 0.8% in the flash estimate for May.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

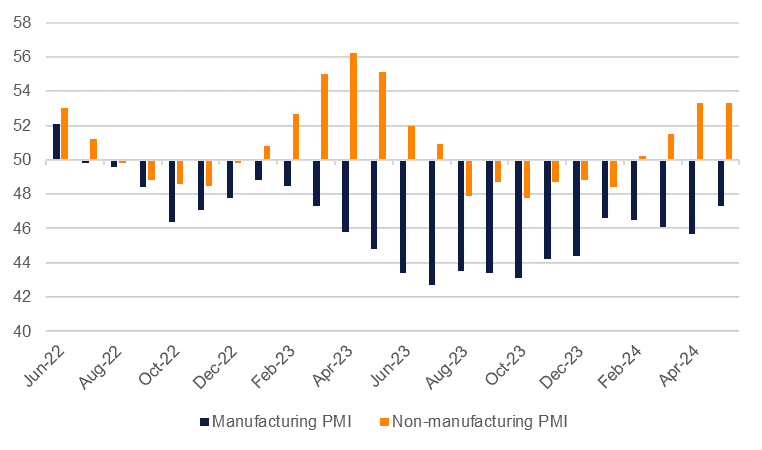

The Eurozone’s economy has also moved out of the recession that took hold in the second half of 2023 with growth of 0.3% q/q in Q1 2024. Near-term indicators like PMIs have also improved in recent prints with the composite Eurozone-wide PMI for May rising to 52.2, up from levels below 50 only as recently as January-February this year.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

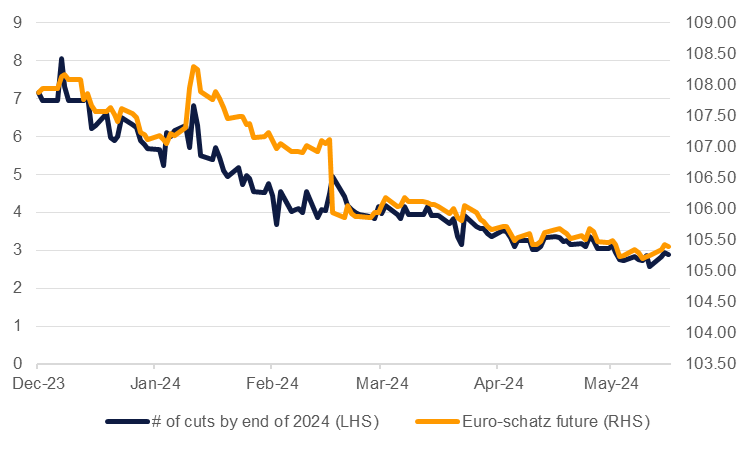

As the inflation picture has improved substantially and the outlook for the eurozone economy is looking brighter—new projections from the ECB will also be published this week—markets are expecting more pause on the path for Eurozone rates over the rest of the year. At the start of 2024, as many as seven cuts were being priced in for the ECB by the end of the year. That now stands closer to three cuts. Strong wage growth and improving near-term signals along with sticky inflation raise the question of whether the ECB does need to cut as deeply as markets predict, similar to the challenge facing the Federal Reserve in the US.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Our own forecast stands for three rate cuts from the ECB this year, starting this week then one 25bps cut each in Q3 and Q4. For now, we still stand by that expectation as some of the recent stickiness of inflation has been due to food and transport fuel prices, something that may fade in coming months as energy prices have turned lower. Upside risks to inflation remain prevalent—services prices rose by 4.1% y/y in May, up from 3.7% a month earlier. Should inflation prove more of a challenge than the ECB seems to expect then we would expect them to temper the pace of rate cuts even more for 2024.