The European Central Bank meets on June 10th with their asset purchases in focus. At its March meeting, the ECB said it would “significantly” raise its pace of asset purchases to help the Eurozone economy recover out of the Covid-19 pandemic. Since then there have been signs of broad economic improvement—regional PMIs have been trending higher, core yields have edged up—and the Euro has strengthened considerably after a soft start to the year. Crucially, inflation is accelerating but after years of failing to hit its target of below but close to 2%, the sudden surge in prices is now seemingly unwelcome. Price pressures will remain acute and may even prove to be more long-lasting than ECB officials are hoping for but we don’t expect to see a tightening of policy in the near term, either in the form of slower asset purchases or more hawkish forward guidance and certainly not an indication of moving policy rates upward.

The Euro has outperformed our expectation for Q2 when we thought the single currency would lose ground against the dollar. Instead EURUSD has risen by more than 4% since the end of March 2021, and now trading closer to 1.22. The gain for the single currency in Q2 has helped it to erase all its year-to-date losses and the Euro is now trading roughly flat compared with the start of the year. We had pegged an eventual improvement in the Euro on better distribution of vaccines but anticipated that the economic benefits would accrue much later, perhaps the end of 2021 or early 2022. We are now bringing that appreciation forward and target EURUSD at 1.21 by end of Q3 and back to 1.22 by the end of Q4 before a more full-throated appreciation in 2022 as the Eurozone economy is set to outpace the US on headline GDP growth.

.png)

Source: Bloomberg, Emirates NBD Research.

The improvement in vaccine deployment across the EU has been a principal agent of bringing the Euro higher. At the end of March, 12% of the total EU population had received at least one dose of a Covid-19 vaccine compared with more than 29% in the US and as much as 46% in the UK. By the end of May, the EU had managed to vaccinate nearly 38% of its population, narrowing the differential to the US considerably even as it had managed to vaccinate more than 50% of its population. In line with the improving vaccination rates, the stringency of Covid-19 restrictions in major Eurozone economies has declined in recent weeks—barring Germany—helping set up the regional economy for a healthy recovery in Q2 compared with the drop of 1.8% y/y recorded in Q1.

Source: Our World in Data

Source: Our World in Data

While the economy is showing signs of rebounding activity—PMI numbers for May showed an acceleration in manufacturing activity across major regional economies—the Eurozone is still very much in recovery mode. Unemployment in the Eurozone at 8% in May is off from pandemic highs of closer to 9% but hasn’t yet got to pre-pandemic levels of around 7% (admittedly still high when compared to headline unemployment in either the UK or US before Covid-19).

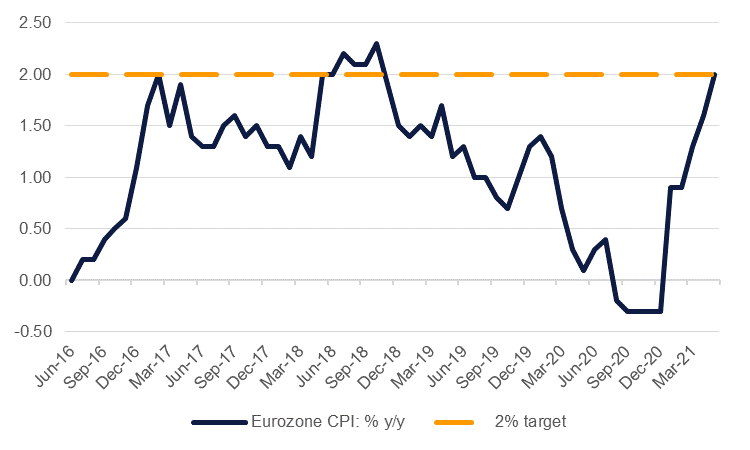

Inflation is accelerating in the Eurozone too, similar to the trend seen in near all other major economies. Headline CPI rose by 2% in May compared with 1.9% previously. After years of failing to hit its target level of close to but below 2%, the price gains now are being treated as a herald of an era of unwanted high inflation, even if higher prices could bring about higher wages and bring more workers into the labour market. Headline inflation though still falls some way short of the pace of price growth in the US at 4.2% for April with the possibility of rising further given elevated energy prices and persistent supply chain issues.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The ECB’s meeting on June 10th will likely set up whether the bank will maintain its asset purchases at the “significantly higher pace” or whether hawkish policy makers will push for an end to the accommodative policy stance brought on by the Covid-19 pandemic. We doubt that the ECB would be prepared to tighten policy while the economy is still finding its feet in the recovery from Covid-19 or that it will prepared to jump ahead of the US Federal Reserve in adjusting policy. Senior ECB officials—such as Francois Villeroy de Galhau, the head of France’s central bank, and Fabio Panetta, a member of the ECB’s executive board—have pushed back recently against any imminent end to higher asset purchases. While there are some prominent hawks in the ECB who favour tightening policy sooner rather than later, we don’t think they will have the winning argument at the June meeting, hence why we see some scope for EURUSD to slip back slightly from its current levels around 1.22.