The ECB kept its policy unchanged at its meeting last week, holding deposit rates at -0.5% and continuing with the EUR 1.35trn Pandemic Emergency Purchase Programme. Christine Lagarde, the ECB president, said she expected to deploy the full amount of the central bank’s quantitative easing programme even as signs of economic stabilization are growing in the Eurozone. On the fiscal side of the ledger, leaders from across the EU were still debating the EUR 750bn recovery fund with fiscally reticent northern members, notably the Netherlands, demanding stronger conditions be applied to any funds distributed as grants across the bloc. The recovery fund is also threatened by conditionality on governance issues that some members in Central and Eastern Europe have resisted.

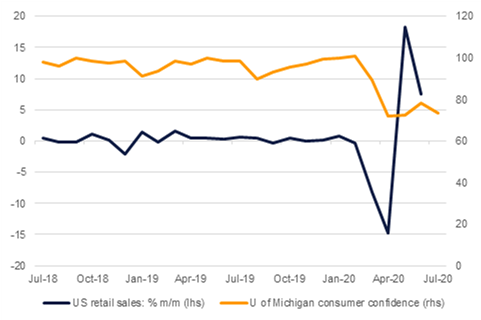

Data out of the US continues to display the uneven recovery underway in the economy. Retail sales rose 7.5% m/m in June and have managed to return back to pre-pandemic levels after two strong months. Most of the recovery has been via purchases of goods—as consumers were largely stuck at home—while services remain well off pre-pandemic levels. The closure of services—restaurants and bars for example—as many states grapple with accelerating case volumes means the upside for consumption to support the economy may be limited going forward. Consumer confidence has already started to wane in response to the pick-up in the number of Covid-19 cases: the University of Michigan consumer confidence index fell to 73.2 for July from 78.1 previously.

Turkey’s central bank raised its foreign exchange reserve requirement ration for banks in the country to 300bps, meaning banks will need to deposit more foreign currency with the CBRT. Foreign exchange reserves in Turkey have fallen below USD 50bn—net of gold—as of mid July, a drop of almost 40% since the start of the year. The Turkish lira has recovered some ground after pushing above USDTRY 7 during the height of coronavirus anxieties in Q2 but has still weakened by 15% ytd.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Bond markets managed to extend their gains last week as concern over the rising number of coronavirus cases compounded softer retail sales and consumer confidence figures in the US. Yields across the US treasury curve were lower with the 2yr down by almost 1bp, closing at 0.145%, and the 10yr yield fell nearly 2bps to close shy of 0.63%. Bund yields actually managed to increase over the week, likely in anticipation of the EU reaching a deal on its emergency support package as well as ECB commitment to spend all of its PEPP funds.

The past two chairs of the Federal Reserve, Janet Yellen and Ben Bernanke, both said it was possible that the Fed would adopt yield curve control to continue its support for financial markets and the economy. Current Fed officials have indicated they have studied the proposal for yield caps but haven’t yet committed to it as a strategy.

EM bonds extened their rally by 0.6% last week with gains now running into 12 consecutive weeks. Spreads over USTs, however, are showing some resistance at around 390bps, roughly where they have been stuck sicne the start of June. Both Brazil and India now have more than 1m cases of coronavirus each, making positive view on EM assets all the more surprising.

Last week the dollar continued its downwards trend. The DXY index recorded moderate declines to finish at 96.013. The dollar has been locked in a downtrend since the beginning of the month and shows no signs of slowing down so far. USDJPY was largely unchanged despite some choppy movement mid-week to trade at 107.03.

The euro advanced beyond the 1.1400 mark and has remained there to finish at 1.1429 ahead of a key EU summit discussing a coronavirus recovery fund. Reports out of the summit suggests that EU leaders are deadlocked in their negotiations. Sterling declined moderately to end the week at 1.2568. Bank of England Governor Andrew Bailey reiterated the bank's commitment to low rates and took a more cautious stance on the state of the UK.'s economic recovery. The AUD has continued its positive streak, breaching the 0.7000 handle on multiple occasions last week and has finished just under this area whilst the NZD recorded a moderate decline to trade at 0.6557.

Last week was broadly positive for global equities. In the US, a run of consensus-beating data releases contributed to the S&P 500 gaining 1.3% over the week, while the Dow Jones Industrial Average gained 2.3%. Europe also saw gains, with the DAX rising 2.3% and the FTSE 100 3.2%. In Asia, however, the Shanghai Composite closed down 5.0% w/w, erasing some its recent spectacular gains. Thursday saw the index’s biggest daily loss in five months as investors weighed the risks of better-than-expected Q2 GDP growth prompting tighter monetary policy, and poor retail sales. Rising tensions with the US also likely played a part, and Hong Kong’s Hang Seng Index closed down 2.5% over the week, as the special administrative region had its special trade and commerce status revoked by President Donald Trump.

In the region, local markets were in the red over the week, as the DFM lost 1.2%, the ADX 1.3% and the Tadawul 0.1%.

Oil prices showed little conviction in any direction last week with Brent closing slightly lower—down by 0.2%--while WTI added all of USD 0.04/b over the course of trading. Anxiety remains higher over demand losing its recent recovery as escalating cases of coronavirus force localized lockdowns across the US and elsewhere, particularly in emerging markets. Indeed over the past four trading weeks oil market volatility has pushed close to year-to-date lows while the spread between minimum and maximum values for Brent and WTI futures has narrowed considerably.