Equity markets are largely unchanged ahead of today’s key US inflation data for February. Headline CPI is forecast to rise marginally to 2.2% y/y from 2.1% in January while core CPI is expected to remain unchanged at 1.8% y/y.

India’s CPI for February came in softer than expected at 4.4% y/y, and down from 5.1% y/y in January. The decline was mainly due to lower food and vegetable prices. Separately, industrial production rose 7.5% in January 2018 beating consensus forecast of 6.4%. Encouragingly, the growth was driven by the manufacturing sector which grew 8.7% y/y. Both these data points support our view that economic growth in India is rebounding strongly and the RBI is likely to remain on hold with a neutral stance.

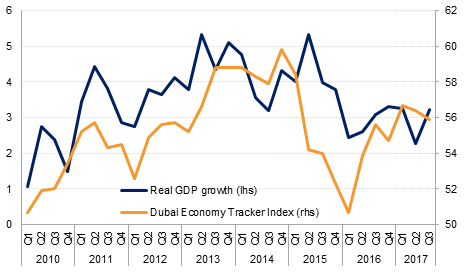

Dubai’s GDP growth accelerated to 3.2% y/y in Q3 2017 from 2.3% in Q2 and 3.1% in Q3 2016, according to official data. The highlight in our view was a sharp recovery in construction sector growth, which accelerated to 7.7% y/y in Q2 and 7.5% y/y in Q3 2017, the fastest growth rates since the financial crisis. The Emirates NBD Dubai Economy Tracker had indicated a rebound in construction sector activity last year, and this now appears to be confirmed by the official GDP statistics. The transport & storage sector grew 4.2% y/y in Q3 2017 while wholesale & retail trade expanded 3.9% y/y. We estimate Dubai’s economy grew 3.5% over the whole of 2017 and we expect growth to accelerate to 4.0% this year.

Finally, the Financial Times reported that the IPO of Saudi Aramco would likely be delayed into 2019, citing comments from British officials following the Crown Prince’s visit to the UK last week. The Saudi finance minister had previously refused to confirm that the IPO would be completed this year.

Source: Emirates NBD Research

Source: Emirates NBD Research

US treasuries held onto their gains amid a hefty auction schedule. A subdued follow-up to positive move in equity markets at the end of last week also played a part. The yield on the 2y UST, 5y UST and 10y UST closed at 2.26% (flat), 2.63% (-2 bps) and 2.86% (-3 bps) respectively.

Regional bonds remained unchanged as the pipeline of new issuances continues to build. Majid Al Futtaim is seeking to buy back USD 500mn perpetual notes and has made any-and all tender offer. The company is also in the market to issue new perpetual bonds and current IPT guidance is around low to mid 6% area.

Fitch downgraded Batelco to BB- from BB+ with stable outlook. This follows a downgrade of the Bahrain sovereign earlier in the month.

NZD is outperforming in the Asia session, gaining against the other major currencies following the sale of the April 2029 government bonds. Compared with expectations for demand of NZD 1.5bn, the auction had a total book size of more than NZD 5bn. As we go to print NZDUSD is trading 0.25% higher at 0.7315. We expect support at the 50 day moving average (0.7284) and resistance at 0.73745, the 76.4% one year Fibonacci retracement.

This afternoon, investors will be looking towards the US where economic data is expected to show that consumer price inflation accelerated to 2.2% y/y in February. Following last week’s constructive employment report, any upside surprises in inflation are likely to result in greater appetite for USD.

Developed market equities closed mixed with the Euro Stoxx 600 index adding +0.3% and the S&P 500 index losing -0.1% as investors took some money off the table ahead of key data releases later this week from the US and China.

Regional markets closed higher with the Qatar Exchange adding +5.0% and the Tadawul gaining +1.1%. Yet again, much of the focus remained on the banking sector stocks as Qatar National Bank said it will raise foreign ownership limits. The stock closed +10.0% higher. Emirates NBD continued its rally with gains of +4.5% following a similar announcement early on Sunday morning.

The EGX 30 index added +2.1%. El Sewedy Electric closed +10.0% higher after the company said it has signed a contract worth EGP 2.12bn with Egyptian Electricity Transmission Co.

Oil prices closed lower but off the lows of the day with Brent and WTI losing -0.8% and -1.1% respectively. The start of the new week was marked by fresh concerns over supply from the US and possibly some profit booking following a sharp rise in oil prices on Friday.The Bloomberg Base Metals Spot Price Commodity index ended last week with losses of -2.4% as the US President formally ratified import tariffs of 10% on Aluminium and 25% on Steel. This was third consecutive week of losses for the index.