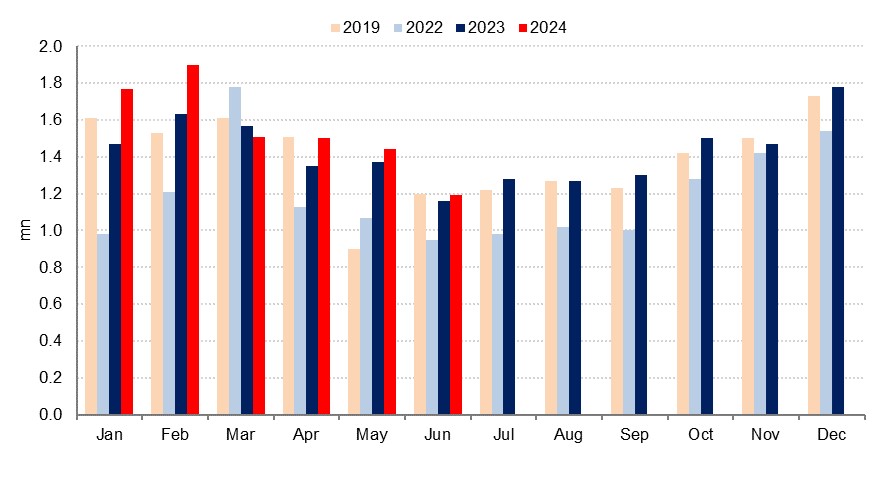

Dubai’s tourism sector has hit new records this year as the emirate welcomed 9.31mn international overnight visitors across the first six months of 2024, registering an 8.9% increase on the 8.55mn logged in H1 2023. The 2024 numbers were also up 11.4% on pre-pandemic H1 2019 as the Dubai tourism sector has continued to see robust growth even as reopening gains have largely now been realised. The sector has managed to retain its attractiveness and tourists have continued to visit in ever greater numbers despite the extended period of restrictive monetary policy and elevated price growth globally that has crimped households’ spending power.

Source: DTCM, Emirates NBD Research

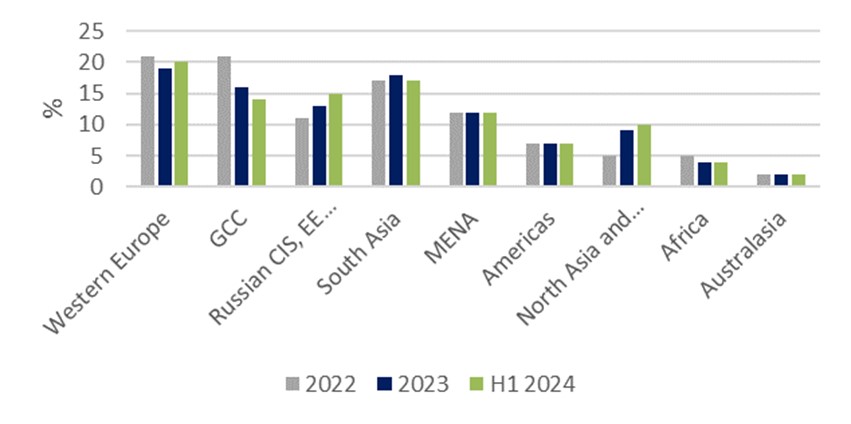

Source: DTCM, Emirates NBD ResearchSimilar to 2023, Western Europe has continued to account for the largest share of tourists to Dubai, contributing 20% of the total over January to June this year. This was followed by South Asia (17%), Russia, CIS, and Eastern Europe (15%), GCC (14%), the rest of MENA (12%), North and Southeast Asia (10%), Sub-Saharan Africa (4%), and Australasia (2%).

There was a notable rise in visitors from North and Southeast Asia which expanded 36.1% y/y in H1 as Chinese visitor numbers rose strongly. With Chinese visitors having lagged the recovery from other countries coming out of the pandemic, we anticipated that their return would bolster growth this year. This effect is now starting to moderate, and the pace of annualised growth in visitor numbers is slowing. Nevertheless, China is not the only driver of the growth and all the regions have been registering a positive expansion this year. Russia and CIS visitors were up 16.7% y/y in H1, while visitors from Western Europe, South Asia, the Americas, Africa and Australia were all up around 9% compared to 2023.

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD Research

Average hotel room occupancy was 78.7% in H1 2024, up 1pp from 77.7% in H1 2023, while revenue per available room (REVPAR) was up 6% y/y to AED 439.

Supporting economic growth

While tourism does not appear individually in Dubai’s national accounts data, it directly provides a meaningful contribution to hospitality and transport & storage, which were the two fastest-growing sectors last year and together accounted for around 15% of real GDP. Tourism also provides an indirect boost to a range of other sectors including wholesale & retail trade, and construction and real estate activity. According to the Ministry of Finance, tourism accounted for 11.7% of national UAE GDP last year, so the share for Dubai was likely even larger than this.

With the tourism sector continuing to log strong growth in numbers through the first half of the year, the data is supportive of our 2024 growth forecast for Dubai of 3.8%, up from 3.3% last year. The outlook for H2 is also fairly bright given other timely data indicators: the ongoing growth in the tourism sector has been reflected in the S&P Global PMI survey so far this year, which has continued to indicate a robust pace of expansion. In June, the sector saw stronger growth than was logged in May, with the index hitting a three-month high of 56.0, from 55.0 previously. The uptick was driven by a rise in output, and new orders also accelerated, suggesting a healthy pipeline of work for the coming months. Firms also continued to increase their headcount in another sign of business optimism. Meanwhile, DXB saw its busiest ever quarter in Q1 as 23mn passengers were handled at the airport over January to March.

Global macroeconomic conditions should remain supportive of growth in tourism numbers through the remainder of the year. With monetary policy in the major economies expected to ease through H2, and with inflation down markedly from recent highs, pressure on discretionary household spending should diminish, which would be supportive of holidaymaking. Ongoing dollar strength has continued to make Dubai a more expensive destination when tracked against our nationality-weighted FX index, but the pace of this depreciation should also moderate over the coming months as the Federal Reserve starts to ease rates. Further, while geopolitical tensions in the wider MENA region continue to make headlines, there is no indication that this has had a material effect on deterring visitors to Dubai.