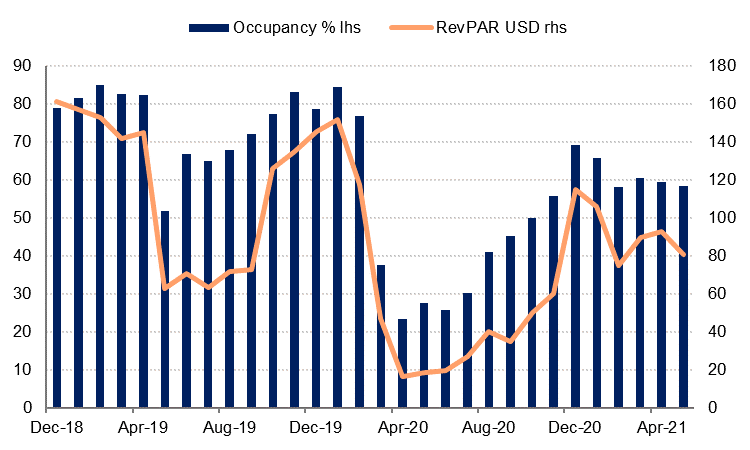

Hotel occupancy in Dubai slipped to 58.5% in May 2021 from 59.4% in April and 60.5% in March. Revenue per available room (RevPAR) declined -13% m/m in May, the first monthly decline since February. The y/y metrics look much better as last May international borders were closed. Hotel occupancy was thus 31pp higher y/y in May 2021 while RevPAR was up more than 300% y/y.

Source: STR Global, Emirates NBD Research

Source: STR Global, Emirates NBD Research

The introduction of travel restrictions on flights from India on 25 April 2021, in response to the surge in coronavirus cases there, would have had an impact on Dubai’s travel and hospitality sector as India is the largest source of international visitors to Dubai. While the hotel occupancy rate was only marginally lower in May than in April, this was likely due to price discounting by hotels to support demand, as well staycations and the Eid holiday. These restrictions, as well as restrictions on travel from South Africa and Nigeria which had been in place since early this year, will be eased from 23 June, suggesting that UAE hotels could see an improvement in demand over the summer. New restrictions have been imposed on travellers from Liberia, Sierra Leone and Namibia, but these are much smaller source markets for Dubai.

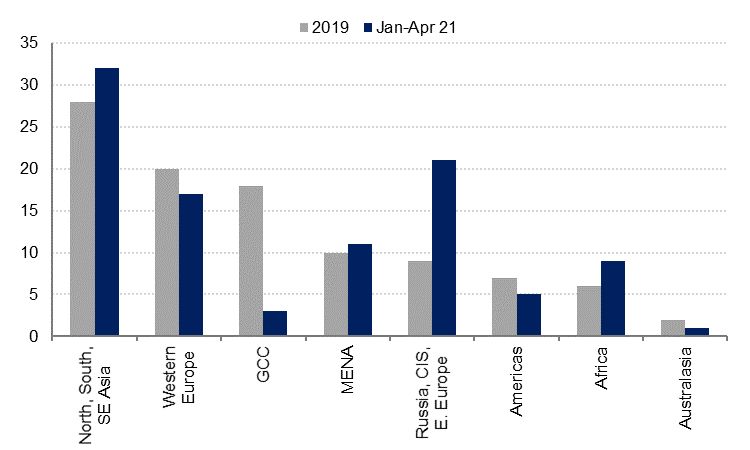

In our view, a bigger headwind to the recovery of the tourism sector is the restrictions (including quarantine requirements) that have been imposed by other countries on their residents travelling to the UAE. Pre-Covid, the GCC countries accounted for 18% of Dubai’s international visitors, with Saudi Arabia being the second largest source market after India. In the first four months of 2021, the GCC accounted for just 3% of total international visitors with restrictions and quarantine requirements largely imposed by other GCC states. These have been relaxed in recent weeks however, and it’s possible that the data for May and June will show a return of GCC visitors to Dubai in a more meaningful way.

The UK has traditionally been the third largest source market for international visitors to Dubai with 1.2mn visitors in 2019 but the UK’s decision to keep the UAE on its red-list is likely to deter holiday-makers from coming to Dubai, despite the UAE’s high vaccination rates. Quarantine requirements in most EU countries have also likely discouraged non-essential travel to the UAE from this key market since the start of the year, but these are gradually being eased as vaccination rates in the EU improve and countries prepare to open for summer tourism.

Data on international visitor numbers to Dubai through April 2021 show a 73% decline in the total number of visitors compared with pre-Covid levels (Jan-Apr 2019). The average number of visitors per month was around 417k. India remained the largest source market by far, with 390k visitors in January through April, almost three times as many as from the second largest source market – Russia with 144k. With the ban on Indian flights taking effect in late April, this gap is likely to close in May and June.

As the number of visitors from the traditional major source markets (UK, GCC) remained constrained, the importance of Eastern Europe and central Asian markets has increased. Russia and the CIS accounted for 21% of all visitors to Dubai in the first four months of this year, compared with 9% in 2019. Visitors from African countries accounted for 9% of international visitors in Jan-Apr 2021 up from 6% pre-Covid.

Source: Department of Tourism and Commerce Marketing, Emirates NBD Research

Source: Department of Tourism and Commerce Marketing, Emirates NBD Research

The faster Covid-19 vaccine rollout in the EU and the opening up of travel corridors with some EU countries in recent weeks is encouraging, and we are hopeful that the UAE’s travel and hospitality sector will recover at a faster rate in H2 2021 as other restrictions in key markets are relaxed. However, this is to some extent dependent on the domestic coronavirus situation in many countries, as well as the speed with which vaccines are rolled out. The latter is likely to be particularly challenging for emerging markets which are facing supply constraints and in some cases a lack of adequate infrastructure to support a fast roll out of Covid-19 vaccines.