The latest data from the Dubai Department of Tourism and Commerce Marketing (DTCM) shows the total number of international visitors rose 3.6% in the year-to-July 2019, compared with the same period in 2018. This is a faster growth rate than was recorded for the same period last year, but softer than the growth in visitor numbers in Jan-July 2017.

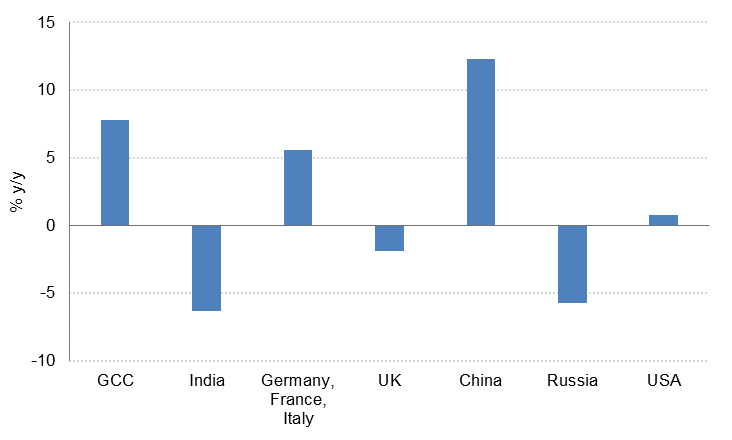

Visitors from other GCC countries rose nearly 8% y/y, driven by a sharp rise in visitors from Oman (up nearly 30% y/y). Visitor numbers from Saudi Arabia rose only marginally y/y while visitor numbers from Kuwait declined -7.5% y/y in the year-to-July. India, the largest market for international visitors to Dubai, saw a -6.3% y/y contraction in visitor numbers in the first seven months of this year, while visitors from Russia were down -5.8% y/y and those from the UK down -1.9% y/y.

However, there was growth in the number of international visitors from China (+12.3% y/y) and the large Eurozone countries (Germany, France, Italy +5.6% y/y). There was also strong growth in smaller markets (ranked 10-20), including the Philippines and Nigeria, both of which saw visitors to Dubai rise by nearly 30% y/y in the year-to-July. Kazakhstan made the top 20 list in the July data, with visitors to Dubai from that country up 27.3% y/y.

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD Research

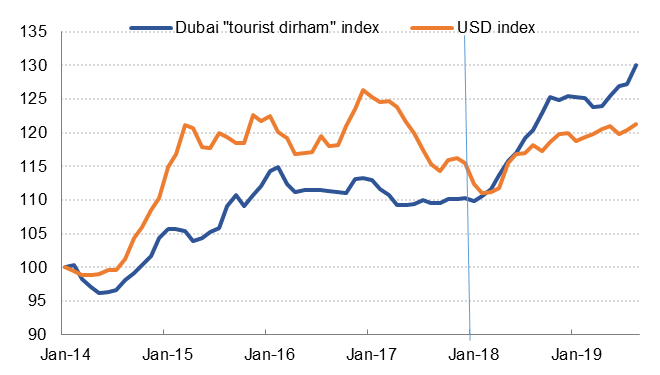

More than half of Dubai’s international visitors come from emerging markets, and EM currencies have continued to weaken against the USD this year, making Dubai a relatively more expensive destination for visitors from emerging markets. Indeed, our “tourist dirham index”, which is a basket of currencies weighted by the share of international visitors to Dubai, has appreciated further in August, suggesting that the tourism sector in the UAE has likely remained under pressure through the summer.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

One way for firms in Dubai’s tourism industry to offset the impact of a stronger currency is by reducing their selling prices. This trend of price discounting has been evident in a number of sectors, including hospitality and retail.

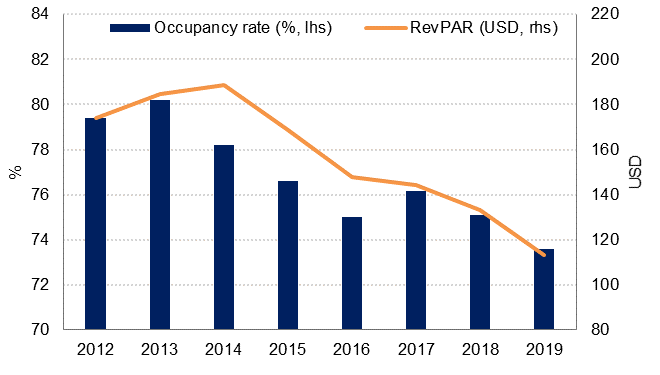

Data from STR Global shows that revenue per available room (RevPAR) in Dubai in the year-to-July declined by -14.7% y/y. In July 2019, Dubai’s RevPAR stood at USD 65 per room according to STR Global, while the average RevPAR year-to-July was USD 133, the lowest since at least 2012. The increase in the supply of hotel rooms has been a key driver of lower hotel room prices, but the relatively modest growth in international visitor numbers over the last two years has not helped. Average hotel occupancy in Dubai in the year-to-July 2019 fell to 73.6% from 75.1% in the same period last year, and the lowest occupancy rate for this period since at least 2012.

Source: STR Global, Emirates NBD Research

Source: STR Global, Emirates NBD Research