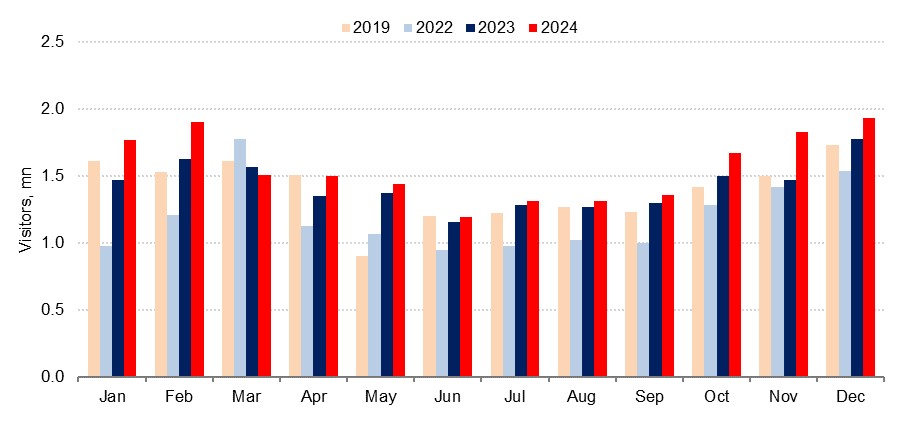

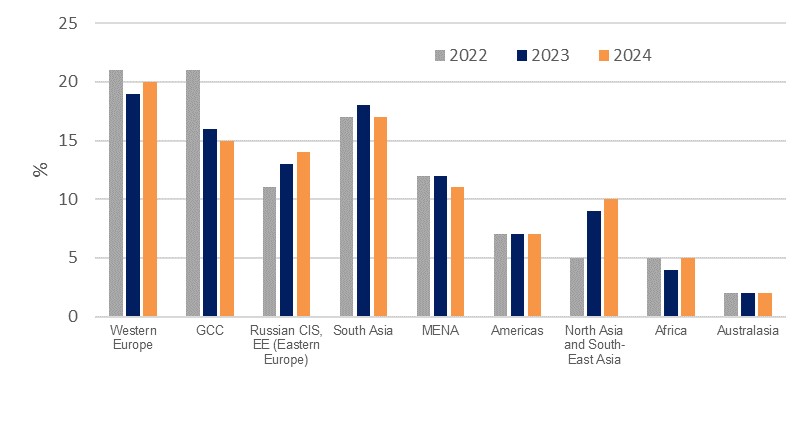

Dubai’s tourism sector continues to hit new records as full-year 2024 figures show a total of 18.72mn visitors, representing y/y growth of 9.2% on the 17.15mn recorded in 2023. This followed the 19.4% growth recorded the previous year, with momentum being maintained even as pre-pandemic visitor numbers are long since recaptured. Similar to 2023, Western Europe has continued to account for the largest share of tourists to Dubai, contributing 20% of the total. This was followed by South Asia (17%), GCC (15%), Russia, CIS, and Eastern Europe (14%), GCC (14%), the rest of MENA (11%), North and Southeast Asia (10%), Sub-Saharan Africa (5%), and Australasia (2%).

Source: DTCM, Emirates NBD

Source: DTCM, Emirates NBD

The region that logged the strongest growth in terms of visitors was SSA, with growth of 31.6% in 2024. This growth accelerated through the second half of the year, with the resumption of direct Emirates flights to Nigeria in October after a two-year suspension likely supporting this. A new interline agreement signed between Emirates and West African carrier Air Peace should also be supportive of growth between Dubai and Africa’s most populous country through 2025. North Asia and Southeast Asia started the year with very strong growth on the back of base effects related to China’s late reopening from Covid-19 (92.3% y/y in January), but with these now passed through the cumulative annual growth rate softened to 17.4% by December. Western Europe made the largest contribution to the annual figure as not only was it the largest source market but its visitor numbers also grew by 14.8% last year, while South Asia expanded by a softer 1.6%.

There remains notable momentum in visitor growth, with the pace of expansion accelerating through the final months of the year – visitor numbers in November were 24.5% higher than in November 2023, and growth remained strong at 8.4% y/y in December, compared with just 2.6% in June. While unrest in the wider Middle East region did not appear to impact demand to visit Dubai over the past year, with the situation seeming to calm in recent months there could be a further fillip to the sector through 2025. In addition, slowing inflation and easing monetary policy around the world could give a boost to household spending power and demand for travel as the cost-of-living crisis recedes, although ongoing dollar strength does pose a challenge to Dubai’s competitiveness. And while the tourism subcomponent of S&P Global’s Dubai PMI survey did soften in January from the previous quarter, at 54.9 it remains firmly in expansionary territory.

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD Research

The tourism sector is not a specific account line in the Dubai national accounts data, but the sectors most associated with it – transport & tourism and hotels & restaurants – have been driving the headline expansion in recent quarters. Dubai recorded real GDP growth of 3.1% y/y over the first three quarters of 2024 and within that transport & storage expanded by 5.3%, following 9.2% growth in 2023. The airports and the national carriers are the major contributor to this, and DXB International handled 92.3mn passengers in 2024, y/y growth of 6.2%. As Dubai’s tourism sector continues to grow, it will further support throughput at the airports.

Hotels & restaurants logged y/y growth of 3.7% over the first three quarters of 2024 according to the national accounts data and the metrics released by the DTCM suggest another strong quarter in Q4. For 2024 as a whole, average occupancy rose to 78.2%, up from 77.4% in 2023. While tourism businesses cut their prices charged through much of 2024 according to the S&P Global survey as they sought to remain competitive, firms managed to pass on higher costs to customers over the past two months and the DTCM data suggests that hotels maintained some pricing power as revenue per available room rose 1.5% to AED 421.

The Dubai government continues to invest heavily in developing the tourism sector, not only in the established destinations within the city of Dubai, but also in the rural hinterland with the master plan for the Saih al-Salam Scenic Route, which should encourage more visitors to the countryside, recently approved with a USD 106mn budget. Private sector investment also continues apace with new hotel launches being frequently announced. We forecast headline real GDP growth of 3.7% this year following an estimated 3.2% in 2024, and the tourism sector will be a key component of this.