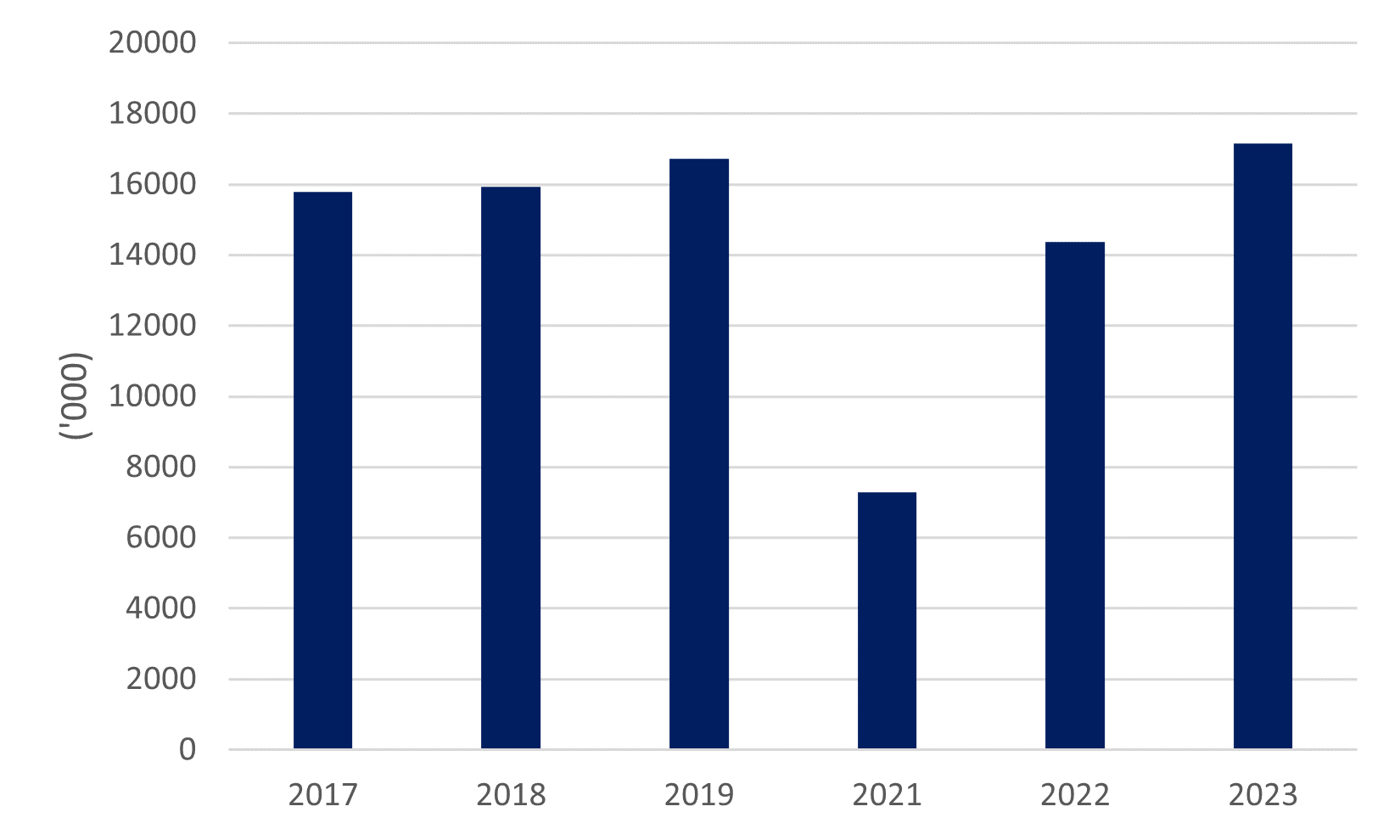

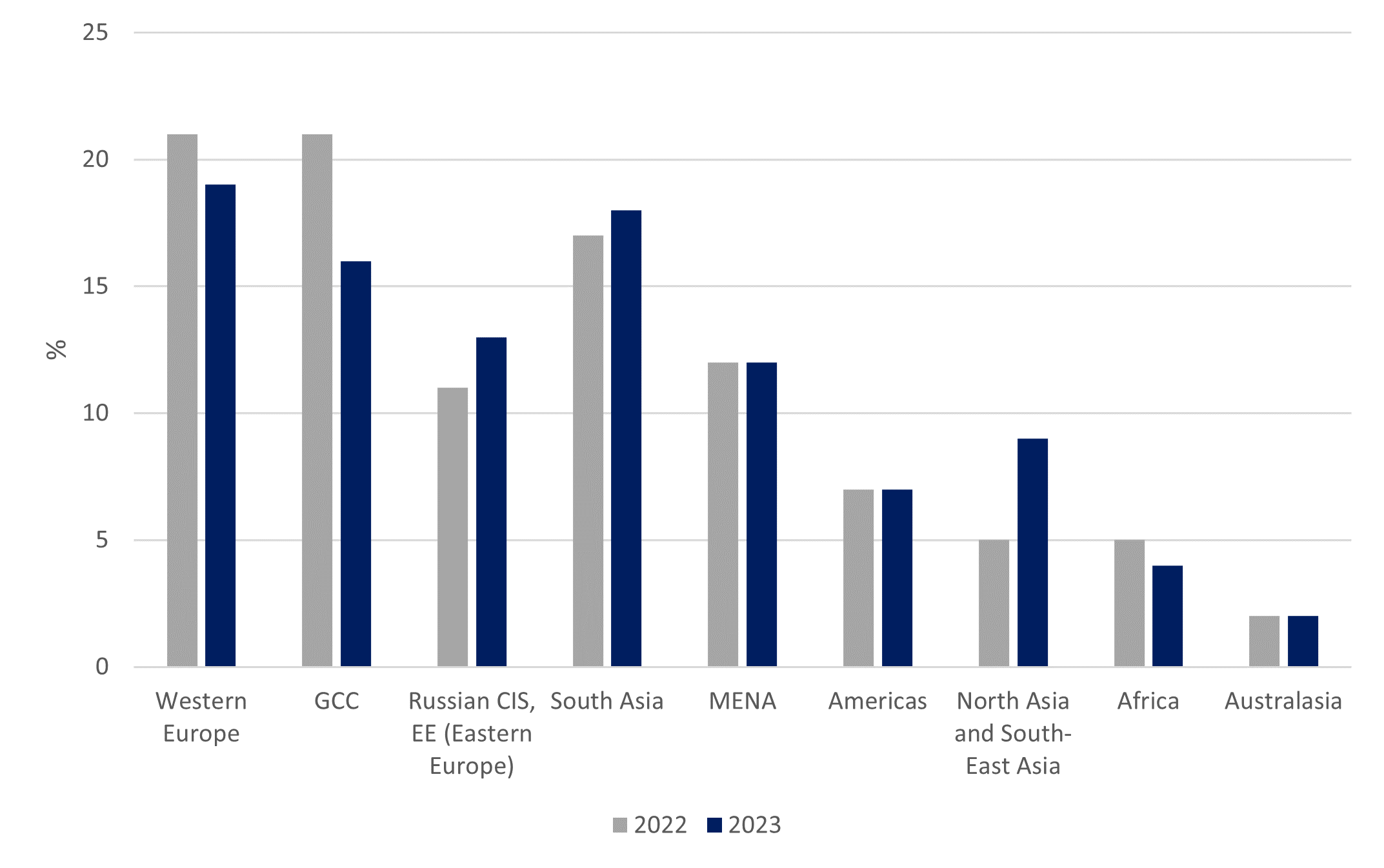

Dubai’s tourism sector achieved record visitor numbers in 2023, attracting 17.15mn international visitors, a 19% y/y increase, surpassing the previous 2019 record of 16.73mn visitors. Western Europe constituted the largest source of visitors, comprising 19% of the total volume, followed by South Asia at 18%. The GCC contributed 16%, Eastern Europe 13%, and MENA 12%. All regions exhibited growth compared to 2022, with most regions experiencing around 20% increase. Africa stood out with 31% y/y increase, but this is due to being calculated off a lower base than other regions. Notably, no African country (except Egypt which falls under MENA) was among the top 20 source countries as of October 2023, indicating a diverse tourism base across the continent. The GCC and North Asia-Southeast Asia had the lowest growth rates among other regions with 15% and 13% y/y respectively.

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD ResearchPassenger traffic through Dubai International Airport surged by 31.7% y/y, to reach 87mn people in 2023, surpassing the pre-pandemic 2019 levels. The second half of the year saw a robust performance with 45.4mn visitors. August was the busiest month with 7.9mn passengers followed by December with 7.8mn passengers. India topped the list as the top destination with 11.9mn passengers, followed by Saudi Arabia with 6.7mn passengers, the United Kingdom with 5.9mn passengers, Pakistan with 4.2mn passengers, and the United States with 3.6mn passengers. London retained its status as the leading destination city with 3.7mn passengers, followed by Riyadh with 2.6mn passengers, and Mumbai with 2.5mn passengers. Dubai Airports expects passenger traffic to increase to 88.8mn passengers in 2024, slightly short of the record of 89.1mn visitors that was set in 2018.This forecast is somewhat conservative in our view, considering IATA projects an annual global growth of 3.4% in international passenger traffic, and given Dubai’s position as a global travel hub. Based on the IATA forecasts, Dubai is likely to exceed the 90mn passengers mark in 2024.Nevertheless, growth in passenger traffic going forward will most likely be at a slower rate. Rising environmental concerns around carbon footprint, taxes, and higher costs of travel could have an impact on passenger traffic growth in the coming years.

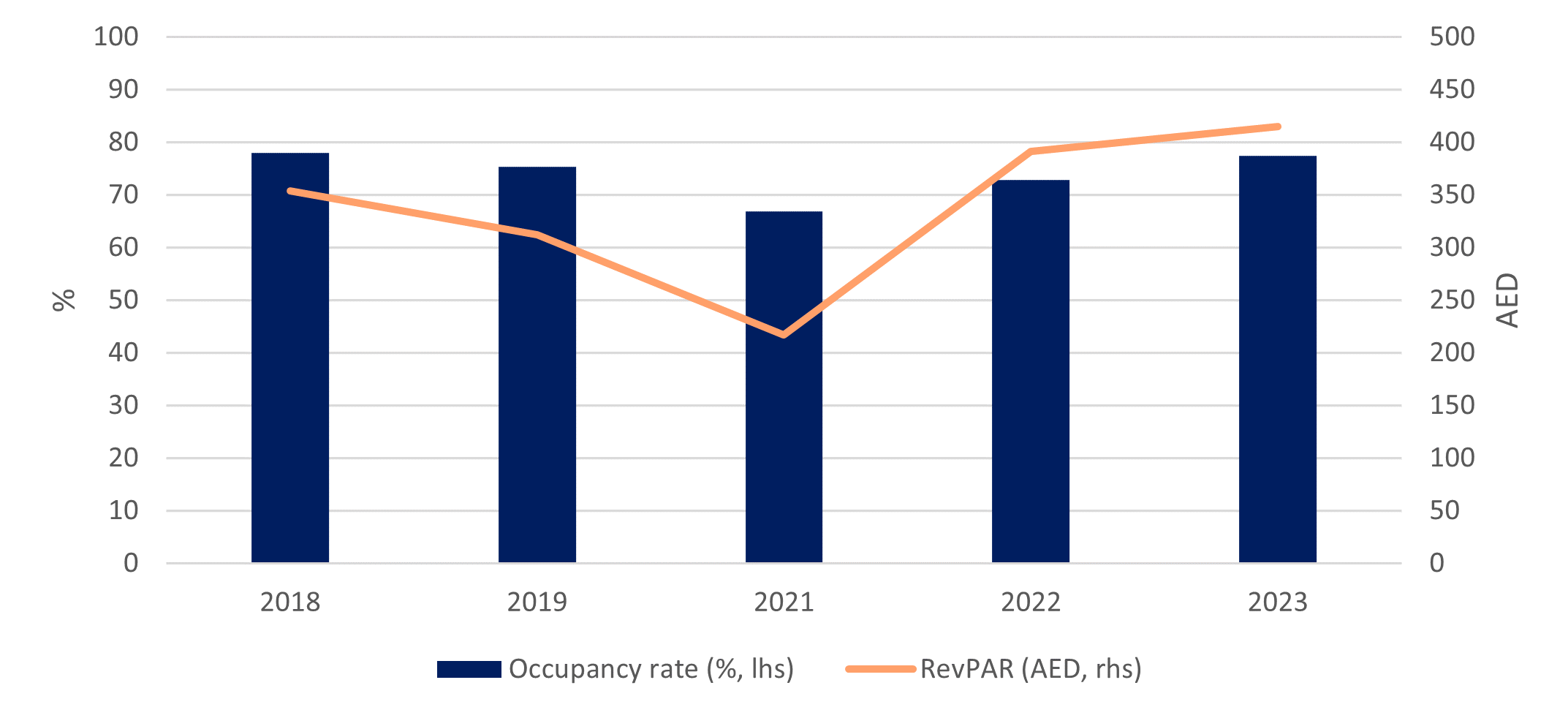

Dubai’s average hotel occupancy in 2023 rose to 77.4%, a 4.5pp increase from 2022, and 2.1pp higher than 2019 according to data from DTCM. Although the guests’ length of stay declined slightly from 3.9 nights in 2022 to an average of 3.8 nights last year, the occupied room nights grew by 11% y/y and 32% from 2019 to 41.7mn nights. The average revenue per available room grew by 6% y/y last year to AED 415.The number of total available rooms grew by 3% y/y to 150,291 rooms. Five-star hotels had the biggest share of the inventory with 35%, while four stars hotels made up 29%, and hotels from one to three stars made up 19%.

Source: DTCM, Emirates NBD Research

Source: DTCM, Emirates NBD Research