The government of Dubai will inject equity into Emirates airlines to ensure that it can survive the current disruptions to global travel. No details on the size of the financial aid were provided in the statement. Emirates has already reduced staff salaries and cancelled all passenger flights. Separately, Emaar Properties has temporarily halted construction of a project in downtown Dubai, citing delays in operation outside the company’s control, according to a Reuters report. In Kuwait, the cabinet approved a stimulus package to cope with the pandemic’s impact. It includes supporting liquidity through prompting government bodies to pay any funds owing to the private sector, providing soft long-term loans, and easing loan repayments for any companies that are struggling in the current environment.

There was more positive news from China, as the unofficial Caixin PMI survey confirmed what the official PMI results told us yesterday - that the country is slowly getting back to work. The survey came in at 50.1, which is just about over the neutral 50.0 line which delineates a contraction and an expansion in the non-oil private sector. This compared with a deeply contractionary 40.3 last month, and consensus expectations of 45.5. It also chimes with the positive official PMI reading of 52.0 yesterday.

By contrast in the US, which is some weeks behind China in terms of the pandemic’s spread, consumer confidence fell to 120.0, compared to 130.7 the previous month. The consumer had been the stalwart of the US economy through 2019 but has been derailed by the coronavirus-related disruption, driving confidence down to 2017 levels - although it was stronger than consensus expectations of 110.0.

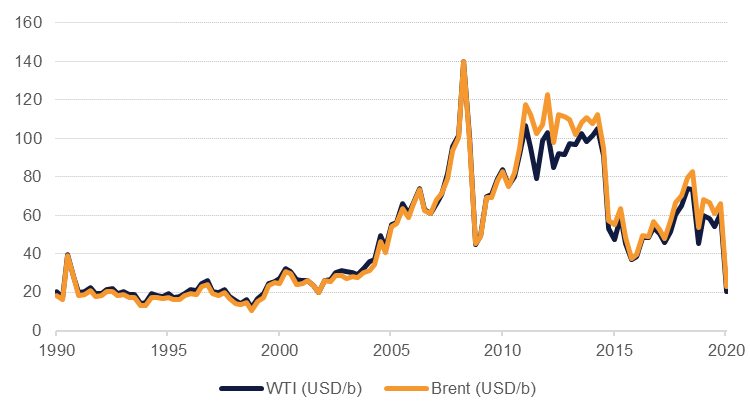

Oil markets ended the first quarter with their worst performance ever. Closing at USD 20.48/b overnight, WTI fell 66.5% in the first three months of the year while Brent futures were down by 66% to end at USD 22.74/b. The declines far outpaced the oil price collapse in 2015-16 and the Global Financial Crisis. The oil market now enters a new era where Saudi Arabia produces at 12m b/d or more, a level that was only meant to be reached for emergency shortages. Meanwhile the full extent of economic shutdowns in core consumption markets of OECD Europe, the US and India will begin to be felt this quarter with the level of demand destruction likely to permanently alter the long-term trajectory for oil consumption. Even if OPEC countries, Russia and now perhaps the US were to come to some form of production cut agreement, the scale of cuts required to balance the market would be unacceptable to producers.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as stocks closed lower from their session highs. The curve whipsawed through the trading session before yields on the 2y UST and 10y UST closed at 0.23% (-1 bp) and 0.64% (-2 bps) respectively.

Regional bonds closed largely flat. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained around 4.74% while credit spreads hovered around 410 bps.

The Dollar was choppy on Tuesday, the last day of Q1, firming initially and then losing ground with the USD index now below the Monday closing price at 99.070. Month and quarter end related USD selling was a factor, but dollar demand has noticeably eased since the Fed's unlimited QE commitment. Yesterday the Fed announced a measure to stabilize dollar funding markets; a temporary repurchase agreement facility for foreign central banks which will allow participants to temporarily exchange US Treasuries for dollars. Better than expected Chicago PMI and consumer confidence data had little overall lasting effect.

Developed market equities closed mixed as investors remain wary of a rather prolonged shutdown. The Euro Stoxx 600 index added +1.7% on the back of a solid bounce in Chinese data while the S&P 500 index lost -1.6%.

Regional markets traded mixed. The rebalancing of portfolio and bargain hunting remained the theme. The DFM index lost -1.0% while the Tadawul added +2.1%. Banking sector stocks led the rally on the Tadawul while weakness in Emaar-related names weighed on the DFM index.

Oil prices were mixed overnight, bringing an end to their worst ever quarterly performance (see above). May Brent futures expired essentially flat at USD 22.74/b while WTI managed to gain just shy of 2%. Discussions between the Russian and US presidents appear to be spurring hope that some kind of productin deal may be in the works but we are doubtful how successful oil market diplomacy will be at present.

Private sector oil inventory data warned of a 10.5m bbl build in stocks last week. EIA data will be released later today with market expectations of a continued build in stocks.