Dubai’s real estate market recorded steady and persistent growth in Q3 of 2022. The latest figures from the Dubai Land Department show a near 14% q/q increase in overall transactions from 22,423 to 25,496 and an increase in the value of transactions from AED 58.99bn to AED 69.49bn (up 17.8% q/q). This has primarily been driven by a large uptick in off-plan property sales which increased to 11,774 (up 30.9% q/q). Existing properties still made up the largest bulk of sales at 13,722 but this figure represents a modest increase of 2.2% from the previous quarter, a marked deceleration from Q1 and Q2 which recorded growth of 19.2% and 12.6% respectively.

The significant rise in sales of off-plan properties combined with a pronounced slowdown in sales of existing properties is indicative of how markets conditions have developed over the course of 2022. Interest rates have risen to their highest levels in over a decade and direct payment to property developers has become a much more enticing prospect as it is typically less expensive to purchase real estate under construction. The UAE central bank follows the policy rates from the Federal Reserve given the dirham’s peg to the dollar and with inflation still at elevated levels in the US (8.3% y/y as of August), it is unlikely that the Fed will slow their tightening of monetary policy. We estimate the Fed Funds target rate (upper bound) to continue increasing into 2023, reaching a high of 4.75% around its midway point before easing back later in the year. The USD has also strengthened considerably off the back of these hikes, to a two-decade high in September, making Dubai relatively more expensive, particularly for foreign investors which will affect supply and demand. Ultimately these developments will increase costs for buyers going forward which may prolong the current pattern of purchasing into the new year.

.png) Source: Dubai Land Department, Emirates NBD Research

Source: Dubai Land Department, Emirates NBD Research

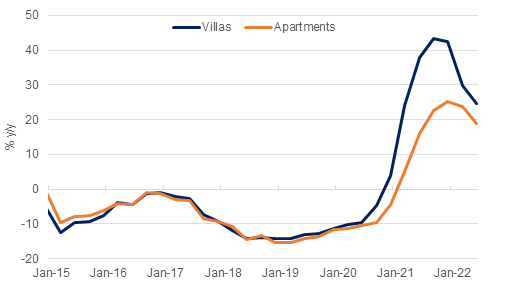

Property price growth has slowed down as a result of these factors after soaring to y/y highs in 2021. Villa and apartment price gains slowed to 24.6% y/y and 19.0% y/y respectively. The average rent price for apartments has overtaken the average rent price for villas in Q3 on a y/y basis (22.6% y/y compared to 22.1% y/y), driven almost entirely by the average rent of three-bedroom apartments which has more than doubled from the second quarter. Rent prices will likely increase even further in the final part of the year due to the FIFA World Cup in Qatar starting in November, bringing a huge surge of visitors to the region and Dubai in particular due to its position as a regional hub. Commercial properties continue to rise as well, as demand for business space recovers.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

Dubai has proven to be a favourable destination for property investors in 2022. The total number of transactions recorded this year, 71,278, has already surpassed total transactions for the entirety of 2021, 60,347 (up 18.1%). As of this writing the total worth of these transactions is up 28.7% (AED 191.92bn from AED 149.16bn) representing a notable upswing with the rest of the year still remaining. Unit and land transactions have been the primary drivers of growth; existing property sales exceeded more than AED 2bn on three separate occasions. The luxury sector in particular has attracted significant investment in 2022, as several luxury villas have sold for high profile valuations in the range of AED 100 – 300m.

Dubai’s real estate sector has likely in part benefitted from the success of Expo 2020. The event welcomed over 24mn visits during its six-month runtime, with one in every three visitors coming from overseas, at a point where restrictions still hampered global tourism. The successful hosting of the festival whilst simultaneously handling tricky Covid-related difficulties will have provided good advertising for the city. Furthermore, Expo Village, an area that was once home to international participants working at the event, is set to become a residential community for domestic citizens. The Expo site itself has also been repurposed into a new development dubbed “Expo City Dubai” which will provide a hub for thousands of businesses and residents alike.