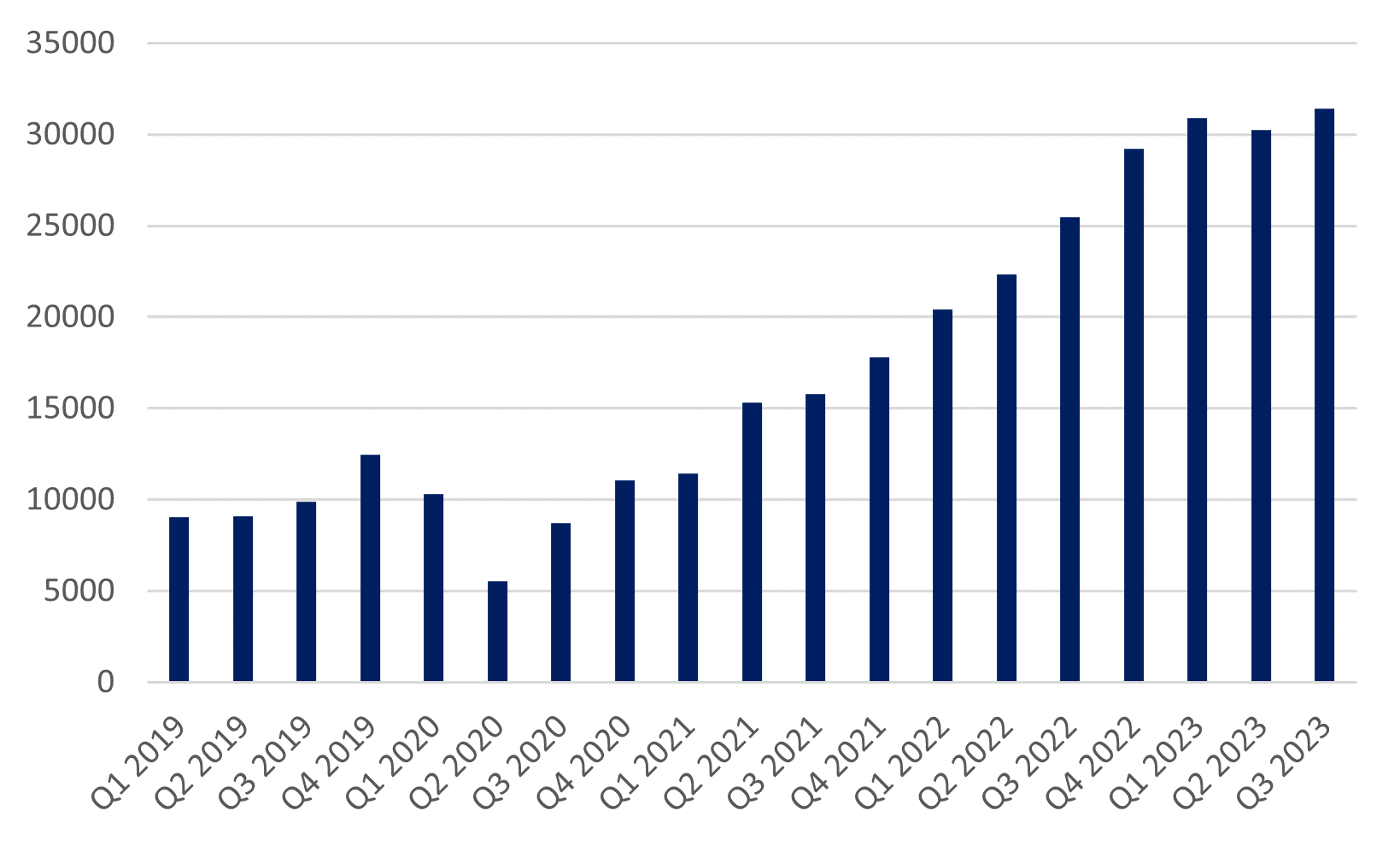

The Dubai real estate market registered a new record in the number of transactions and the total value of transactions in Q3 2023, according to the latest figures from Dubai Land Department. After a slight decline in Q2 2023, the number of transactions rose 3.8% q/q and 23% y/y to 31,399 transactions. The total value of the transactions grew 7% q/q and 40% y/y to AED 97.5bn

Apartments accounted for the largest share of transactions, with 22,136 transactions and a total value of AED 43.2bn. Villas recorded 5,627 transactions for AED 27.9bn. Plots saw the biggest growth; the number of plot transactions grew 112% q/q and 197% y/y to 2,702 transactions for a total value of AED 25bn. Commercial property recorded 934 transactions for AED 1.5bn.

Source: Dubai Land Department, Emirates NBD Research

Source: Dubai Land Department, Emirates NBD ResearchIn terms of geographical performance, Dubai Marina stood out as the top-performing area performing area in total sales value in Q3 2023, generating AED 7.2bn in sales value. Business Bay followed in second place with AED 4.5bn. Al Merkadh came in third with AED 3.7bn. Jumeirah Village Circle came fourth with AED 2.1bn and Arjan came in fifth with AED 1.3bn.

Jumeirah Village Circle led Dubai’s residential real estate market in the total number of transactions, registering 2,485 transactions. Business Bay came in second with 2,386 transactions. Al Merkadh came third with 2186 transactions. Dubai Marina came in fourth with 1851 transaction and Arjan came in fifth with 1,536 transactions.

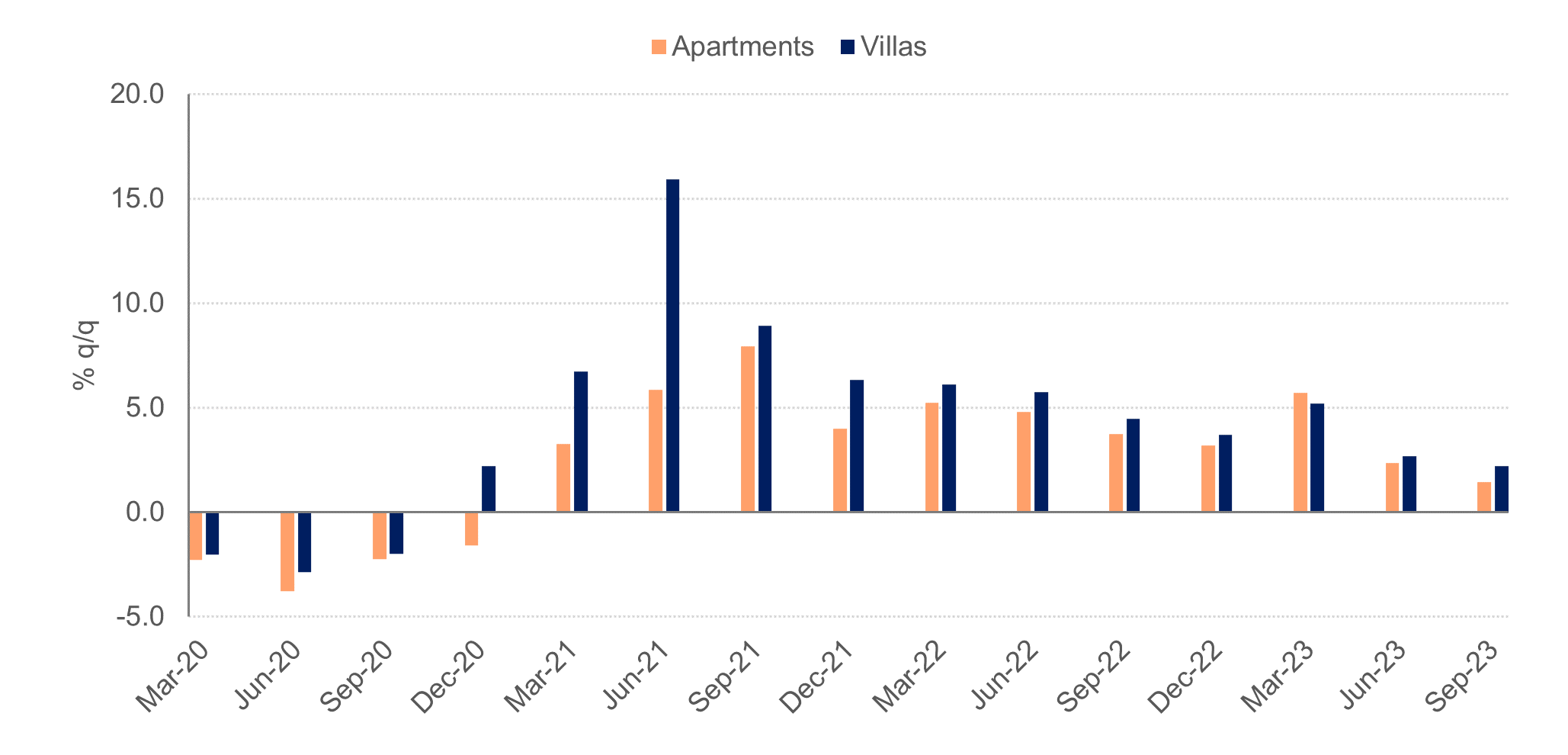

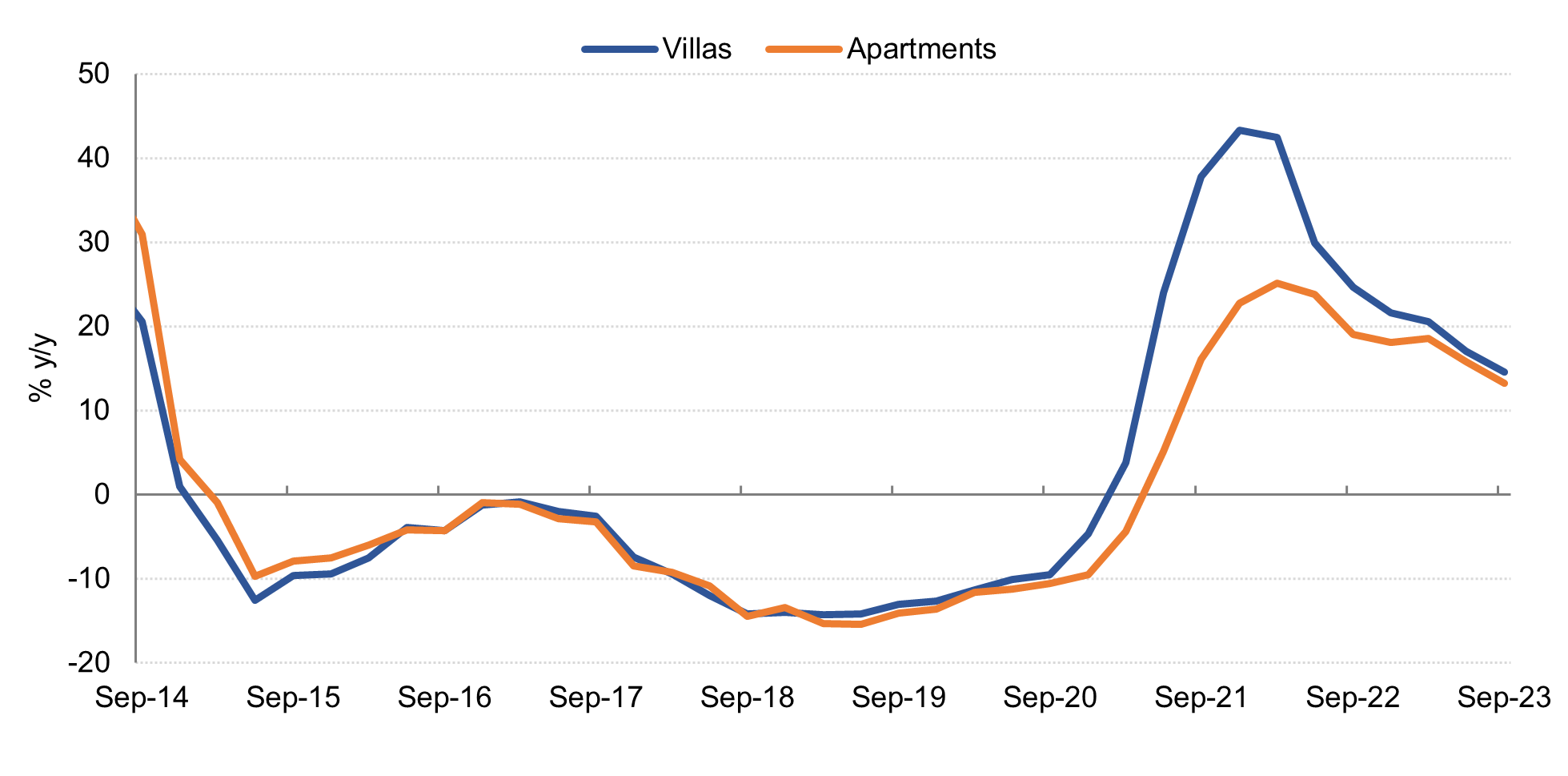

For existing freehold properties, data from ASTECO showed that Dubai freehold residential real estate prices continued to make gains but at a slower pace. Apartments rose 1.4% q/q and villas rose 2.2% q/q, the slowest growth rate since Q4 2020.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD ResearchOn an annual basis, the pace of price appreciation also decelerated with freehold villa sales prices growing by 14.5% y/y, down from 17.1% y/y in Q2 of 2023, the slowest growth rate since Q1 2021. Freehold apartment sales prices have also continued to grow but at a slower pace, rising by 13.3% y/y, the smallest y/y gain since Q2 2021.

Source: ASTECO, Emirates NBD Research

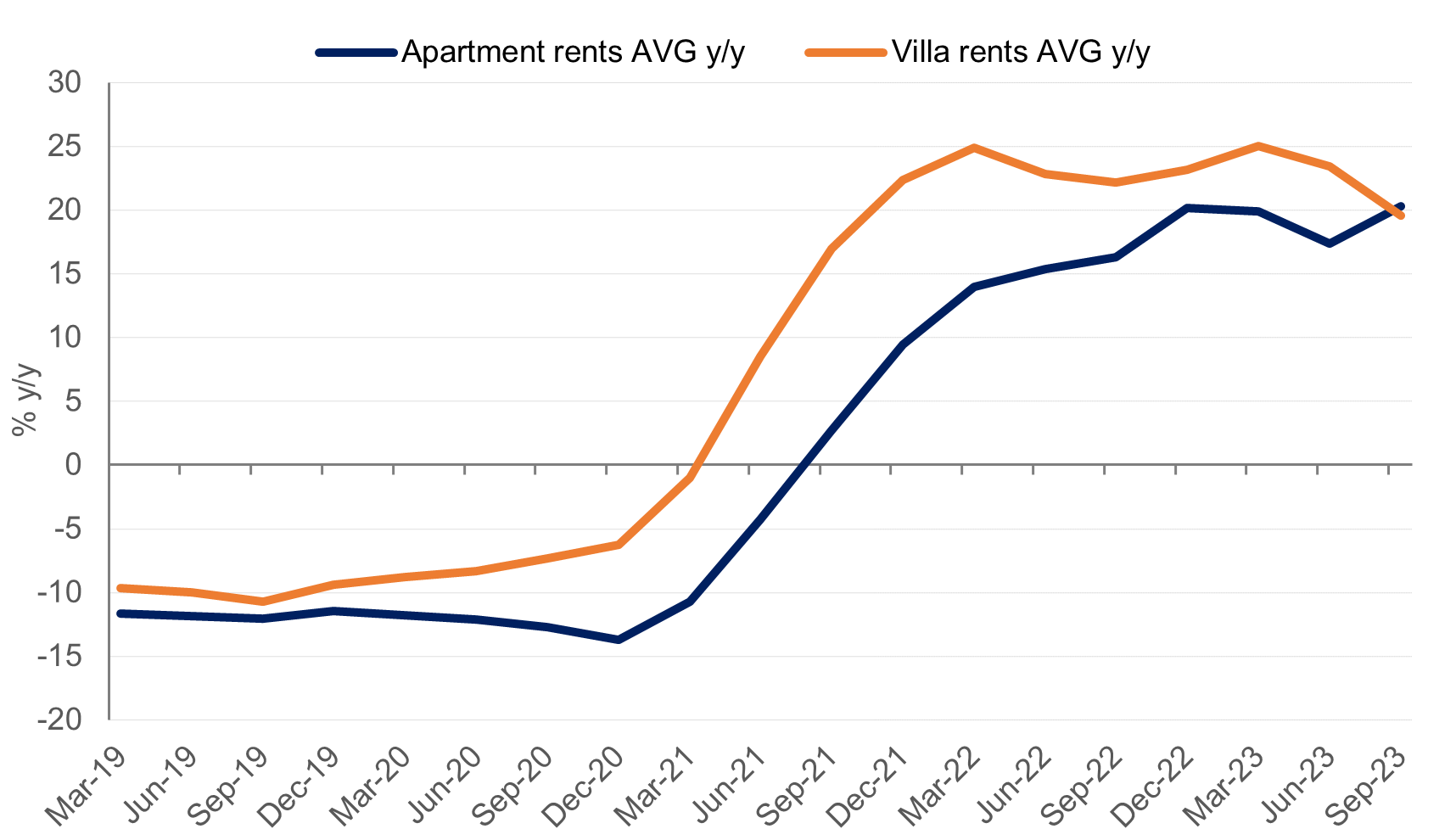

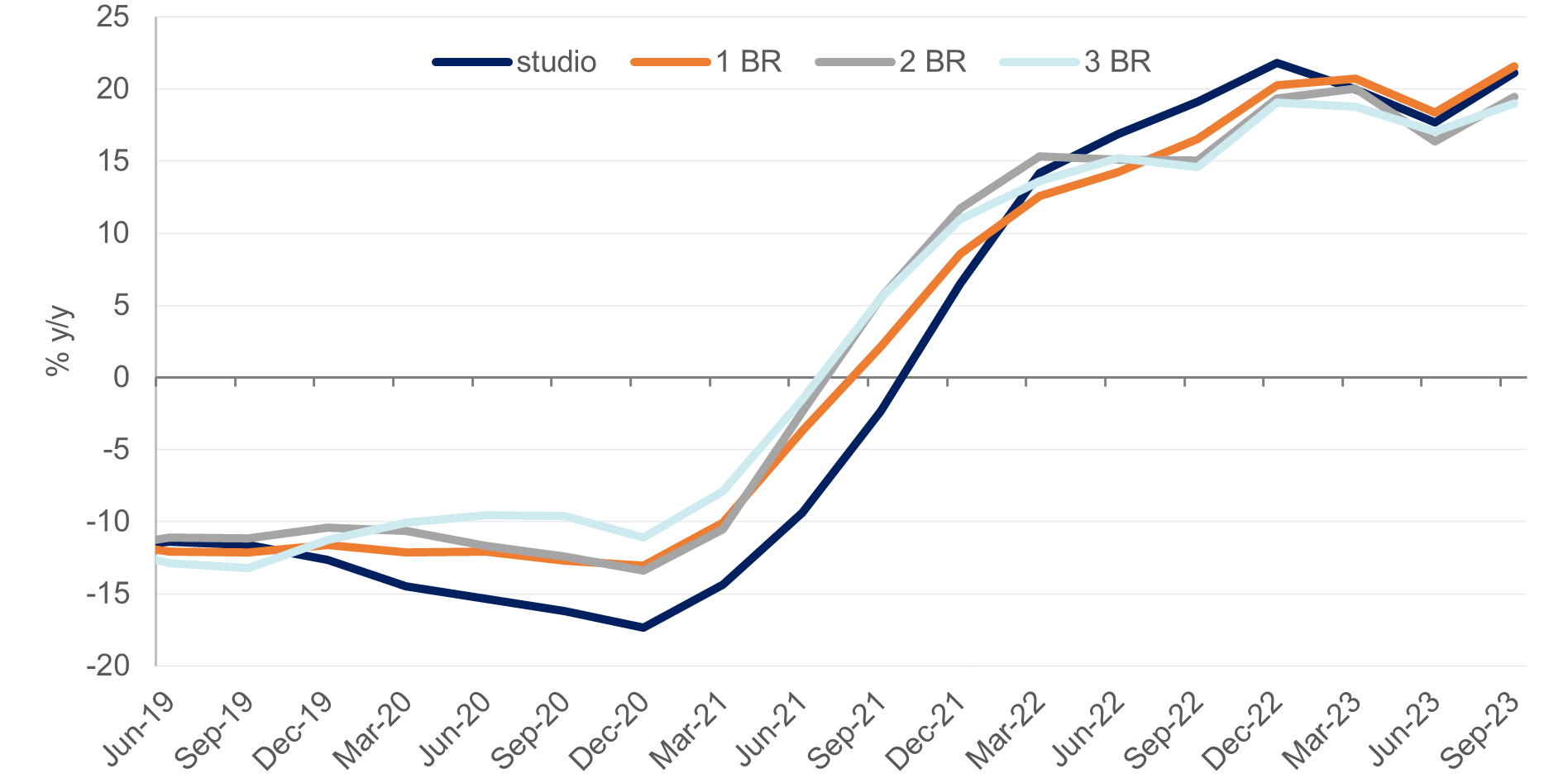

Source: ASTECO, Emirates NBD ResearchVilla rents have continued to rise but at a slightly slower rate in Dubai freehold areas, with the average growth in villa rents easing to 19.6% y/y from 23.5% y/y in Q2 of 2023. Conversely, apartments rents have diverged from the villa rental growth trend and continued to grow sharply with rents rising 19.6% y/y from 17.4% y/y in Q2 2023.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

All apartments’ segments have recorded an increase in rent growth. Studios, one-bedroom, and two-bedroom, three-bedroom apartments saw rents rise by 21.1%, 21.6%, 19.5%, and 19.0% y/y, respectively.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

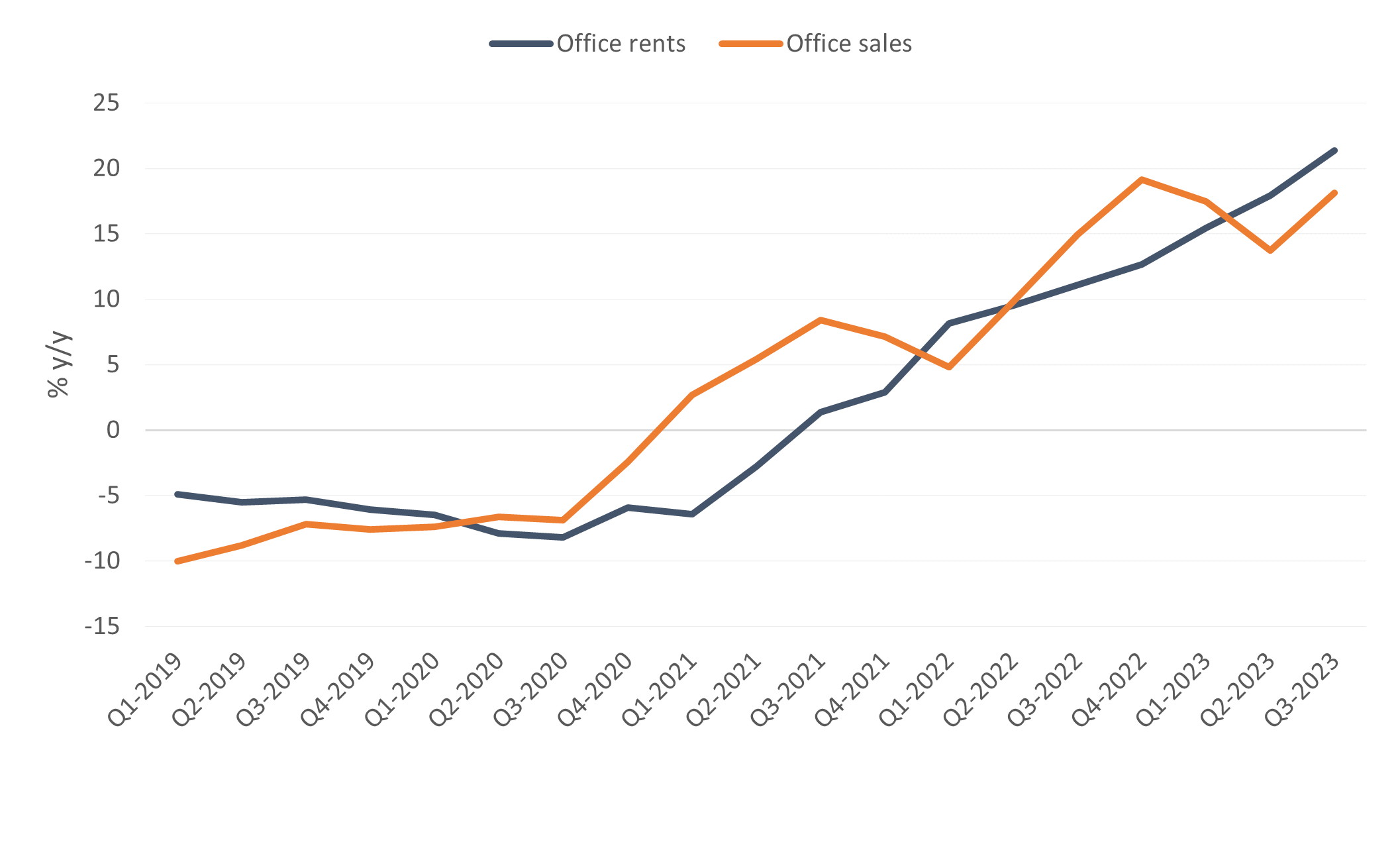

Office rents continued to rise for the 10th consecutive quarter and saw their fastest growth in Q3 2023, with rents rising by 6.2% q/q and 21.4% y/y, reaching a new high of AED 138 Sqf per year. Office sales also recorded a strong quarterly performance, rising by 9.6% q/q and 18.1% on y/y to an average price of AED 1188 per sqf.

Source: Reidin, Emirates NBD Research

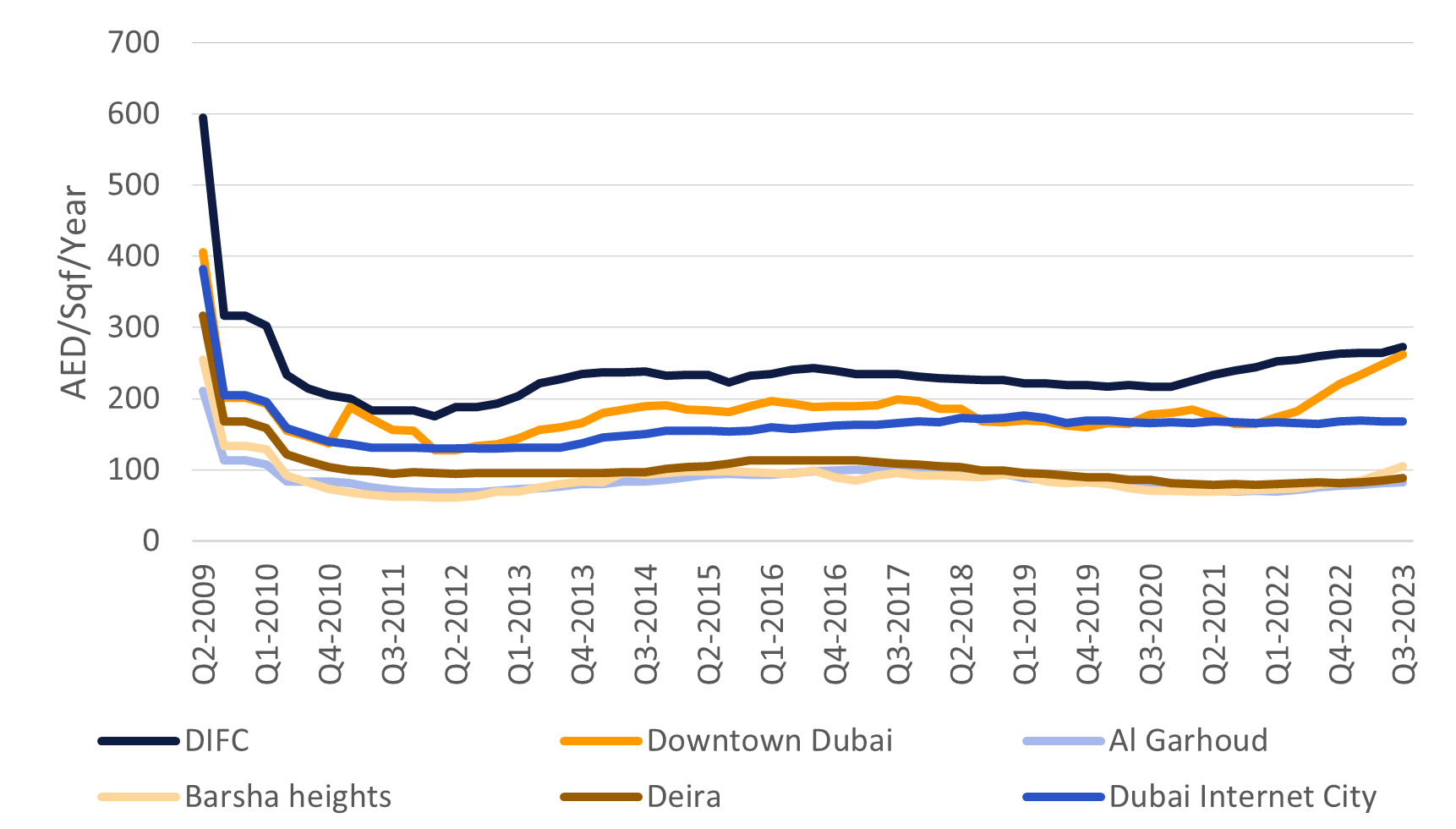

Source: Reidin, Emirates NBD ResearchAccording to the latest data from Reidin, the average occupancy rate in Dubai has risen 3.4pp y/y to 81.2% in H1 of 2023. Prime offices had the highest occupancy rates with DIFC and Downtown Dubai having 91% and 87.4% occupancy rates respectively. The strong demand for prime offices has further widened the divergence in the value of rents between areas.

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD Research

The robust and rapid expansion of Dubai’s real estate market, in conjunction with elevated interest rates, has notably affected the affordability of the average household. The combination of high interest rates and diminished affordability exerts a downward influence on the real estate market. Nevertheless, the robust growth observed in the non-oil sector of the economy, alongside population growth, may provide momentum for the real estate market to sustain its upward trajectory.