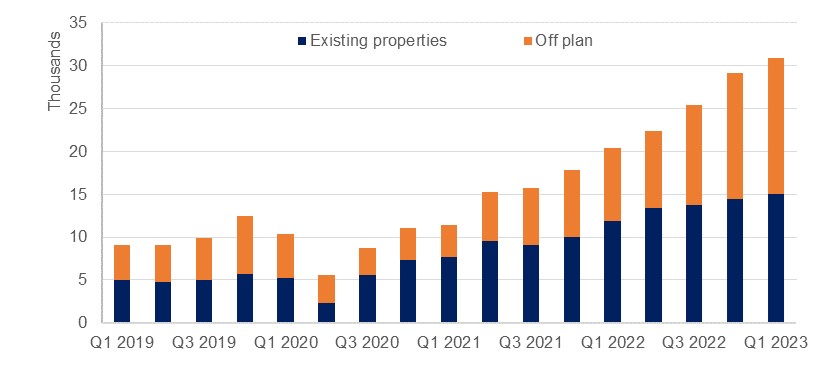

Dubai’s real estate sector continued to grow, albeit a slower pace in Q1 of 2023. According to the latest figures from Dubai Land Department, the total number of transactions grew 5.8% q/q to 30,897 and the value of transactions grew 8.1% q/q to AED 88.72 bn.

Investors’ appetite for off-plan properties remains strong, with off-plan properties making up 51.5% of total transactions. Buyers may have a preference for off-plan sales in a rising rate environment as developers often provide incentives and flexible payment options.

Despite the increase of 87.3% q/q in the number of transactions for off-plan properties, there was a slight decline of 1.2% q/q in the value of these transactions. This could be due to the increase of transactions in areas with a lower price per square foot and fewer transactions being made in prime real estate areas. The average price for an off-plan transaction in Q1 2023 was 1,781 AED/Sqf, almost -7% lower than the 1914 AE/Sqf average in Q4 2022. The average value of off-plan units sold in Q1 2023 was AED 2.23mn, a decline of almost -9% from the previous quarter, according to data from ReidIn.

Source: Dubai Land Department, Emirates NBD Research

Source: Dubai Land Department, Emirates NBD Research

For existing properties, the number of transactions in Q1 was only 3.8% q/q higher than the previous quarter, although the value of the transaction was up 15.3% q/q, suggesting that activity was driven by the prime segment.

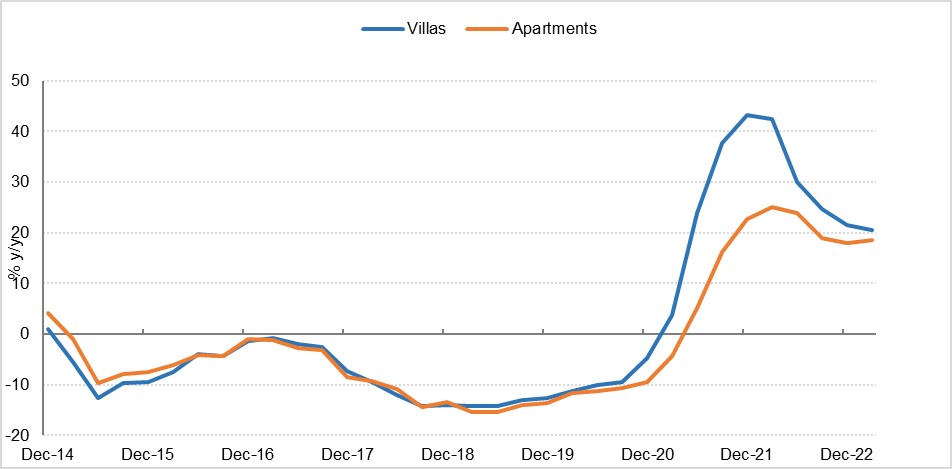

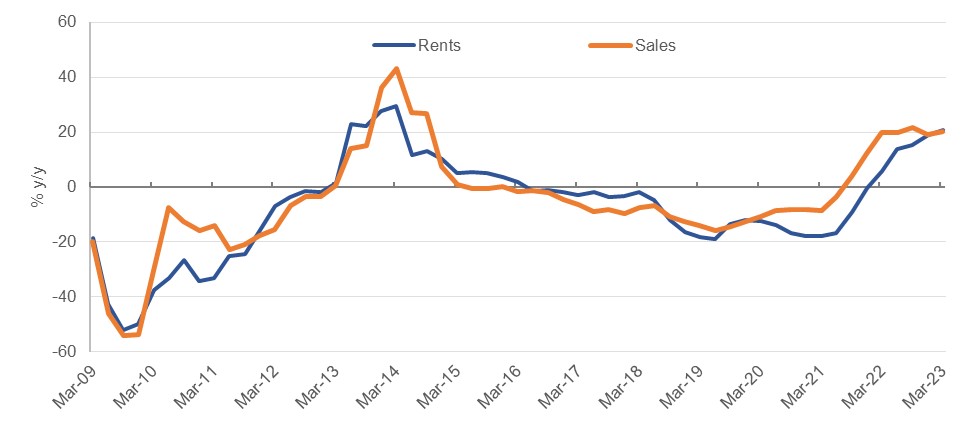

For existing properties, data from ASTECO show that freehold villa sales prices continued to rise in Q1 2023, although growth moderated slightly to 20.5% y/y. On the other hand, freehold apartment prices appear to have gained momentum at the start of 2023, rising 18.6% y/y.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

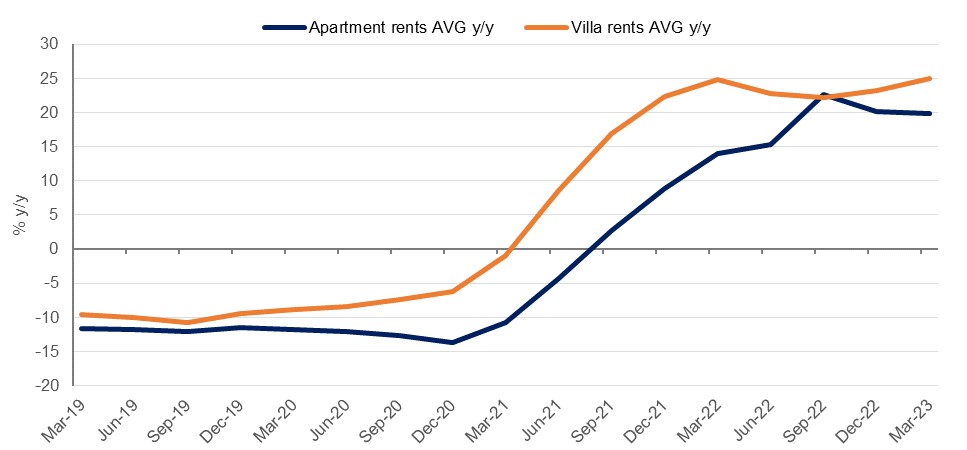

Villa rents rose sharply in Q1, with the average growth in villa rents up 25% y/y.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

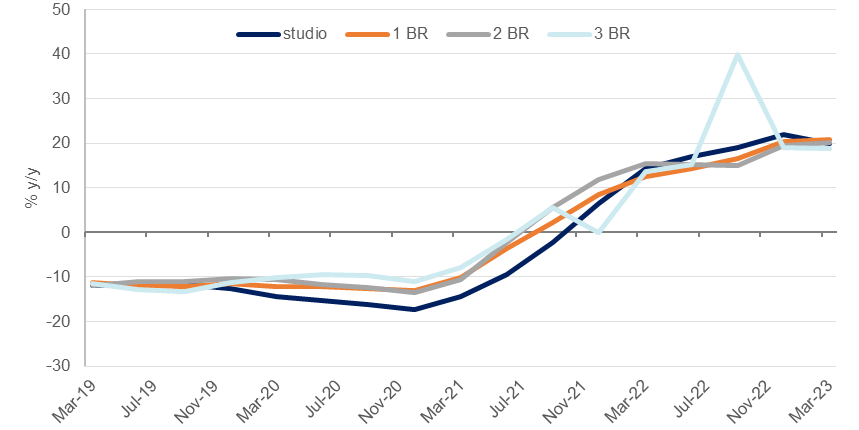

The average growth in rents is starting to stabilize across all apartment segments, with the average growth in apartments rents declining slightly from 20.1% in Q4 2022 to 19.9% y/y in Q1 2023.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

Office rents continued to rise for the 8th consecutive quarter, up 20.8% y/y in Q1 2023. The average sales price of freehold office space was up 20.1% y/y, reaching a new high at 1,149 AED/Sqf, the highest since 2017. This a clear indication that more businesses are moving to Dubai, boosting demand for office space, particularly in prime areas such as DIFC, Barsha Heights and Jumeirah Lakes Towers.

Source: ASTECO, Emirates NBD Research

Source: ASTECO, Emirates NBD Research

Dubai’s real estate market has been resilient so far in the face of sharply higher interest rates. However, higher borrowing costs can take a year or longer to feed through to the real economy, and we expect growth in real estate prices to moderate further over the course of 2023.