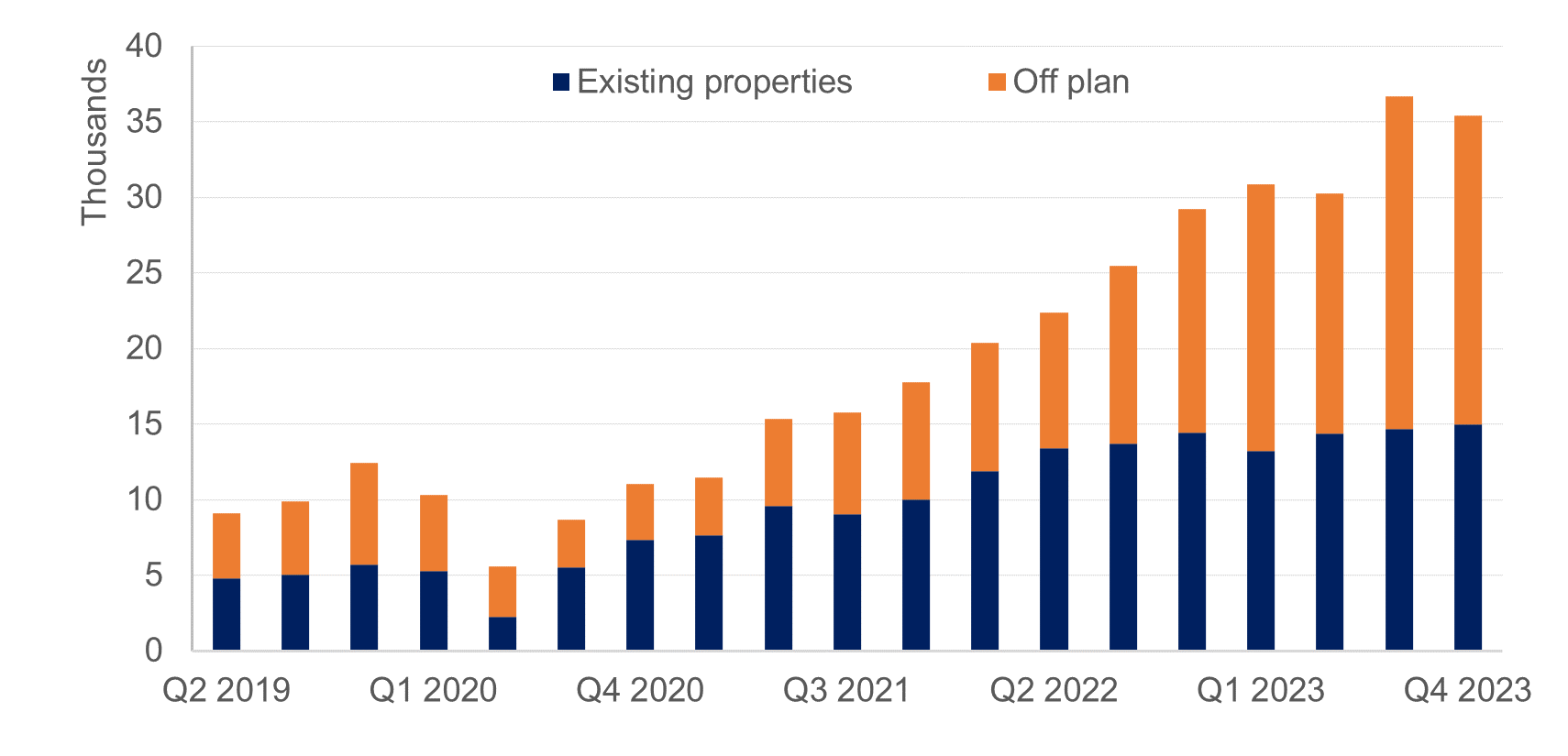

2023 has been an exceptional year for Dubai’s real estate market, setting new records in both the total number of transactions and the total transactions value. The total number of transactions in 2023 rose by 37% y/y to 133,300 transactions and the total transactions value grew 51% y/y to AED 400bn.

Source: Dubai Land Department, Emirates NBD Research

Source: Dubai Land Department, Emirates NBD ResearchIn terms of geographical performance, Palm Jebel Ali stood out as the top-performing area in terms of sales value in Q4 2023, generating AED 14.2bn. Dubai Marina followed in second place with AED 8.3bn, while Business Bay came in third with AED 5.1bn. Downtown Dubai ranked fourth with AED 5bn, and Arjan came in fifth with AED 4.9bn.

Jumeirah Village Circle led Dubai’s residential real estate market in terms of the total number of transactions, registering 3911 transactions. Al Merkadh came in second with 2943 transactions. Business Bay came third with 2741 transactions. Dubai Marina came in fourth with 2164 transactions and Dubai Hills Estates came in fifth with 1593 transactions.

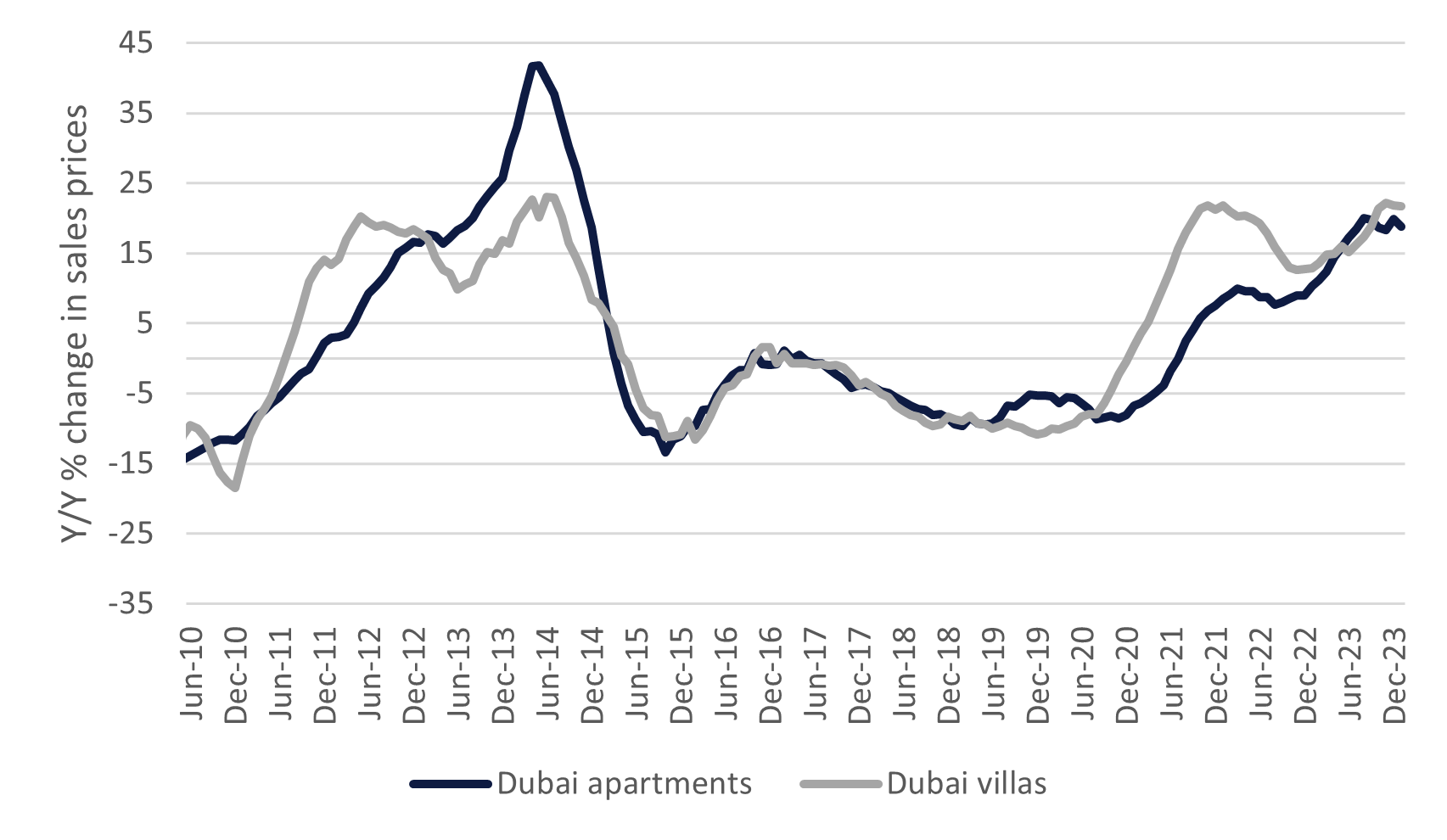

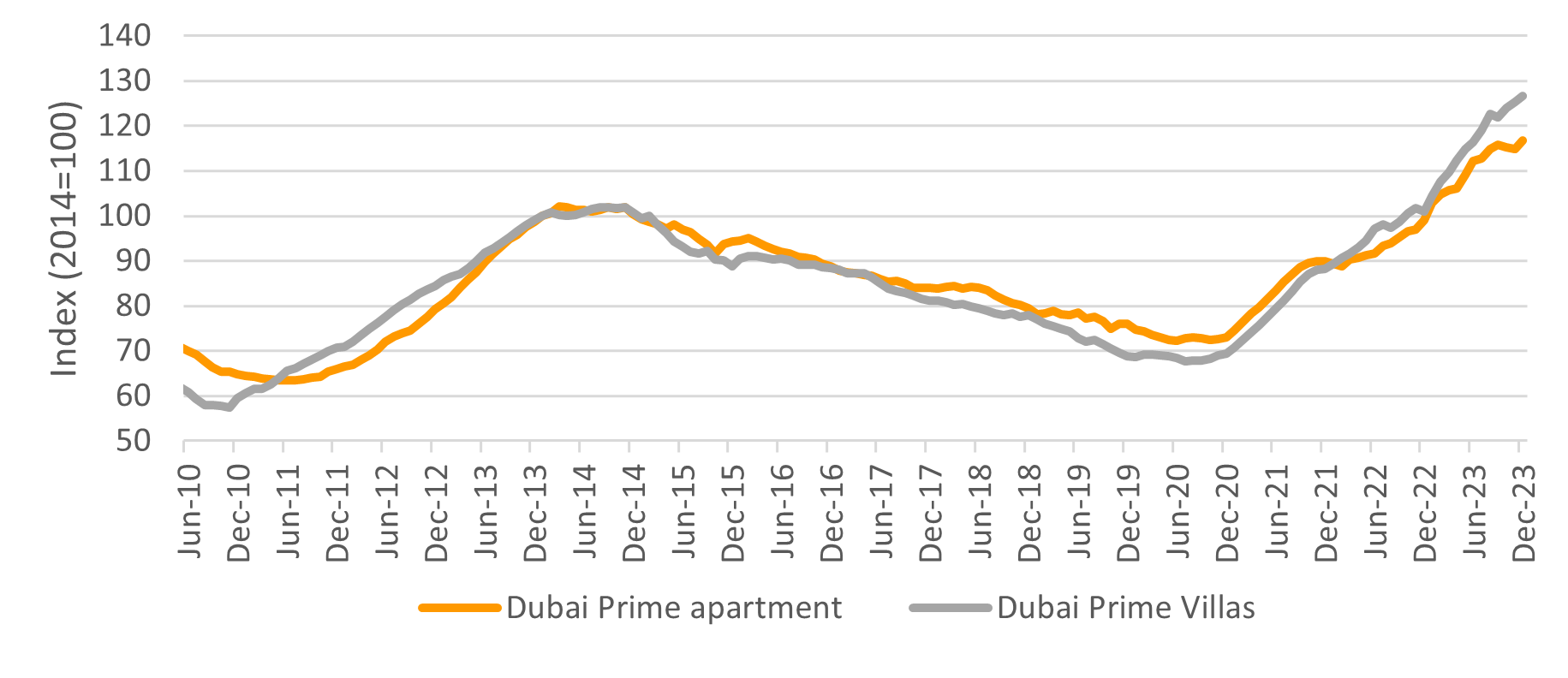

Dubai apartment and villa sales prices continued their rapid growth, rising 19.8% y/y and 21.8% y/y respectively in December. The average villa price/sqf of AED 1686 surpassed 2014 peaks by more than 16%. The average apartment price/sqf of AED 1399 /sqf is still around 6% below the July 2014 peak of AED 1491/sqf. However, in the prime segment of the market, prime apartments exceeded 2014 levels by approximately 17% in December. Dubai Marina has been the standout among the prime apartments sales segment, with 24% y/y growth in prices by the end of 2023. In the prime villas sales segment, Jumeriah Islands and the Palm outperformed their peers in 2023 with a surge in prices of 33% y/y and 36% y/y in December, respectively.

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD Research

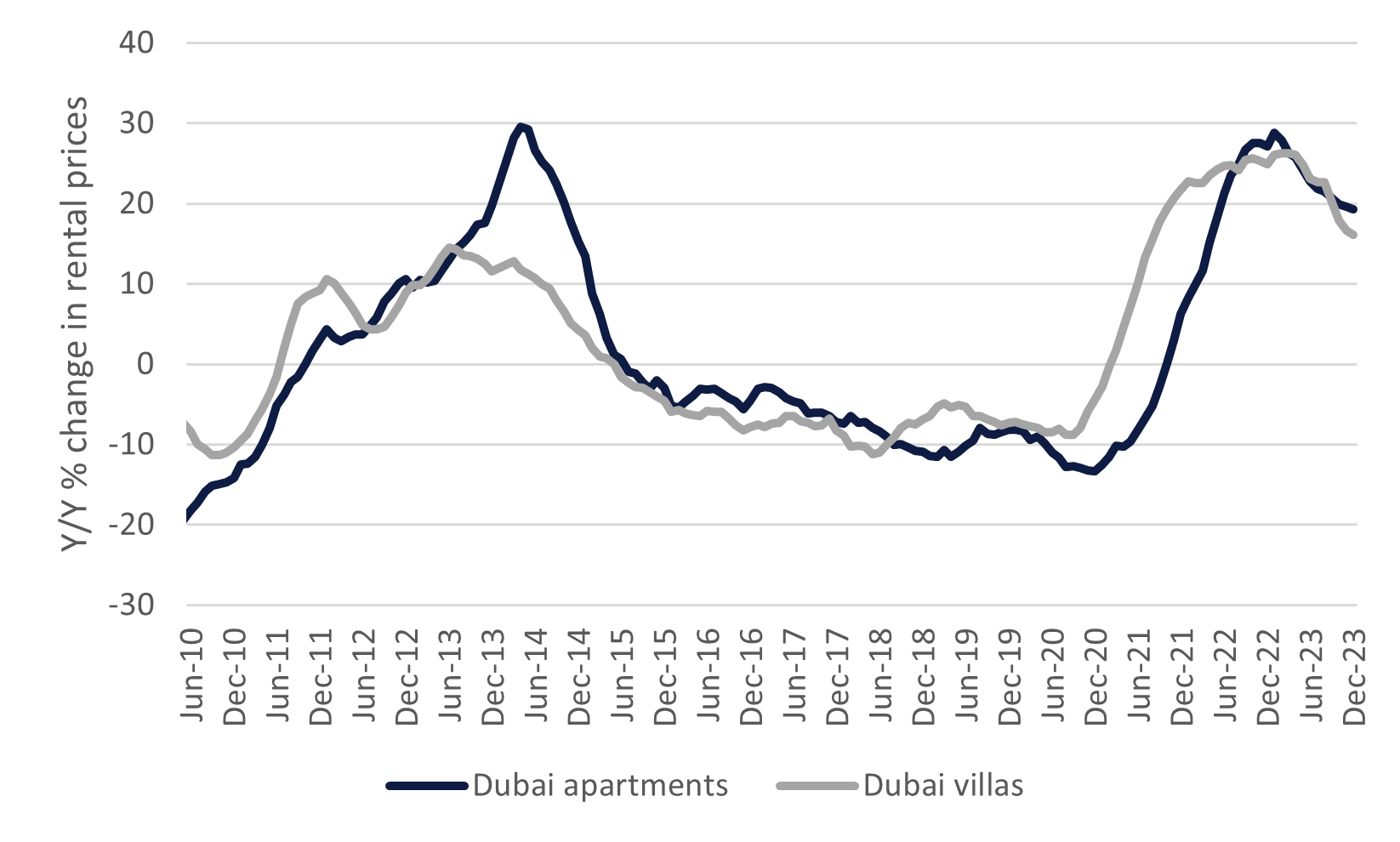

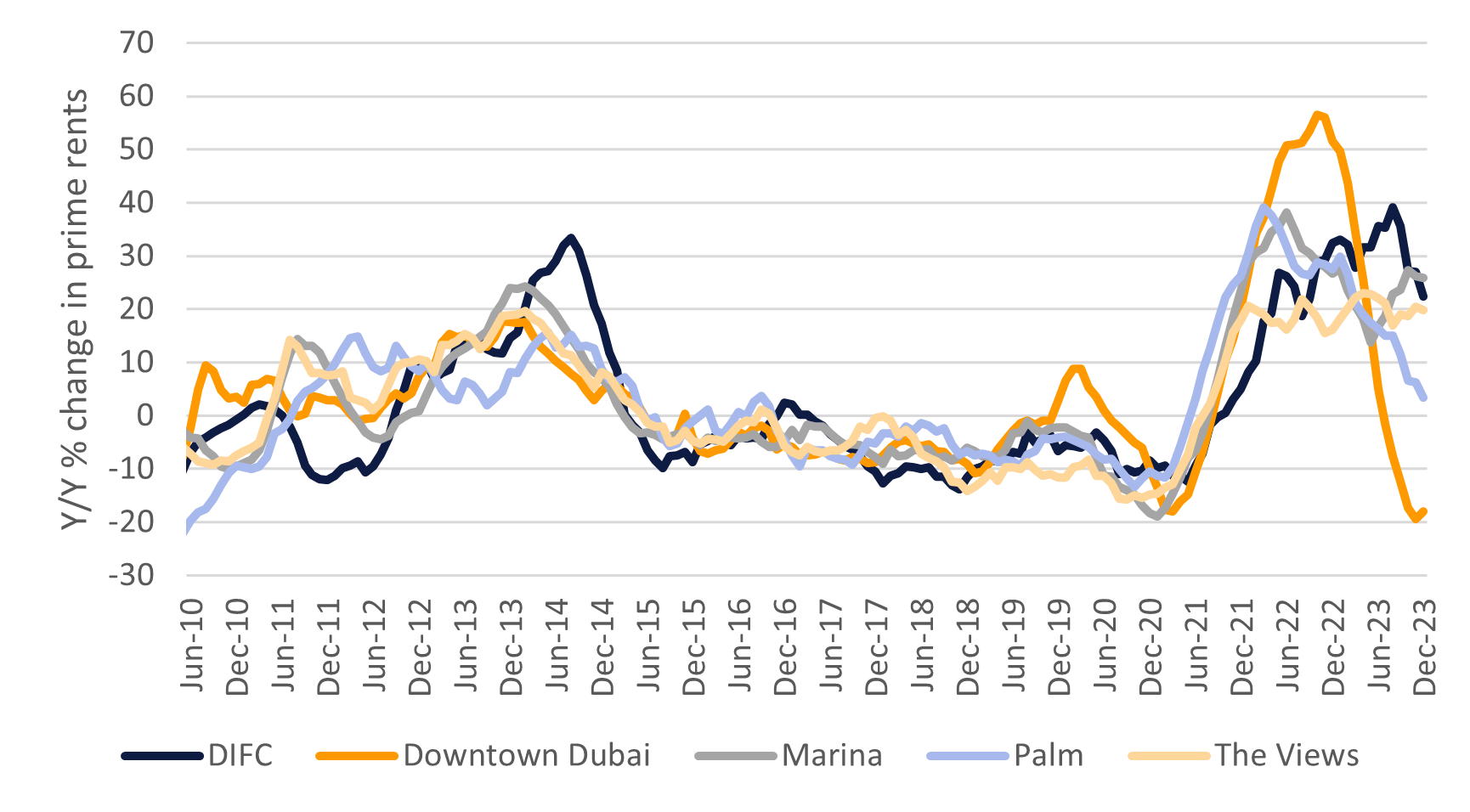

Residential rents continued to grow but a slower pace. Dubai apartment and villa rents increased by 19.3% y/y and 16.1% y/y respectively in December, with a moderating growth trend since the start of 2023. The prime segment of the market has seen a larger deceleration in growth. Dubai prime apartments rents grew by 6.3% y/y in December while Dubai prime villas rents grew by 12.2% y/y, compared with 34.7% and 26.2% in December 2022.

Downtown Dubai apartments rents saw the largest decline among prime areas, dropping -18% y/y in December, after surging in 2022. Dubai Marina showed the most substantial gains in December, rising 25.8% y/y.

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD Research

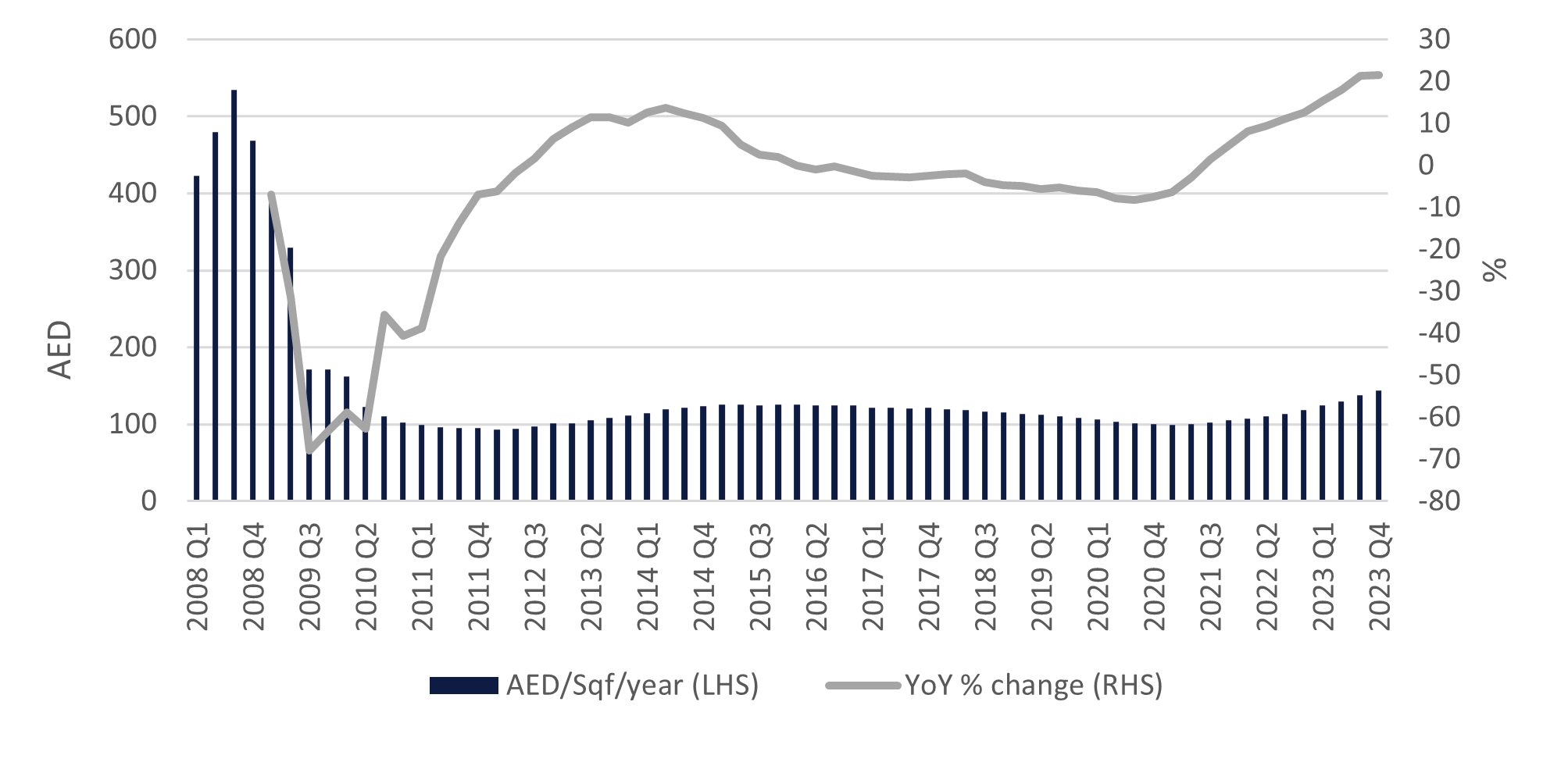

Source: Reidin, Emirates NBD ResearchOffice rents grew 21% y/y to AED 143.4/ sqf per year in Q4, driven by strong demand for office space. The strong demand is evident with the increase in the average occupancy rate to 85.9%, a strong recovery from the lows of 78% registered back in Q4 2020. Nevertheless, office rents remain significantly below the highs of 2008, where office rents peaked at AED 534.7/ sqf per year.

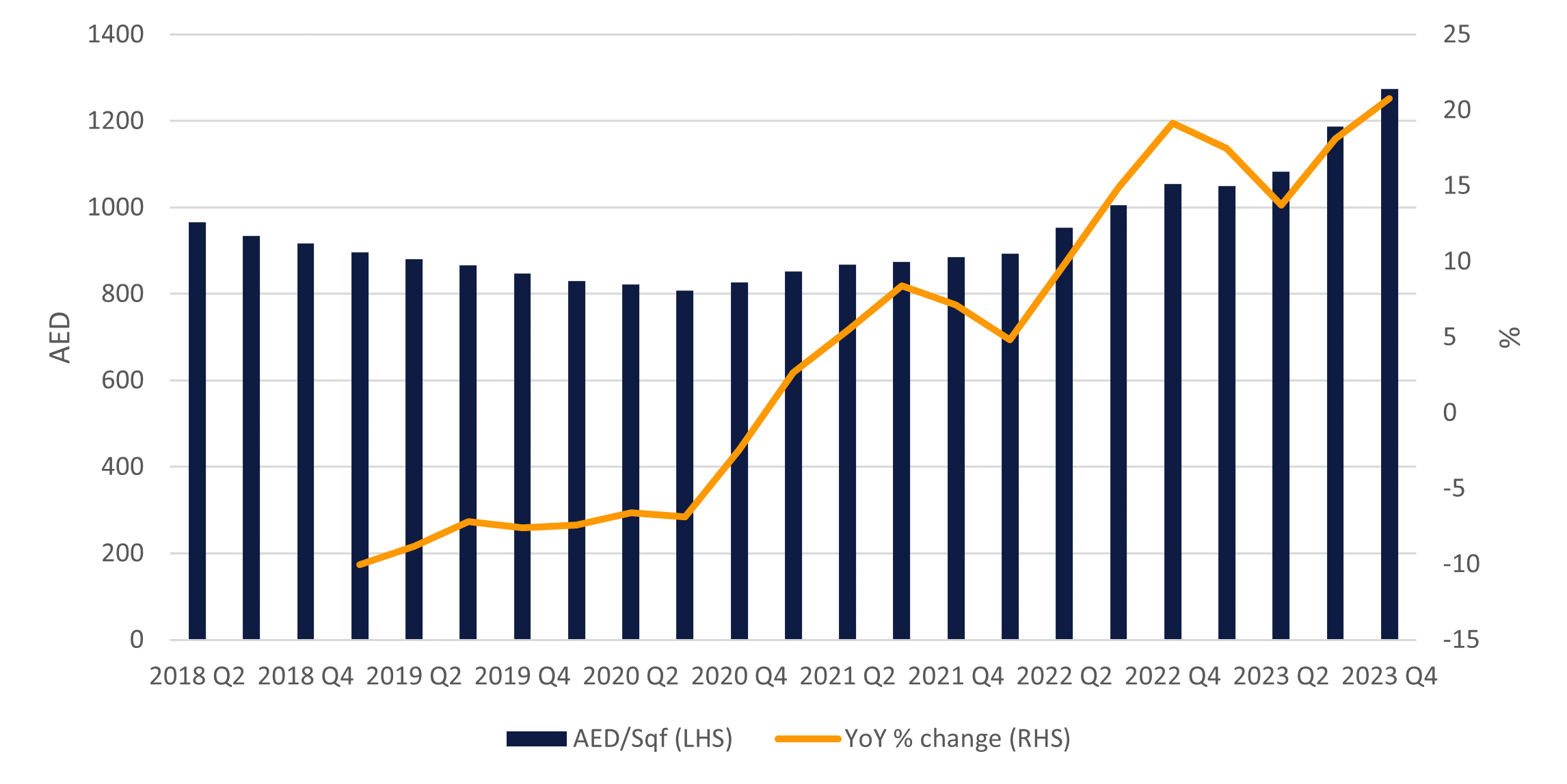

Office sales prices also surged by 21% y/y to an average price of AED 1273.8/ sqf. Office prices have grown consistently since the pre-pandemic lows of AED 807/ sqf in Q3 2020. The limited supply of offices has supported the growth of the offices market. The total office gross leasable area that is currently under construction and will come to the market in the next three years is 2.43mn sqf which amounts to only 2% of the total existing office supply. The strong demand for offices coupled with the limited supply may support the growth trend into 2024.

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD Research

Source: Reidin, Emirates NBD ResearchDubai’s real estate market concluded 2023 on a resilient note, achieving significant milestones even as interest rates peaked. Population growth has been one of the key drivers of the real estate market growth. Dubai’s school enrollments grew 12% at the start of the new school year in September 2023, DEWA reported 4.7% growth in new accounts last year and the number of mobile phone subscribers were up 7% y/y at the end of Q3; all of which are indicative of new household formation.

Looking ahead, Dubai’s real estate market is likely to face some headwinds in 2024, including continued high interest rates, declining affordability for the average household, and a growth in the supply of new units. The impact of high interest rates last year was reflected in a -7% y/y decline in the total value of mortgage transactions to AED 125bn. The rapid price growth, coupled with the high interest rate environment has affected the affordability of housing for the average household. The anticipated increase in supply, comprising 41,500 apartments and 18,500 villas in 2024, should help to stabilize residential real estate prices this year.