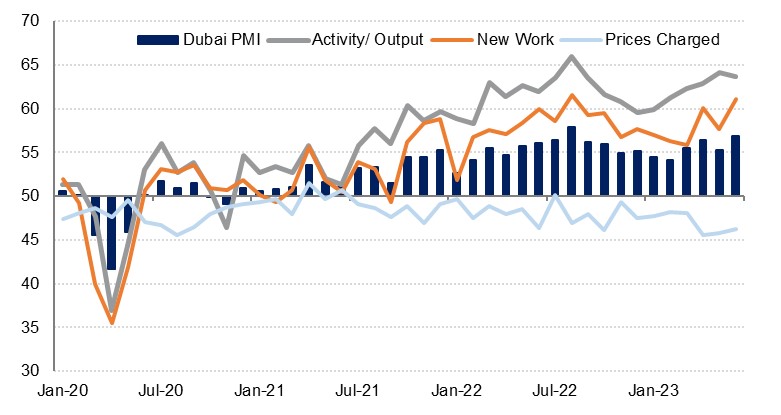

The S&P Global PMI survey for Dubai strengthened in June as it rose to 56.9, from 55.5 the previous month. This marked the strongest reading for the survey since August, reaffirming our view that the Dubai economy has remained robust through the year so far despite mounting global challenges. Indeed, we recently revised up our 2023 real GDP growth forecast to 5.0%, from 3.5% previously. Drilling down into the subcomponents of the survey it seems likely that a healthy expansion rate will be maintained over the coming quarters given that new orders accelerated at the fastest pace in 10 months in June. Input costs did rise more rapidly than seen in May, but still at a far slower rate than seen in mid-2022, which allowed businesses to continue discounting as prices charged declined for the 11th consecutive month. Firms continued to hire in order to cope with the rise in output.

Travel & tourism was the strongest performing of the three sectors individually covered by the survey, as the headline reading was the highest since August. New work expanded especially sharply, and businesses ramped up their hiring as they sought to cope with demand. This was maintained through heavy discounting which was at the most acute level since October. Business expectations rose to a 19-month high. The survey suggests that the tourism data from the DTCM will continue to show a strong recovery in visitor numbers this year, with January-April data showing the total nearing pre-pandemic levels.

Construction strengthened to 55.1 in June, from 54.1 in May. This marked the strongest reading in four years as the sector has benefitted from strong demand for both residential and commercial projects. The sector was also discounting, with prices charged falling at the sharpest rate since June 2021, while input costs accelerated on May’s print but remained slow compared to last summer. Hiring slowed in June but remained positive.

The wholesale & retail sector also grew more rapidly in June than in May, as the sector PMI rose to 56.4 – up from 55.4 and back to the level recorded in April. Output expanded strongly in June and new orders also grew more rapidly, but the pace of hiring slowed. Discounting was at a slightly softer rate than the series low recorded in May but remained sharp compared to the other two sectors. Input costs accelerated slightly meanwhile.