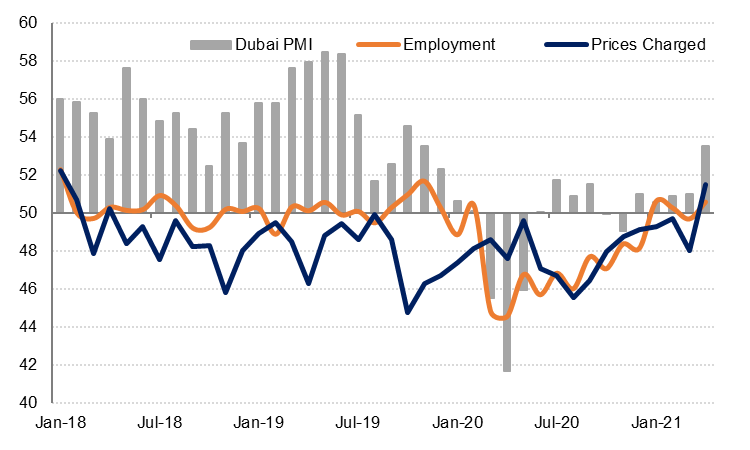

The Dubai PMI rose to 53.5 in April from 51.0 in March, the highest reading since November 2019. New work and business activity grew at the fastest rate in over a year, and the employment component of the PMI moved back into expansion territory at 50.6, although the rate of job growth was slight. Business optimism was sharply higher in April than in the preceding months, indicating greater confidence in the recovery.

Input price inflation eased in April, although input costs did rise slightly and supplier delivery times lengthened for the third month in a row. Firms raised selling prices in April for the first time in three years.

All three Dubai sector surveys showed an improvement in business conditions in April.

Source: IHS Markit, Emirates NBD Research

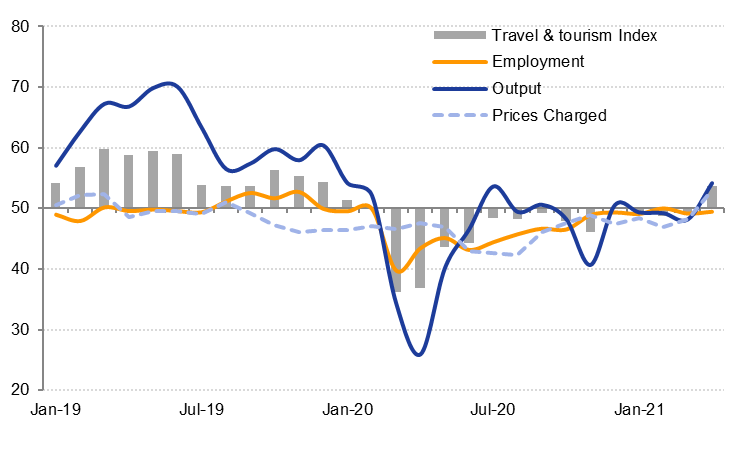

Source: IHS Markit, Emirates NBD Research

The travel & tourism sector index rose to 53.6 in April after three months of sub-50 readings, as business activity and new work increased at the sharpest rate since the pandemic began. Selling prices in the sector increased for the first time since August 2019 and firms were the most optimistic about their future output than they have been in 14 months. However, since the April survey was carried out, the UAE imposed a travel ban on passengers from India which may weigh on travel & tourism activity in the coming months, as will the fact that the UAE remains on the UK’s red list for now.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The wholesale & retail trade sector index rose to 53.1 in April, the highest reading since July 2020. New orders increased sharply from March, and business activity grew at a faster rate as well. However, there was still some job shedding in the sector. Input costs rose again in April but at a much slower rate than in March. Firms in the wholesale & retail sector reduced selling prices for the ninth consecutive month despite facing higher input costs. Overall, firms in the sector were more optimistic in April than they have been since last summer, but the level of optimism remains below the series average.

The construction sector index declined to 51.9 in April from 52.9 in March, as business activity grew at a much slower rate last month. New work increased at a similar pace to March but employment in the sector contracted again. Input cost inflation eased from March as well. Firms in the construction sector were only slightly more optimistic in April about their future output.