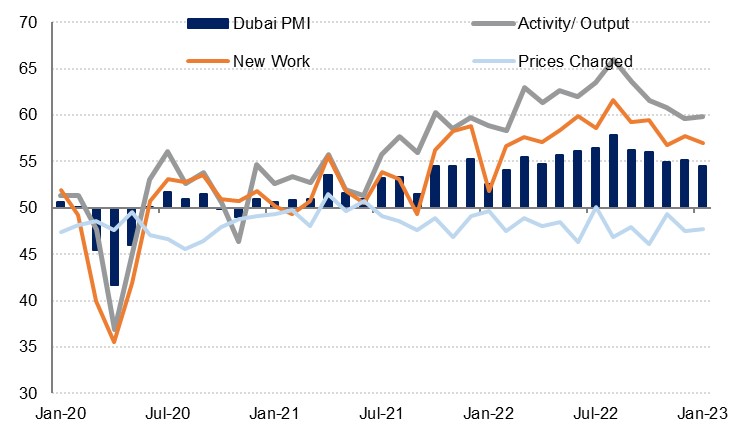

The S&P Global Dubai PMI survey fell slightly in January as it came in at 54.5, compared with 55.2 the previous month. While this is still a robust reading when compared with the negative or weak PMI readings we have seen in the major global economies since the middle of last year, it nevertheless indicates a slowdown in growth momentum that was also evident in Q4 2022. This is in line with our expectations given the headwinds facing the global economy at large, and we forecast that Dubai will see real GDP growth of 3.5% this year compared with an estimated 5.0% in 2022.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

Input costs ticked up again in January, following on from the outright contraction registered the previous month, but the rise was marginal and most firms reported no change in the prices they were paying. This enabled business to continue cutting the prices they charged to customers, with promotions enabling firms to remain competitive, although this was at a slightly lesser degree than seen in December. Output rose at a faster rate than the previous month, and while new work accelerated at a slower pace than in December, the subcomponent remained at a high level, suggesting a healthy pipeline of activity that should support activity in the coming months.

The PMI for travel & tourism was the strongest performing of the three individual sectors covered by the survey in January, as the headline measure rose to a three-month high. New work also accelerated substantially compared with the previous month, supported by ongoing discounting as prices charged fell for the second month in a row, albeit at a shallower pace as compared with December. Business ramped up their hiring in order to deal with the strong output level and an acceleration in new work which was at a three-month high.

Business conditions in in the construction sector improved again in January, albeit at a slower pace than in December. Output increased sharply and new work growth picked up to the fastest pace in several years, suggesting ongoing demand in the coming months. This was supported by a second consecutive month of price discounting. The uptick in new orders helped drive an improvement in business expectations but nevertheless, the pace of hiring slowed in January.

Conditions in the wholesale & retail trade sector also slowed in January, with the headline index slipping to the lowest level since May despite a 10th consecutive month of price discounting. A second month in a row of falling input costs enabled firms to cut their prices, although to a smaller extent than in December. While output growth was modestly slower than the previous month, new orders picked up, and firms increased their headcount for the 19th month running. Nevertheless, business optimism fell back in January, reflecting the potential pressures on the sector from higher interest rates likely weighing on consumption.