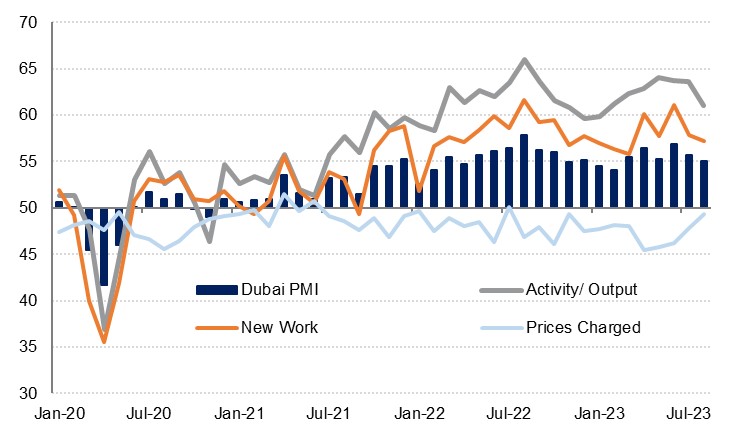

The S&P Global PMI survey for Dubai came in at 55.0 in August, down from 55.7 the previous month. This was the lowest reading for the index since February but is still comfortably above the neutral 50.0 level and remains indicative of an expanding economy. We forecast real GDP growth of 4.0% in Dubai this year.

New orders continue to expand strongly, if at a slightly slower pace than the recent trend. This is contributing to strong business optimism which remains high, rising to the second strongest reading in two years in August. Firms are hiring in this environment, and employment expanded at one of the fastest paces of the past eight years. Firms are still discounting to ensure new work continues to come in in a competitive environment, but this was at the joint slowest pace since November. With input costs rising more quickly, this will be eating into firms’ margins.

Travel & tourism was still the strongest of the three sectors in August but while it continued to expand this was at the slowest pace since January. Firms raised their selling prices for the first time since November last year as input costs accelerated again. Business optimism was strong, rising back to the level seen in June, and firms ramped up their hiring. New orders were moderately slower but still strong. The Dubai tourism sector has performed strongly this year, with visitor numbers in H1 exceeding 2019 levels for the first time since the Covid-19 pandemic.

The construction sector slowed to a four-month low in August and was the weakest-performing of the three sectors, and the outlook for the coming months appears weaker also as new work came in at the lowest level since November. Nevertheless, it remains comfortably in expansionary territory. After five straight months of discounting, prices charged picked up once again in August, rising at the fastest pace since October 2021. Business optimism has waned but firms have been hiring nevertheless, with employment rising at the fastest pace since May.

The wholesale & retail trade index also slowed in August, but new orders accelerated compared to July. Firms continued to discount but not to the same sharp degree seen over recent months, while input costs rose more swiftly than in July. Firms expanded headcount for the 26th consecutive month.