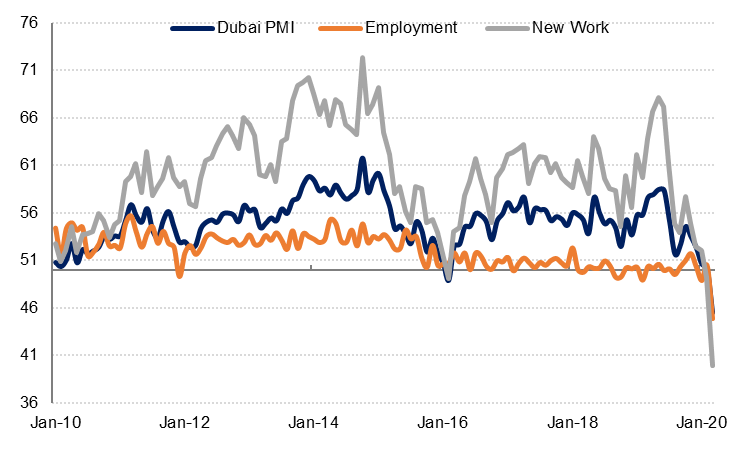

Although the Dubai PMI rose slightly to 52.6 in September, the average reading for the third quarter was the lowest since Q1 2016. This signals a slower rate of growth than the survey data pointed to in H1 2019. There was a marked deceleration in new order growth in Q3, with the September reading for this component the lowest since February 2016.

Output growth picked up in September from August but remains soft compared with the first half of the year. Further price discounting may have contributed to the rise in output/ business activity last month, with more than 8% of firms reporting lower selling prices in September compared with August. The vast majority of businesses reported no change to employment in September, although the seasonally adjusted employment index rose slightly to 50.3. On average, there was no job growth in Dubai’s private sector in Q3 2019, nor in fact for the year to date.

Firms appeared to be a little more cautious looking forward: stocks of inventories increased at the slowest rate since January, and the business expectations index fell to the lowest level so far this year. We note that nearly 60% of firms still expected their output to be higher in a year’s time, but this was the lowest percentage since March 2018.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The construction sector index was unchanged at 50.6 in September, just fractionally above the “no change” level for two months in a row. New work growth in the sector was the weakest since March 2019 and output growth was the slowest since February 2016.

New orders in the wholesale & retail trade sector grew at the slowest pace since October 2016, although output/ business activity was similar to August. Price discounting in the wholesale and retail trade sector was the steepest since April, despite sharply higher input costs, further squeezing firms’ margins.

There was some improvement in new work and output in the travel & tourism sector in September, although the overall sector index was broadly unchanged from July and August at 53.7. The average for Q3 suggests slower growth in the travel & tourism sector relative to Q2.