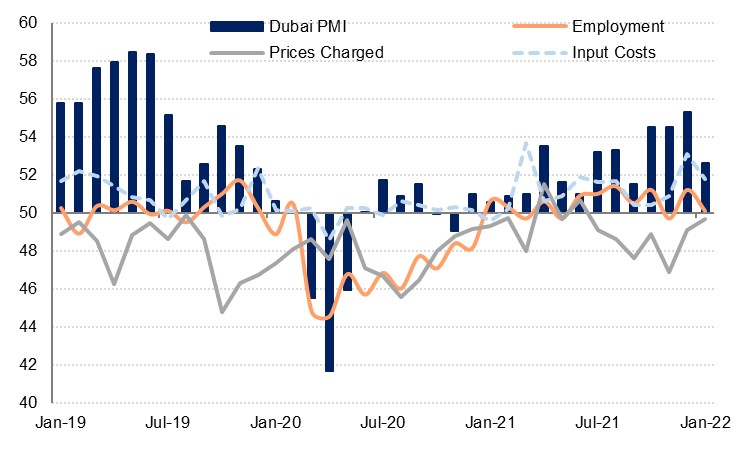

Dubai’s headline PMI reading dipped from its two-and-a-half year high of 55.3 in December, falling back to 52.6 in January as the economy grappled with the fallout of the Omicron variant of Covid-19 alongside the ongoing challenges related to supply chains and inflation. Nevertheless, the positive reading above the neutral 50.0 level continues to signal an ongoing expansion in the non-oil private sector. The index has now been positive for 14 consecutive months since November 2020.

The slowdown in growth was broad-based across all the key subcomponents of the survey, but new business saw a particularly sharp slowdown compared to the previous three months. Output in general remained high compared to recent averages however, as business activity fell only modestly from December’s high reading.

Price pressures appeared to moderate in January, as input prices expanded at a slightly slower pace than seen in December. Firms continue to absorb these costs themselves in a competitive market, as output prices remained in contractionary sub-50.0 territory, albeit by a lesser degree than seen in recent months.

Firms remained positive with regards future activity, but the level of this optimism has fallen to an eight-month low. This was reflected in a slowdown in hiring activity, with overall staffing levels almost unchanged compared to the previous month.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The travel & tourism sector expanded at the slowest pace since June last year in January, as the spread of the Omicron variant weighed on the robust recovery seen in the preceding months. New work slowed, and business optimism with it, which fell to a 10-month low. Most firms still expect stronger conditions in 12 months’ time, however.

The slowdown in the sector saw staffing levels decline for the first time since September. Input costs were broadly unchanged on the previous month, allowing firms to cut output prices even more in a bid to remain competitive; prices charged contracted at the fastest rate since September 2020.

The wholesale & retail sector had the lowest reading of the three industries covered by the Dubai PMI as the headline reading fell to a four-month low of 51.8. Firms’ margins are being squeezed here also as input prices continue to expand while business cut their output prices, although both measures were at a less pronounced rate than seen in December. Respondents here continued to boost staffing levels, however, albeit at a slightly slower rate than seen the previous month.

Construction was the fastest growing of the three sectors in January, with output levels actually expanding to a three-month high of 60.9. Nevertheless, the headline PMI reading dipped compared with the previous month as other subcomponents moderated. Employment turned negative again after expanding in December as new work slowed. Meanwhile input prices accelerated at the fastest pace since March 2021 while firms continued to cut output prices and maintain competitiveness. Business expectations fell to a four-month low but remain higher than the post-pandemic average, if still lower than the long-run trend.

Despite the near-term challenges to growth that have been highlighted by this latest PMI survey for Dubai, we maintain our view that the non-oil sectors will coninue to recover from the pandemic through the course of 2022. While growth may slow somewhat in early 2022, we forecast the UAE's non-oil sectors to expand by 4.0% this year.