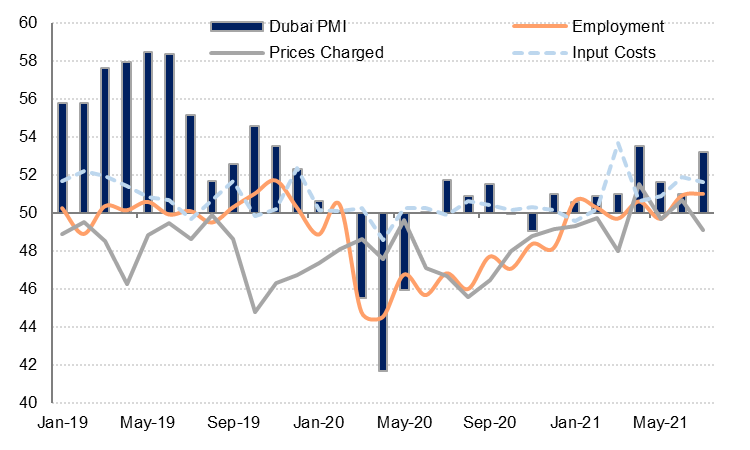

Dubai’s PMI rose to 53.2 in July from 51.0 in June, the highest reading since November 2019. The main driver was faster growth in business activity and new work, on the back of improving demand. Firms increased hiring at the fastest rate since November 2019, with many businesses adding to their sales teams in response to increased consumer spending and footfall. The employment index for Dubai has been in expansion territory in five of the last seven months.

Input costs continued to rise modestly on the back of delayed shipments and shortages, but firms reduced selling prices on average last month to boost sales. Stocks of inventories declined fractionally last month for the first time since January, which likely also reflects supply chain disruptions and longer supplier delivery times.

Despite the solid increase in business activity last month, firms are only cautiously optimistic about the outlook for the coming year, citing uncertainty about the path of the pandemic and continued supply side problems.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

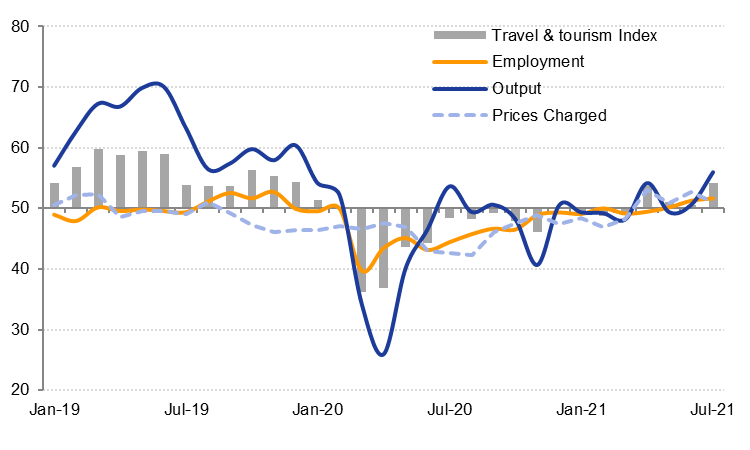

The travel and tourism index rose to 54.1 in July, the highest reading since the pandemic began, despite continuing restrictions on international travel. This was largely due to rising business activity and new work, which may be partly driven by domestic demand over the summer holidays. Firms in the sector increased hiring for the third month in a row and increased selling prices for the fourth consecutive month to help offset higher input costs. The easing of some travel restrictions in key markets from August, and the start of Expo 2020 in October, should support the continued recovery of the travel and tourism sector through the rest of the year.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The wholesale and retail trade sector also saw output and new work increase at a faster rate in July, although this was likely due to steeper price discounting. Prices charged declined at the fastest rate since September 2020, even as input costs increased. However, firms in the sector hired more staff for the first time in five months.

The construction sector index rose to 52.8 in July from 50.9 in June, as output increased sharply. New work also increased modestly in July after declining in June, but business expectations about the coming 12 months were softer.

We remain optimistic that non-oil sector growth will continue to accelerate through the end of this year, underpinned by high vaccination rates, increasing consumer spending and a gradual rebound in international travel.