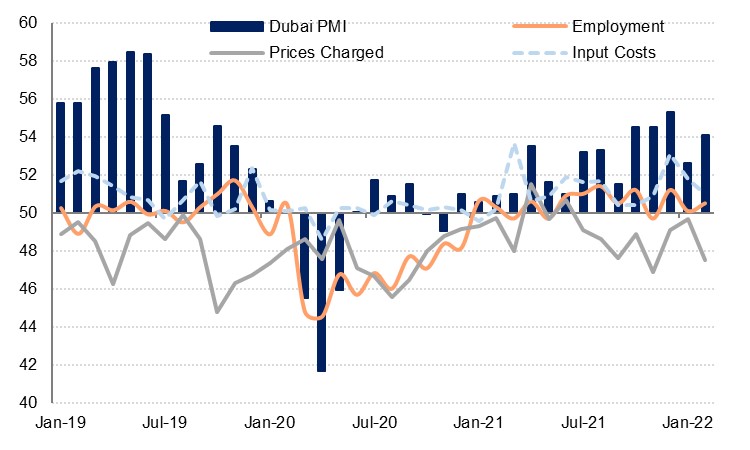

Dubai’s PMI ticked up in February as pressures related to the Omicron variant of Covid-19, which had weighed on the economy at the start of the year, dissipated. The headline reading ticked up to 54.1, compared with 52.6 in January, driven by a sharp acceleration in the pace of growth of new work. The travel & tourism sector in particular saw an uptick as restrictions on travel and movement eased. In terms of output, this continued to expand rapidly though at a similar pace to that seen the previous month.

Price pressures continued to ease in February, with input costs rising at the slowest pace since November, although these will likely pick up once more in subsequent readings given what has developed in commodity markets in recent weeks. Despite the higher input costs, firms continue to cut their prices charged as they look to maintain competitiveness in the market, with the fastest pace of discounting recorded in three months.

Business optimism picked up in February but remained below the Q4 2021 average as firms remained wary of the challenging logistical environment, which could explain why hiring remains lacklustre despite the strong growth in new work. Employment grew only modestly in February.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The travel & tourism sector was the strongest performing of the three individually tracked industries, expanding at the fastest pace since July 2019 as the Omicron wave faded and restrictions were eased internationally. With domestic requirements on PCR tests removed from March 1, businesses were also more optimistic with regards future activity, with expectations at a three-month high. Input prices for the sector were marginally contractionary compared with the previous month, while the cuts in output prices were not as severe as seen in January, and firms expanded their hiring once again following the decline in employment seen the previous month.

Wholesale & retail trade was the respective laggard in February, but it did accelerate compared to the slowdown seen in the first month of the year. Input costs expanded at only a marginally slower pace than in January, while discounting widened, contributing to a fall in business optimism to a nine-month low. Hiring was positive but slightly slower than seen the previous month as output slowed fairly sharply from 56.7 to 53.6. The sector was negatively affected by ongoing supply chain issues as delivery times lengthened and stock levels declined.

Expectations also weakened in the construction sector, with optimism falling to a five-month low as the headline construction index reading picked up from January but remained below the Q4 2021 average. Output levels continued to expand sharply but firms cut staffing levels for the second consecutive month as new work remained comparatively soft.