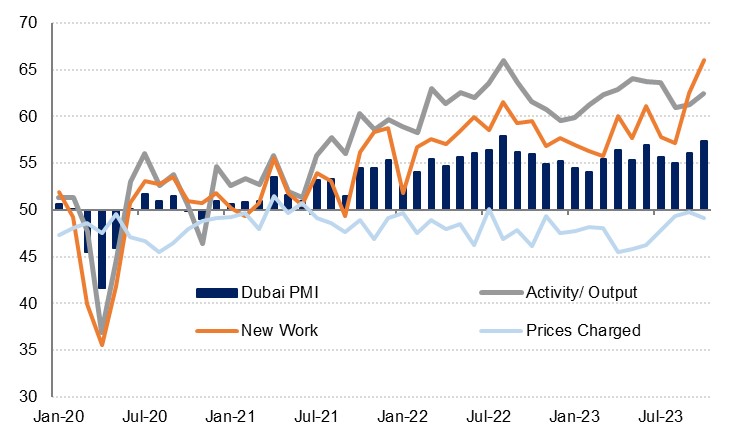

The S&P Global PMI survey for Dubai rose to 57.4 in October, up from 56.1 in September and well above the neutral 50.0 mark which delineates expansion and contraction. This marked the highest headline reading for the survey since August 2022 and indicates a strong start to the final quarter of the year. Dubai recorded real GDP growth of 2.8% y/y in Q1 and 3.6% in Q2 and we anticipate that it will have accelerated further through the second half of the year. As in the wider UAE PMI survey released last week (which was at a more-than-four-year high), it was a robust expansion in new orders that drove the pick-up in the headline reading. Sales growth was at the strongest level since June 2019 with respondents to the survey noting new clients and greater demand.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

Looking at prices, input costs accelerated in October at the fastest pace since last June, with businesses highlighting higher supplier prices. Nevertheless, firms continued to discount their asking prices in order to remain competitive, with prices charged falling at a moderately faster pace than seen in September. Despite these price pressures, business confidence jumped to its highest level since February 2020, just prior to the Covid-19 pandemic, with over a third of firms anticipating higher output in 12 months’ time. Employment headed higher for the 18th consecutive month, although the pace of hiring was the slowest since last September. Stocks of purchases rose sharply in October, rising at the fastest pace in six years.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

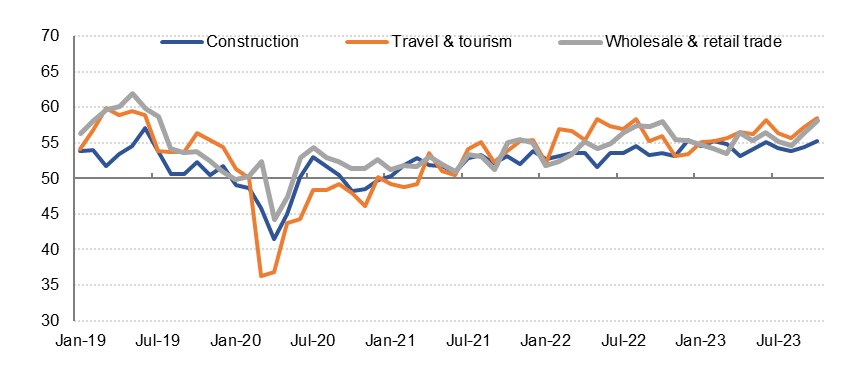

For the 10th month in a row, the travel & tourism sector was the strongest performing of the three individual industries tracked by the survey as the sector index rose to the highest level since mid-2019. New orders accelerated for the second month in a row, helping business confidence back up to pre-pandemic levels. This continued to be supported by heavy discounting, with prices charged falling at a faster pace in October. Visitor numbers to Dubai have hit new records this year and the sector outlook for the next several months is highly positive with COP28 approaching and reports that hotels are already fully booked.

The construction sector PMI rose to its highest reading in eight months, in line with the February survey. The sector also saw a strong expansion in new orders as ongoing economic and population growth continues to underpin new work. With the Dubai budget released this week having earmarked considerable funds for new projects and infrastructure spend, business confidence was high, rising to a multi-year high. New order growth was underpinned by heavier discounting in October as compared with September, however, and with input costs accelerating, margins will be compressed.

The wholesale & retail sector also gained momentum in October, rising to a 51-month high on the back of a solid acceleration in new orders. Output was also higher than in September, and business confidence was at its highest level since January 2020. The sector continued to discount selling prices but at a slower pace than the other two sectors, and to a lesser degree than in September, likely reflecting the pressures of higher input costs which rose at the fastest pace since last June.