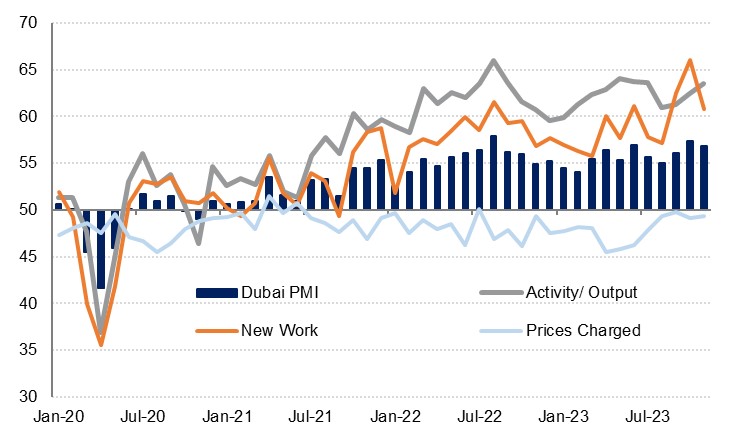

The S&P Global PMI survey for Dubai fell to 56.8 in November, down from the 14-month high of 57.4 recorded the previous month. This was still the third highest reading this year, and it remains well above the long-run series average. Output accelerated in November, rising at the fastest pace since July, but there is evidence of a slowdown from the robust levels of growth seen in recent readings, especially as new orders have slipped to a three-month low.

Source: S&P Global, Emirates NBD research

Source: S&P Global, Emirates NBD research

Businesses continued to cut their output prices in order to remain competitive and prices charged fell for the 16th consecutive month even as input prices continued to rise (albeit at a moderately slower pace than in October). In this environment, there was a sharp drop-off in business confidence in November, falling to the lowest level since April.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

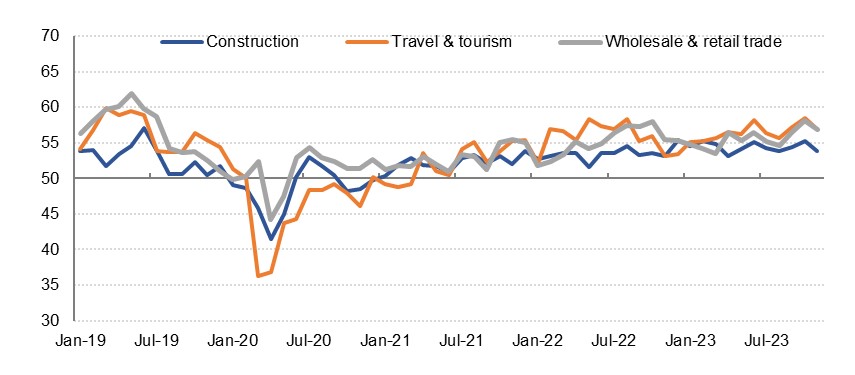

Travel & Tourism

Travel & tourism’s headline reading fell to its lowest since August in November, and after 10 consecutive months of being top, this month it was tied with wholesale & retail trade for the strongest performing of the three individual sectors tracked by the index. Output accelerated to a five-month high, but new work saw a sharp slowdown to a three-month low, and business expectations fell in tandem. Companies continued to discount in order to attract new orders, but not at such a sharp pace as seen in October, while input costs picked up compared to the previous month.

Construction

After the eight-month high seen in October, the construction PMI slipped in November, dropping back to the level seen in August. Output slowed compared to the previous month, while new orders slipped to a three-month low. More positively, input costs expanded at the slowest pace since August, coming down from the sharp rise in October. Businesses continued to discount, but at a softer pace than in October. Business expectations fell to a nine-month low, but firms ramped up their hiring and stocks of purchases growth slowed only modestly from the previous month.

Wholesale & retail

The wholesale & retail trade also slowed in November, dropping from the multi-year high registered on the previous reading but still well above the series average. Output slowed only modestly from October, but there was a marked slowdown in new orders, albeit from elevated levels. Business expectations fell off sharply compared with the previous month, and the pace at which firms hired slowed from recent months back to an 11-month low and not far above the neutral level.