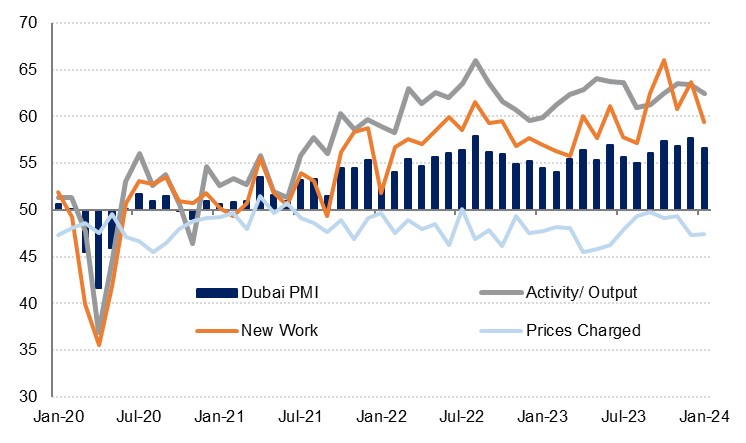

The S&P Global PMI survey for Dubai slipped to 56.6 in January, exactly level with the UAE survey released earlier in the week. For Dubai, this marked a four-month low for the index as it came down from the 16-month high of 57.7 recorded at the close of 2023, but the measure remains indicative of an economy that is expanding strongly, and it remains above the long-run series average. The pipeline of new work continues to expand rapidly even if at slightly softer pace than seen in December and we forecast real GDP growth of 4.0% in Dubai this year, unchanged from our 2023 estimate.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

There are some indications of a softer outlook, however, and the strong growth in output and orders was supported by ongoing discounting as firms cut their output prices for the 18th month running. Firms did increase staffing levels in January but only marginally and at a slower pace than in December, with many reporting that there was no need to increase workforces even with higher workloads. Business optimism fell back to the lowest level since December 2022 as respondents to the survey noted that the diversion of ships from the Red Sea could impact their supply chains. Any impact has not been acute so far as input costs accelerated only modestly in January.

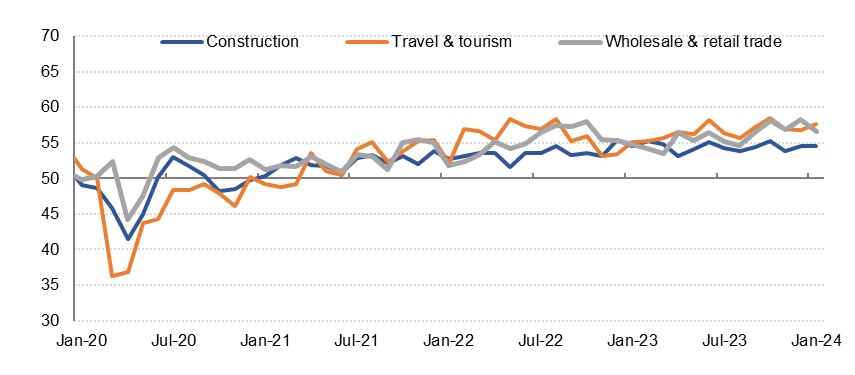

The travel & tourism sector’s PMI indicated the strongest pace of growth of the three sectors individually tracked by the survey, suggesting that 2024 has got off to a strong start after the record number of visitors recorded to Dubai in 2023 (visitor numbers hit 17.15mn in 2023, up 19.4% y/y and 2.5% higher than pre-pandemic 2019). The headline reading rose compared with December and while new orders slowed slightly from December, they remained very strong. There was only a modest rise in input prices, enabling firms to deepen their discounting at a pace not seen since January 2022. Confidence about activity in the year ahead fell to a two-year low, however.

Construction

The construction index also rose in January, albeit only modestly. The sector saw the strongest growth in staffing levels of the three sectors surveyed, even as new orders slowed compared with the previous month. Input prices rose in January, and businesses were able to pass on some of these costs to consumers as output prices rose for the first time since August last year. Business expectations for future output fell to the lowest level since February 2023.

Wholesale & Retail

The wholesale & retail sector saw the worst performance of the three sectors surveyed in January, as its headline reading declined from December’s to a four-month low. New work growth also softened sharply, although it remained indicative of a robust pipeline of new work. New orders were supported by sharper output price cuts which fell at the sharpest pace since July 2023, while input prices ticked up modestly. Business confidence declined but was still stronger than in the other two sectors.