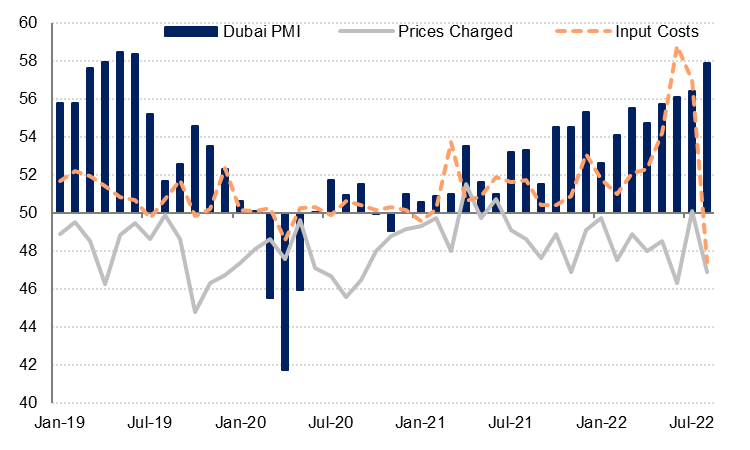

The Dubai PMI, compiled by S&P Global, rose to a three year high of 57.9 in August from 56.4 in July. Both business activity and new work growth accelerated in August and firms added to their headcount for the fourth month in a row. As was the case for the whole UAE, input costs for private sector firms in Dubai fell outright last month, as petrol prices declined after several months of increases. Firms reduced selling to prices to their customers on the back of the easing input cost pressure, which may have contributed to the strength of demand.

Firms also restocked their inventories at the fastest rate in two years, even as their degree of optimism about the coming year moderated somewhat. The business expectations index fell to its lowest level in three months as the global economic backdrop deteriorated.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

The travel & tourism sector remained the best performing of the three sectors surveyed in August, with the index rising to 58.3 from 56.9 on sharply higher output and new work. The index is seasonally adjusted. Employment in the sector increased in August but at a slower rate than in July, and expectations softened as well. The stronger US dollar and weaker global growth backdrop could weigh on tourism going forward, although the sector will benefit from hosting FIFA World Cup guests in November and December.

The wholesale & retail sector also saw faster growth in both activity and new work last month, with the sector index rising to 57.4, the highest level since July 2019. Input costs declined only slightly in the wholesale & retail sector but firms reduced selling prices by the most since October 2019 which likely boosted business output. Inventories increased after declining in July, and firms remained broadly optimistic about their outlook for the coming year, with the business expectations index slightly higher in August than in July.

The construction sector index rose to 54.6 in August, its highest reading since mid-2019, underpinned by strong business output once again last month. New work also increased at a faster rate than in July, and firms in the construction sector boosted hiring as well. Input costs declined in August, likely reflecting lower raw material prices as well as lower energy costs, although firms increased selling prices slightly for the first time this year. Despite the improvement in output and new work, survey respondents were more cautious about the outlook over the next 12 months, with the business expectations index declining to its lowest level in almost a year. Higher interest rates and slower growth is likely to weigh on the sector going forward.

Overall the August survey data points to a strong Q3 for Dubai in terms of real growth, and we expect activity in the key tourism and retail sectors to be supported in Q4 by World Cup visitors and a broad rebound in global travel. However higher interest rates and the resulting stronger US dollar, as well as a deteriorating global growth backdrop are likely to prove headwinds to Dubai's largely non-oil economy in 2023.