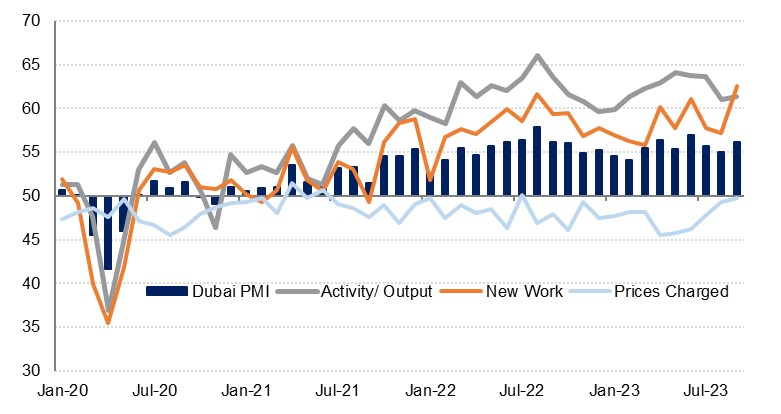

The S&P Global PMI survey for Dubai picked up in September, rising to a three-month high of 56.1, up from 55.0 in August. The index has averaged 55.5 over the first three quarters of the year, exactly in line with the same period last year, and supportive of our 4.0% real GDP growth forecast for the emirate in 2023. A sharp rise in new orders, which expanded at the fastest pace since mid-2019, was instrumental in lifting the headline measure. This also boosted business confidence, which rose to the highest level since March 2020, just before the Covid-19 pandemic crisis took hold. The strong orderbook outweighed the impact of rising costs on sentiment, as input prices rose at the fastest pace since July last year. Nevertheless, firms did slow down their hiring and purchasing activity, with both employment and stocks of purchases expanding at a slower pace than seen in recent months.

The travel & tourism sector was once again the strongest performing of the three individual sectors covered by the survey, coming in at 57.2, from 55.6 in August. This was the strongest reading for the sector since June. While the output component was at the lowest level recorded so far this year, it still indicated a sharp rise in activity last month. The employment measure was almost unchanged on the previous month. The main driver of the improvement in business conditions in September was new order growth, which rose at the fastest pace in three months, ahead of the COP28 event in November.

The construction index was at a three-month high of 54.5 in September, up from 53.8 the previous month. Notably, output accelerated at the fastest pace since mid-2019 and the pipeline looks equally positive as new orders accelerated to a seven-month high. Less positively for businesses, input costs rose at the quickest pace since July 2022, while output prices turned negative once again in September after the first positive reading in six months recorded in August.

The wholesale & retail trade index also improved in September, rising to 56.5, from 54.6 the previous month. Sales rose at the quickest level since mid-2019 and there was a marked improvement in business confidence. This led firms to increase their staffing, which rose at the fastest pace since May 2019. Firms continue to discount but at a slower pace than over the last year.