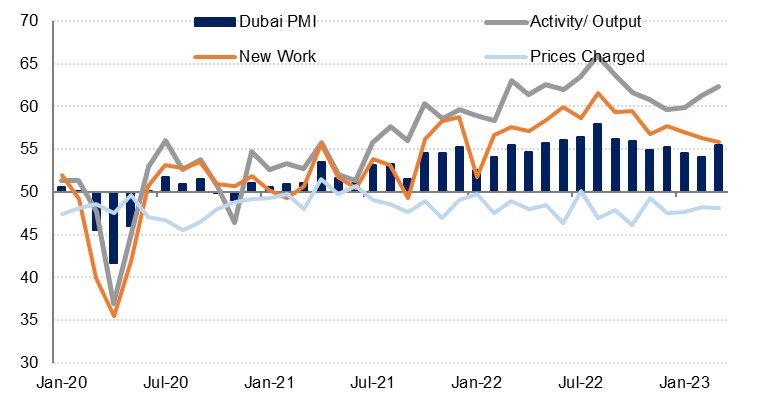

The S&P Global PMI survey for Dubai rose to a five-month high of 55.5 in March, up from 54.1 in February. The first quarter of 2023 was the weakest for the survey since Q1 last year, in line with our expectations that the economy would slow as the headwinds of a global slowdown, high interest rates, and a strong dollar were all brought to bear. Nevertheless, the Dubai economy continues to perform strongly, especially in comparison with much of the rest of the world outside of the local region. We forecast GDP growth of 3.5% in Dubai this year, compared with an estimated 5.5% in 2022.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

Looking at the survey’s subcomponents, output accelerated, rising at the fastest pace since September. In this environment, employment rose at the strongest level since 2018, although this was on the back of a still quite marginal rise in jobs. Firms also ramped up their stocks of purchases, which rose at the quickest pace since May 2018 as firms needed more raw materials for projects. Input costs continued to rise as raw materials prices picked up, but at a softer pace than in February, while the pace of discounting by businesses was largely unchanged from the previous month as firms looked to remain competitive. New orders continued to rise but at the slowest pace since January last year, likely contributing to a fall in business optimism to a three-month low, with only 10% of respondents expecting an increase in output over the coming year.

The travel & tourism sector was the strongest performing of the three sectors covered for the third month running in March, as the headline reading rose from 55.3 to 55.6, a five-month high. The pace of output growth dipped slightly but heavy discounting, at the fastest rate since October, helped new orders pick up at the strongest pace this year so far. Firms’ business optimism was unchanged from February and remains low compared to the long-run averages, but businesses ramped up hiring nonetheless, with employment rising at the quickest pace since October.

Dubai’s construction sector expanded at a slightly softer pace than in February, with the headline sector index at 54.8, compared with 55.2 previously. There was a slowdown across the board, but the general level of output and new work continues to indicate a sector in good health, and business expectations improved in March. After output prices turned positive in February, firms started discounting once more in March as input prices accelerated, but the cuts to output prices were at a marginal level. Hiring was at the strongest level since mid-2018.

Business conditions in the wholesale & retail sector showed the slowest improvement of three sectors covered by the survey. The sector index fell to 53.5 in March, compared with 54.2 in February. This was the weakest reading since March last year, and business expectations softened compared with the previous month. Businesses’ margins are being squeezed as input costs rose at the fastest pace since July last year, while price discounting continued, albeit at a slightly softer pace than seen in February. Nevertheless, firms increased hiring here also, with employment rising at a multi-year high.