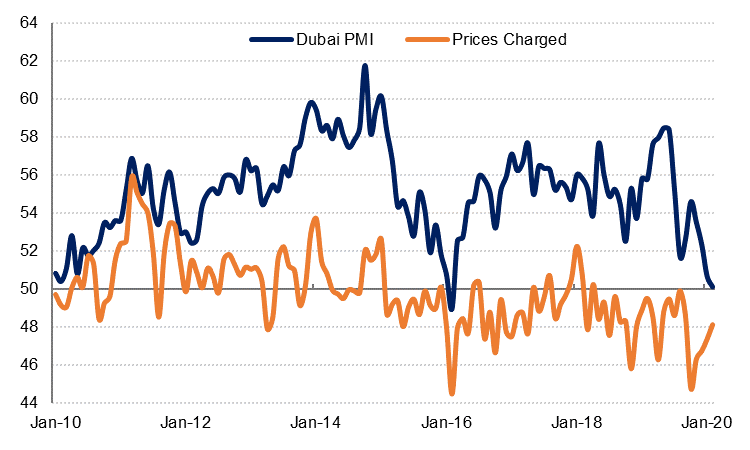

The Dubai PMI declined to 50.1 in February from 50.6 in January, and is the lowest reading since February 2019. While output was slightly up last month, new work declined outright and employment was broadly unchanged in Dubai's non-oil private sector. Business expectations about future output were the softest since July 2017.

The sector surveys showed contraction for the second consecutive month in the construction sector, as both output and new work declined from January. Travel & tourism showed ‘no change’ at 50.0 in February. New work in the travel & tourism sector contracted at the fastest rate since February 2016, likely reflecting cancellations and the lack of new bookings due to coronavirus. The wholesale & retail trade sector index improved slightly to 50.3 from 49.8 in January, as both output and new work stabilized.

Source: Emirates NBD Research

Source: Emirates NBD Research

To a large extent, the February readings are already irrelevant (as is most of the economic data that has been released over the last week) as the full impact of the coronavirus disruptions are likely be reflected in the March figures. Further cancellations of flights continue to be announced, with Saudi Arabia today announcing that all flights to and from the UAE (and several other countries) are suspended. The sharp drop in oil prices over the last couple of trading sessions adds further uncertainty as it will likely affect the willingness and/ or ability of governments in the region to boost spending in the face of an economic slowdown. Our GCC growth forecasts are under review in response to the shift in OPEC strategy as well as the impact of coronavirus on the non-oil sectors.