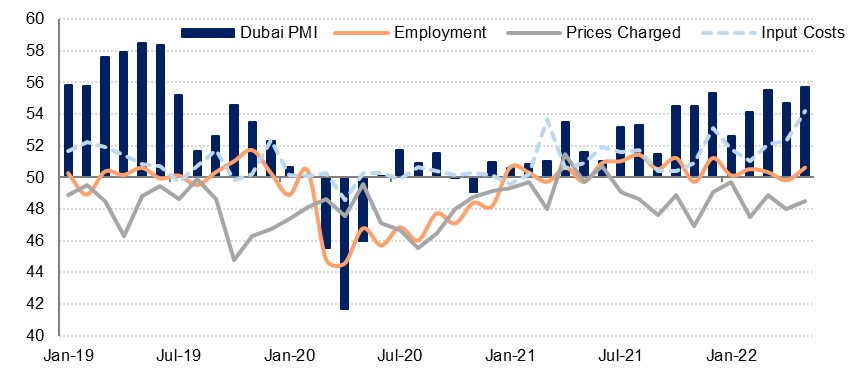

Dubai’s headline PMI survey showed a more rapid expansion in the non-oil private sector in May as it rose to 55.7, from 54.7. This was the highest reading in nearly three years and was driven by a strong rise in output, and in new orders as demand continued to recover from the pandemic crisis.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD ResearchHowever, the headline readings obscure some of the weaker aspects of the survey, with the travel & tourism sector far outpacing wholesale & retail and construction, and mounting price pressures continuing to weigh heavily on firms’ margins. Input prices across the private sector rose at the fastest pace in over four years in May, while at the same time, businesses continue to cut prices in order to attract new work in a competitive environment. This is contributing to a deteriorating outlook on the part of respondents to the survey, and business optimism sank to the lowest level since May 2021.

The travel & tourism sector continues to recover strongly even as EXPO 2020 has passed, and visitor numbers to Dubai were up over 200% y/y over the four months from January to April. The pace of growth in May’s PMI rose to a near three-year high, and new orders accelerated at the sharpest rate since June 2019. However, input prices rose at the quickest rate since January 2018, while firms cut their prices charged by an even faster pace than seen in April. Business expectations sank compared to April, but were still stronger than the Q1 average, and employment turned positive after contracting the previous month.

The wholesale & retail PMI index slowed in May, although it remained stronger than the Q1 average. New work moderated but remained comparatively robust, and employment ticked up for the 11th consecutive month as firms dealt with the strongest output growth since June 2019. Nevertheless, this is being maintained through aggressive discounting as prices charged contracted at the fastest pace in five months. With input costs accelerating, business optimism has sunk to a three-month low.

Construction was the weakest of the three sectors in May for the third month in a row as it came in at the lowest level since January 2021. Output fell to the slowest pace of growth in 10 months, and concerningly for the next several months, new work was negative for the first time since September 2021. Output prices were negative again for the sixth month running, albeit at a less pronounced rate than seen in the other two sectors in May. Input prices accelerated again however, at the fastest pace since March last year, and business expectations were at an eight-month low.