The government of Dubai has announced another AED 500m of aid for businesses in the Emirate, taking the total assistance up to almost AED 7bn in Covid-19 relief. Most of the aid will be in the form of exemption from fees or lower rents, helping firms lower their overheads. However, the new package does not appear to entail any additional spending that would allow consumption and investment to recover. The Dubai Economy Tracker, a PMI for the emirate specifically, has been hovering in the low-50s-range, indicating that the economy is essentially stabilizing albeit at a likely lower overall level of output.

Turkey’s central bank surprised observers on Thursday as its monetary policy committee opted to keep the benchmark one-week repo rate on hold at 10.25%, rather than the 175bps hike to 12.00% predicted by consensus estimates. The lira sold off on the news, rising to nearly 8 against the USD. The bank has continually tightened policy by the back door and the weighted average cost of funds has climbed to 12.50%, as compared to 7.30% in mid-July. While the one-week repo was unchanged on Thursday, the TCMB did hike the late liquidity lending rate to 14.75%, doubling its spread with the overnight lending rate to 300bps. The bank said that it would continue with ‘liquidity measures until inflation outlook displays a significant improvement.’

Some 12 months after stepping down in the face of the protests which really kicked off Lebanon’s economic collapse, Saad Hariri has returned as prime minister after garnering 65 parliamentary votes out of 118. Since Hariri left office last year there have been a couple of short-lived governments, but neither have managed to effectively grapple with the myriad of challenges facing the country. Effectual and decisive leadership is essential if Lebanon is to secure a new IMF deal and release the CEDRE funding promised in 2018.

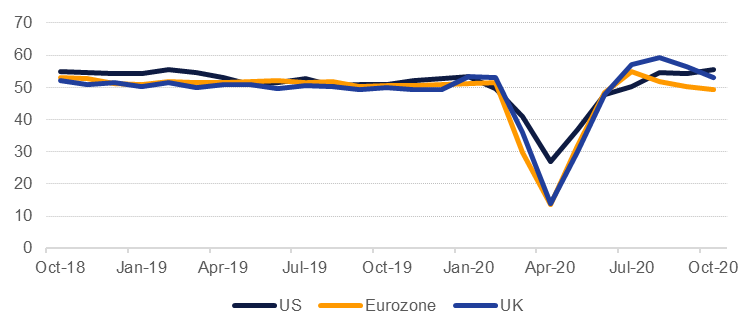

Flash estimates for October PMIs in the Eurozone and UK highlighted the persistent risk of the Covid-19 pandemic affecting major economies. The Eurozone composite PMI fell to 49.4 from 50.4 a month earlier with the services component falling to 46.2, its worst reading since May. Manufacturing is still holding up, printing a strong number at 57.8. In the UK the flash PMI estimate fell from a strong 56.5 in September to just 52.9 in October. A spate of lockdowns across the Eurozone and UK will be drag on services sector growth in Q4, setting the economy up for a particularly soft ending to 2020. The ECB meets at the end of this week with no change in policy rates (-0.5% on deposits) expected. PMI figures for the US, by contrast, were stronger. The composite flash October PMI rose to 55.5 from 54.3 a month ago. Services gained to 56, its highest level since February 2019 as the US economy continues to open up even as outbreaks of Covid-19 continue to spread into previously unaffected parts of the country.

Source: Emirates NBD Research

Source: Emirates NBD Research

US treasuries continued to sink last week, reflecting market expectations that a Blue Wave of Democrats will sweep the Presidency, Senate and House and unleash mega fiscal stimulus in the US. Yields were higher from the 2yr note out to the 30yr. Yields on 2yr UST rose 2bps last week to close at 0.1554% while on the 10yr yields were up nearly 10bps. The expected spending is also steepening the curve: the 2s10s spread closed at more than 68bps, its highest weekly close since February 2019. Any underperformance by Democrats may see a sharp reversal with the curve flattening out and yields compressing.

Emerging market bonds struggled in the face of repositioning ahead of the US election. Emerging market bonds denominated in USD fell by 0.6% last week even as spreads over USTs managed a moderate compression. Minutes from the latest RBI meeting noted that the bank would maintain a dovish tilt to help support India’s economy recover from one of the world’s worst Covid-19 caseloads. Local media in India have also indicated the country could return to international bond markets.

Rating agencies have been active over the last few days in the region. S&P cut its sovereign rating on Sharjah to ‘BBB-‘ with a stable outlook and its rating on Ras al Khaimah to ‘A-‘ from ‘A’ with a stable outlook. Fitch cut its rating on Morocco to ‘BB+’, from ‘BBB-‘, taking it back into high yield territory. S&P is now the only major agency with an investment grade rating on Morocco.

The USD remained on the defensive last week. The DXY index, a measure of the dollar against a basket of major currencies, fell by 1% and closed at 92.768. This marks a move toward the 50-day moving average of 93.266 which may signal further downside risk. USDJPY fell to lows of 104.34 off the back of the USD's weakness and settled at 104.72, a decrease of -0.64%. News of a UK-Japan trade deal being struck was positive but CPI data out of Japan slipped for a second straight month, offering support for the pairing.

The EUR surged by 1.21% and settled at 1.1860 despite some poor PMI data from out of the region. Investors will still be looking to a US fiscal stimulus package, and eyes will be fixed on the US GDP figures to be released this Friday to help set direction for the pair. The GBP surged after the announcement that Brexit talks were to resume, but retreated from highs of 1.3177 mid-week after a UK minister reiterated that no-deal was still an option. Sterling closed at 1.3039, marking an increase of 0.96%. The AUD and NZD both rallied, with the former increasing by 0.81% to close at 0.7139, while the latter advanced by 1.35% and settled at 0.6691.

Benchmark equity markets ended the week higher in anticipation of a boost to growth from a Biden presidency that would provide substantial fiscal stimulus in the US. The S&P 500 index closed up 0.3% although was still down on the week by 0.5%. Positivty surrounding the potential of more Brexit negotiations also hlepd to lift European equities with the FTSE 100 adding 1.3% at the end of the week and gains on both the Dax and CAC 40.

Local markets were mixed. The DFM gave up 0.4% at the start of the trading week while the ADX gained nearly 0.3%. In Saudi Arabia the Tadawul gave up more than 4% as SABIC’s results led the market lower.

Oil prices lost ground last week with Brent futures slipping by 2.7% to settle at USD 41.77/b and WTI falling 2.5% to push it back below USD 40/b at the end of trading. The immediate catalyst for lower prices appears to be market expectation that Libya’s production is going to recover back to pre-civil war levels of more than 1m b/d in the next few weeks, at least according to statements from the country’s National Oil Company. Libya is not bound by the OPEC+ deal to cut production and its oil infrastructure, at least the producing assets, have been relatively less affected by the civil war than some of the midstream infrastructure.