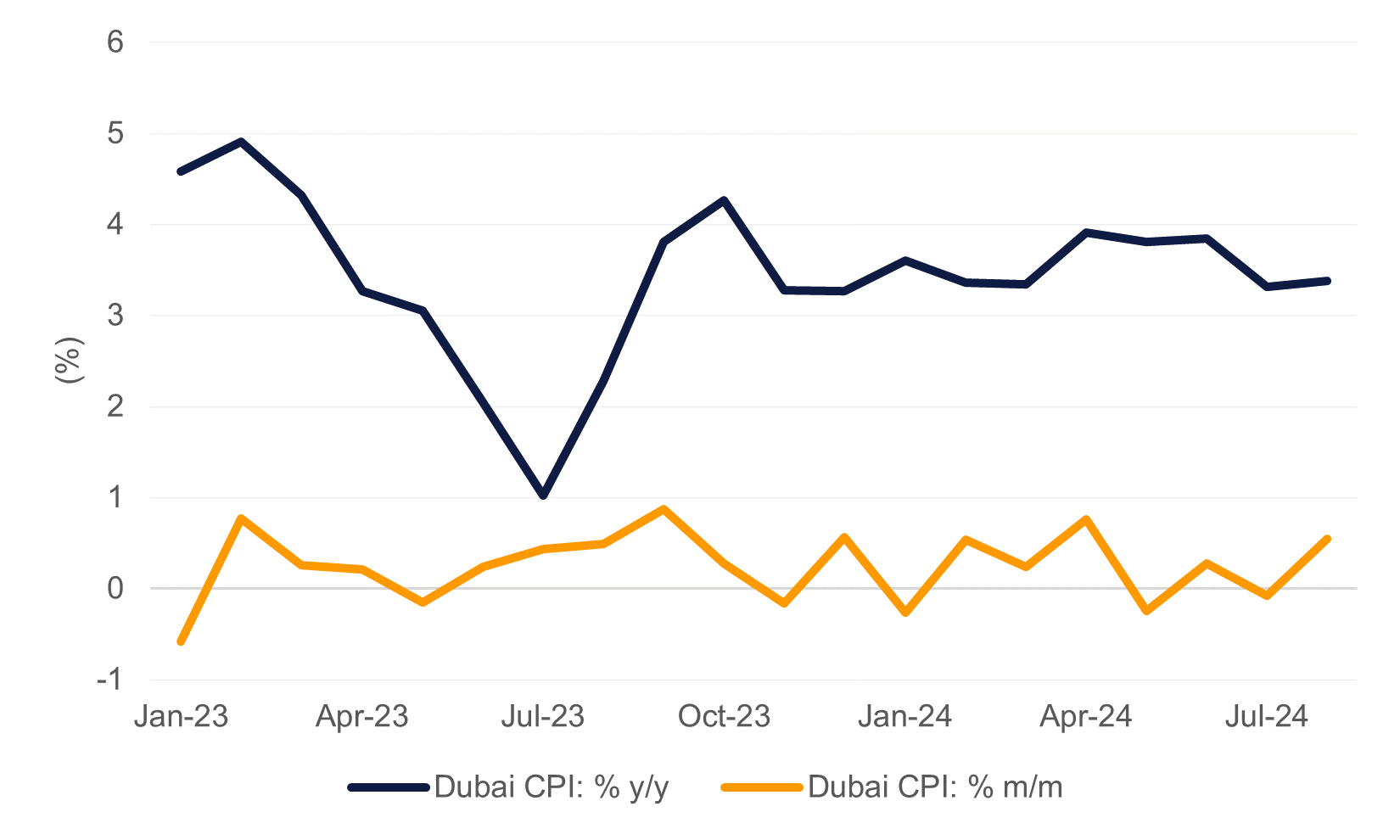

Inflation in Dubai rose by 0.6% month/month in August according to the latest data from the Dubai Statistics Centre. The August print was a pick-up from the modest monthly deflation recorded in July. On an annual basis, CPI inflation rose by 3.38%, up marginally from 3.32% a month earlier. Inflation has been running at 3.6% y/y on average in the year to August, a modest acceleration from the 3.3% y/y recorded for 2023 as a whole.

Source: Haver, Emirates NBD Research

Source: Haver, Emirates NBD Research

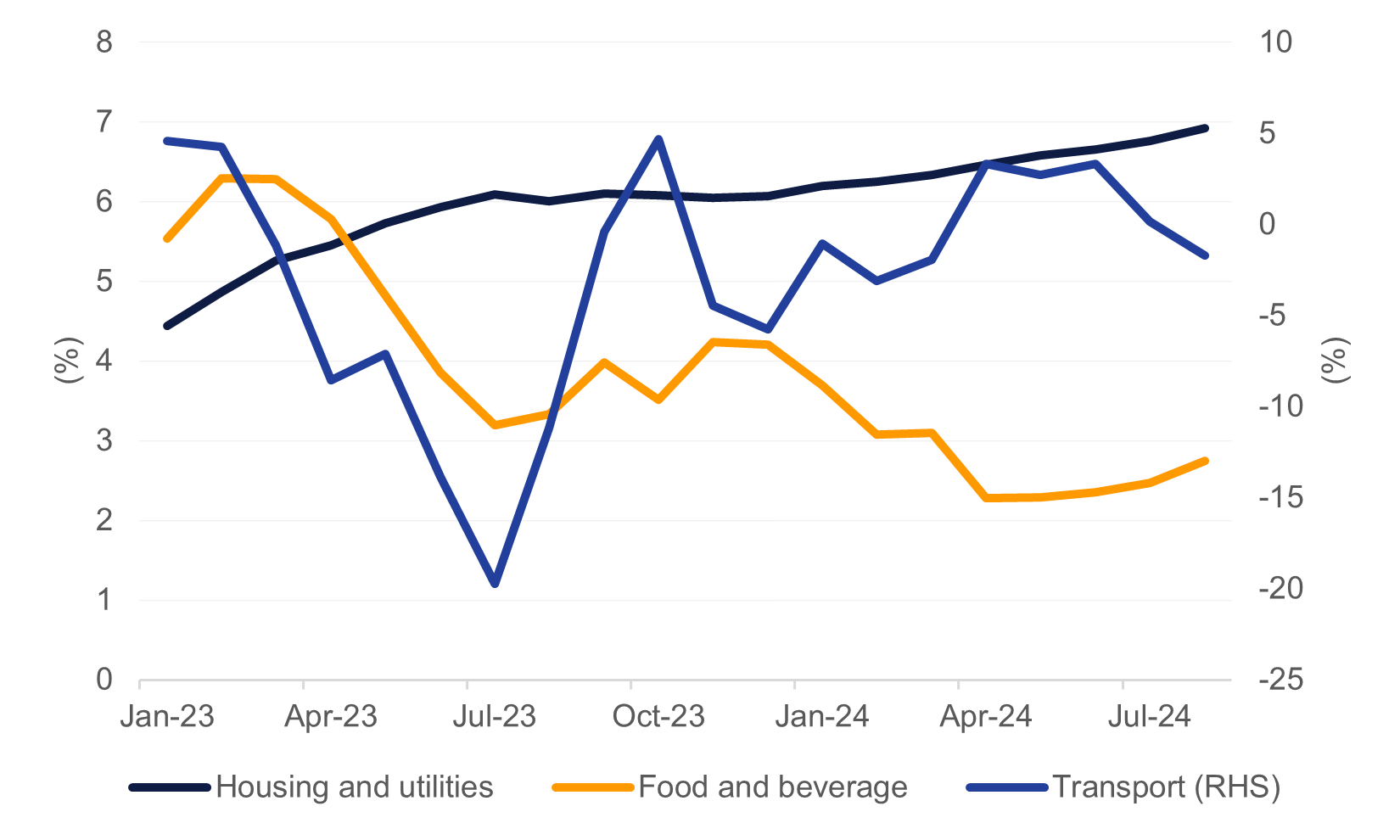

Inflation drivers have been consistent in Dubai in 2024. Housing has risen by more than 6% y/y each month in 2024 with the August housing and utilities component of the basket rising by 6.9% y/y. The rise in housing inflation reflects the underling increase in property purchase and rental costs over the last several years. Given its large weight in the overall CPI basket at more than 40%, housing costs exert a strong influence on inflation overall.

Elsewhere in the August data, transport costs were up by 0.3% m/m though lower on an annual basis while the food and beverage subcomponent also increased m/m, up by 0.6% and was up by 2.8% y/y. Transport costs, which account for more than 9% of the basket, tend to show more volatility on a monthly basis as they are influenced by market costs for oil and refined products.

Source: Haver, Emirates NBD Research.

Source: Haver, Emirates NBD Research.

There was also a monthly jump in recreation prices, up 4.6% m/m and reversing the annual deflation print for July. Other key contributors to inflation in Dubai this year have been financial services (up 5.9% y/y in August) and education fees which have been stable at 3.1% y/y for the last five months.

We expect Dubai CPI inflation at 3.5% y/y on average in 2024, an acceleration from 3.3% recorded last year. Cooling oil prices and energy costs will act as a drag on prices in the final months of the year. Brent oil futures have averaged USD 73/b since the start of September 2024 compared with USD 92/b for the same period in 2023. Housing price inflation will, however, act as a floor to CPI as the index increasingly reflects higher housing prices.