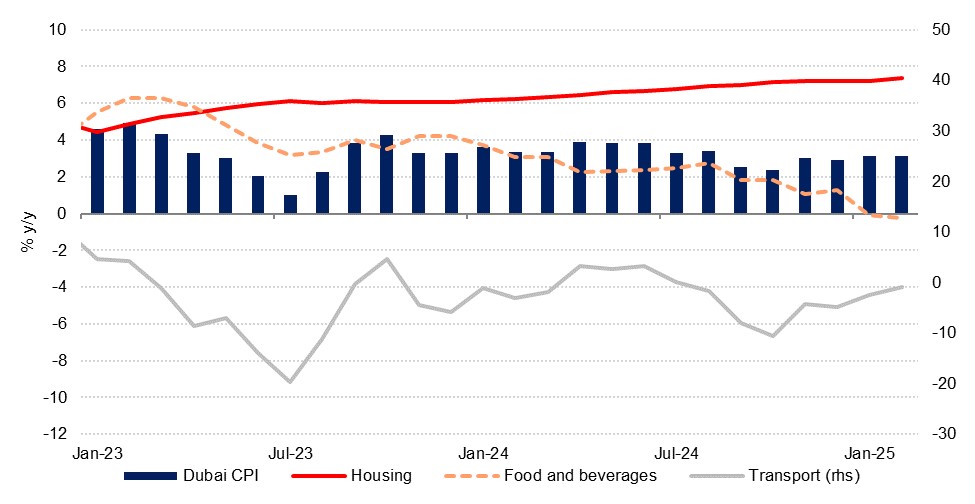

CPI inflation in Dubai was unchanged at 3.2% y/y in February, though the monthly measure accelerated to 0.5% m/m from no change in January. This pace is somewhat stronger than the 2.9% averaged over the course of 2024 but we still anticipate moderately softer inflation this year compared with last, forecasting an average 2.8% in 2025. While the dollar has come off recent highs it remains stronger than the average for last year and this should be supportive of cheaper imports, while weaker global oil prices should also keep price growth in check. Upside risks stem from the potential for a spike in global inflation trends on the back of a nascent trade war.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Housing & utilities is the largest component of the CPI basket, at 40% of the total, and it remains the primary driver of inflation in Dubai as it accelerated in February to 7.4%, up from the 7.2% maintained over the previous four readings. This was the fastest pace of price growth for housing since June 2015. On a monthly basis, housing & utilities prices were up 0.7%, up from 0.5% in January. The price gains are reflective of trends we see in real estate data, where capital values for both apartments and villas rose by an average 2% m/m in February (see https://www.emiratesnbdresearch.com/en/articles/dubai-residential-market-monthly-february-2025).

Outside of housing & utilities, price gains were far softer or in many cases outright deflationary. Prices for clothing & footwear were down 2.7% y/y as retailers implemented discounts in a bid to remain competitive in a crowded market (see https://www.emiratesnbdresearch.com/en/articles/mena-pmis-february-2025 ), while there was only a modest rise in restaurants & accommodation prices which were up 0.7% y/y, compared with 1.5% in January. Education, which represents a sizeable 8.2% of the basket, remained steady at 2.8% y/y and flat m/m, reflecting the annual nature of price rises in the sector.

Transport, accounting for just over 9% of the basket, remained deflationary as prices were down 0.9% y/y, though they fell at a softer pace than the 2.4% drop in January. On a monthly basis, prices were 3.1% higher, reflecting the 5.0% rise in prices at the pump seen in February (though a litre of petrol still cost 5.9% less than one year earlier). Looking ahead to March, a litre of super 98 cost AED 2.73/l, down only marginally from the AED 2.74/l it cost in February but 11% cheaper than it was in March 2024, meaning that annual inflation should be softer in the next reading. We forecast that Brent futures will average USD 73/b this year, down from USD 80/b in 2024 meaning that the transport component of the CPI basket should continue to exert a downward drag on headline price growth, offsetting some of the ongoing rises in housing and resulting in a modestly lower average CPI print this year.