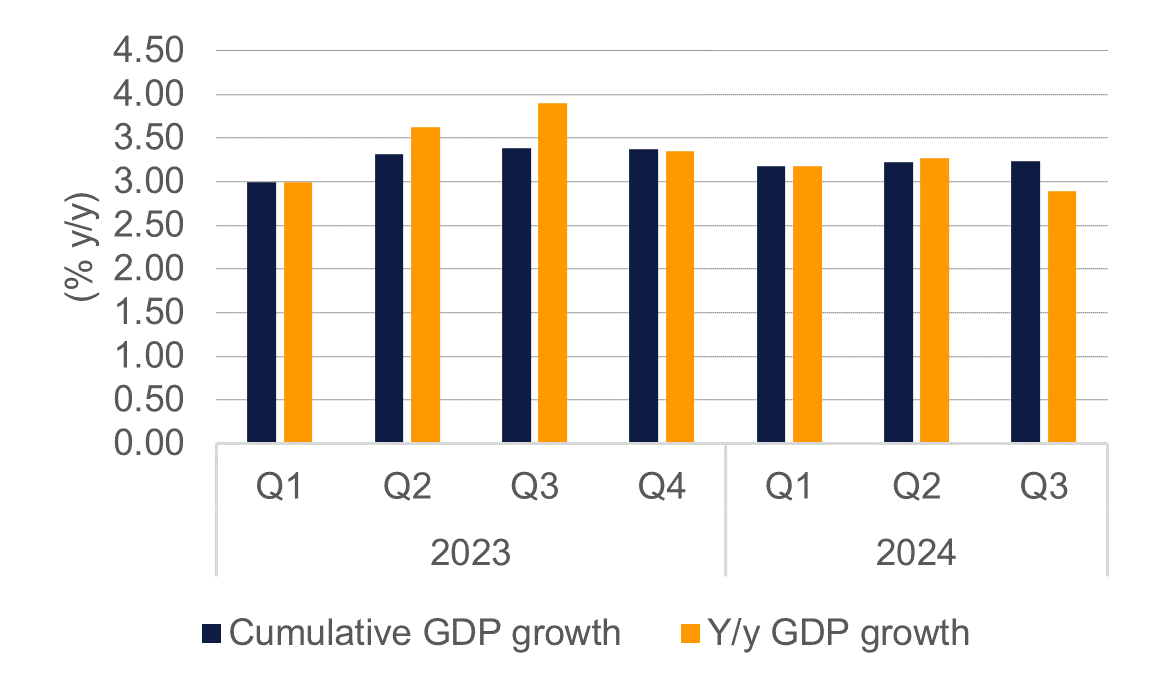

Dubai’s economy expanded by 3.1% in real terms in the first nine months of 2024, according to a statement from the Dubai Media Office. The total level of real GDP reached AED 339bn, up from AED 329bn estimated for the first nine months of 2023. GDP growth on a cumulative basis has been more than 3% y/y for the last seven consecutive quarters with a broad base of activity helping to support Dubai’s economy.

Source: Dubai Statistics Center, Emirates NBD Research.

Source: Dubai Statistics Center, Emirates NBD Research.

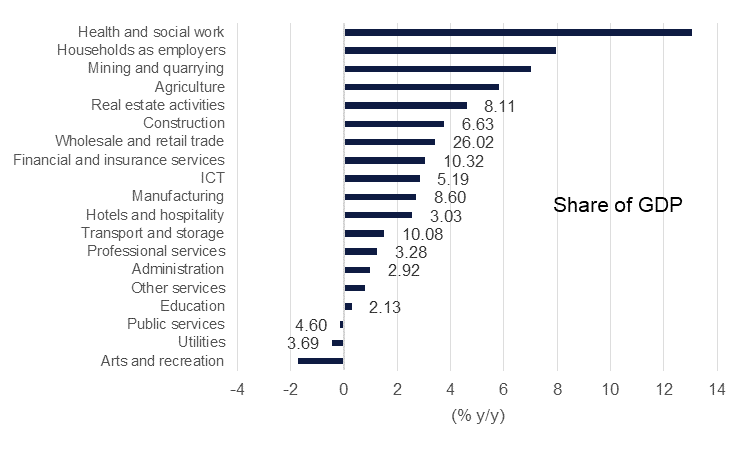

On a year/year basis the economy expanded by 2.9% in Q3 2024 vs the same period last year. The fastest pace of growth was in health and social work but it is a small share of overall GDP. Transport and storage had another strong quarter, rising by 5.3% in the first nine months of the year. In particular, demand for air travel was the primary contributor to growth in the sector. Logistics is likely to receive additional focus in the coming years following the announcement of the UAE Logistics Integration Council earlier in February with the aim of increasing the contribution of the sector to AED 200bn over the next seven years.

Wholesale and retail trade, which represented around 25% of Dubai’s real GDP in 2023, expanded by 2.9% in the first three quarters of 2024. Among the other largest sectors, financial services expanded by 4.5%, manufacturing rose by 2.3% and real estate activities increased by 3.6% in the first three quarters of 2024.

The Q3 2024 print puts Dubai’s economy on track to hit our estimated growth target of 3.2% for 2024 as a whole. PMI data for Dubai’s economy compiled by S&P Global suggests there was a strong upswing of activity in December last year that has carried over into January (both months recorded PMI levels of 55).

Dubai’s economy is in a strong position to record faster growth in 2025, even amid a larger base and some increased external uncertainties. Ongoing government reforms and targeted investment has made Dubai a more attractive destination for international investment, with FDI inflows increasingly going to a broad spectrum of industries. Growth should also be supported by high levels of government and private sector project spending. Easing interest rates as the Federal Reserve has embarked on its rate-cutting should also give a fillip to growth, especially if it encourages increased borrowing and investment by businesses.

Click here to download the full publication