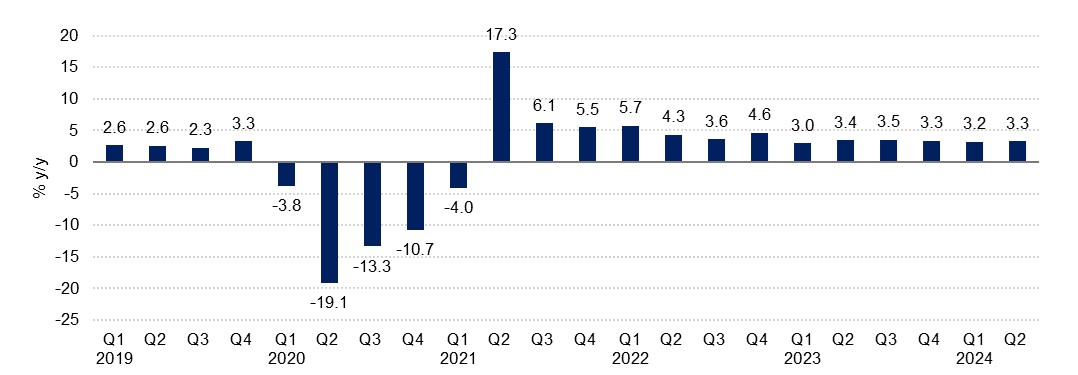

Dubai recorded real GDP growth of 3.3% y/y in the second quarter, an acceleration on the 3.2% for Q1. The growth drivers were broad based across a range of sectors, testament to the ongoing diversification efforts in the economy, and this should mean increased resilience to any external shocks in the coming years. A larger economic base following several years of strong growth means that the pace of expansion has moved to a more sustained level, with expansion of more than 3% y/y for the last six quarters.

Source: Haver Analytics, Government of Dubai Media Office, Emirates NBD Research

Source: Haver Analytics, Government of Dubai Media Office, Emirates NBD Research

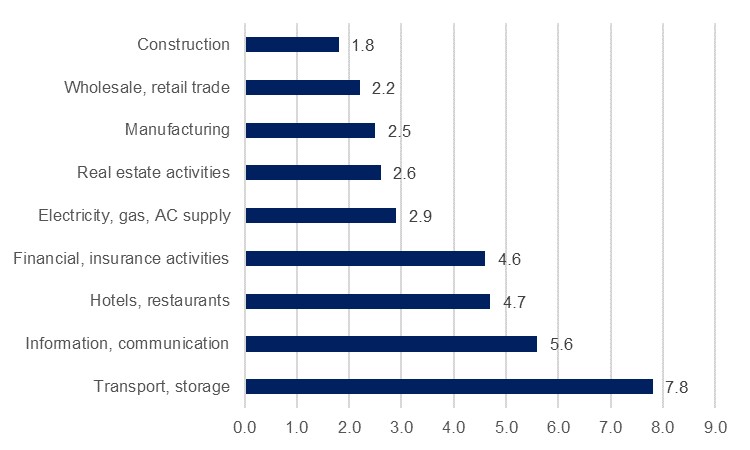

The transportation & storage sector remained the primary growth driver in Q2, expanding 7.8% y/y. The sector is the second largest in Dubai, making up 13.6% of output in Q2, and contributing nearly a third of total growth, similar to the full-year 2023 results. It encompasses air travel, and the strong performance of the national carriers was cited by the government as helping boost growth, with passenger numbers up 4.5% y/y in the period. Dubai International Airport has seen even stronger growth, with passengers passing through the airport up 8% in the first half. This prompted the airport to revise up its 2024 forecast for the second time this year, now projecting 93mn passengers compared with 86.9mn in 2023. Freight volumes at DXB are also up this year, as is cargo at Jebel Ali, the emirate’s container-handling port. The facility handled 7.3mn twenty-foot equivalent units (TEUs) in the first half, growth of 3.9% y/y, while H2 has got off to a strong start with a new record 1.4mn boxes handled in July (see Jebel Ali: Facilitating Dubai's growth agenda).

There are some moderate downside risks to the travel & transport sector in 2025. The risk of trade wars under a second Trump presidency could impact global shipping volumes. Nevertheless, Dubai remains in a good place to weather these challenges. Jebel Ali offers world class intermodal transport links and could benefit from disrupted regional trade routes, while the development of the domestic manufacturing sector should also be supportive. Manufacturing expanded 2.5% y/y in Q2, up from 1.6% the previous quarter and accounts for 9.1% of GDP. With development plans such as the D33 agenda, the sector should continue to grow. For air travel, IATA has announced that global numbers have now fully recovered from the Covid-19 pandemic slump, leaving diminished reopening gains to be won. However, the ongoing growth of Dubai’s tourism sector should continue to fuel air travel demand, with Dubai Airports CEO Paul Griffiths stating that Dubai as final destination now accounts for 60% of passengers, compared with 40% prior to the pandemic.

Source: Government of Dubai Media Office, Emirates NBD Research

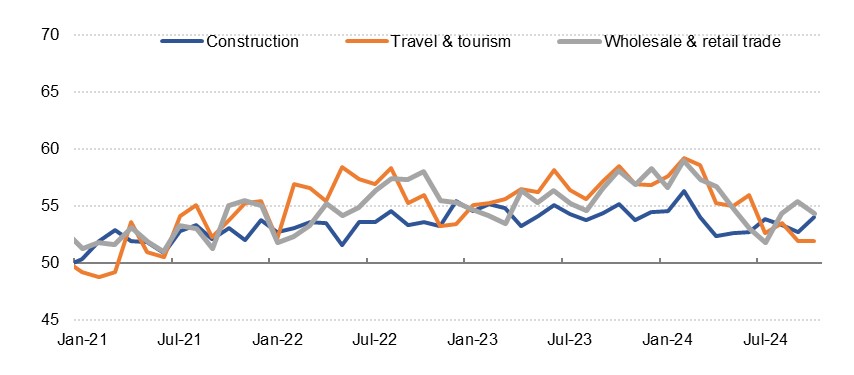

Source: Government of Dubai Media Office, Emirates NBD ResearchRelated to this, accommodation and food services logged y/y growth of 4.7% in Q2, up from 3.8% in the first quarter. Growth this year is slower than the 9.7% recorded in 2023 as reopening gains are now in the base. Nevertheless, the number of tourists visiting Dubai has continued to rise to new records this year, with 9.3mn international visitors in H1, y/y growth of 9% (see Dubai: Tourism sector hits new record in H1 2024). Momentum has been maintained through the first several months of the second half, although with base effects the pace of annual growth has started to slow, with the travel & tourism PMI lower in H2 so far and 11.9mn visitors over January to August meaning an annual ytd increase of 7%.

The growth of Dubai’s population is also likely supportive of the food services sector (see Food services in Saudi Arabia and the UAE), with a host of proxy indicators such as school enrolment and mobile phone subscription figures highlighting an increase in inhabitants. In the GDP data, this was also reflected in 5.6% y/y growth in information & communication, with investment in developing new technologies also contributing to the expansion. The pace of population growth is likely moderating from the apparent sharp rise seen in 2023, however, and utilities (electricity, gas, AC supply) saw slower growth in Q2 at 2.9% y/y, down from 7.5% in Q1. The pace of population growth could also be behind an easing in the wholesale & retail trade sector, which expanded 2.2% y/y, down from 3.0% in Q1. The sector is the largest and arguably most developed in Dubai, however, accounting for around a quarter of output, and so it still accounted for 17% of the total growth.

Base effects following the rapid expansion in 2023 are also likely behind a moderation in real estate activities which grew 2.6% y/y in Q2, down from 3.7% in the first quarter. The sector remains vibrant, with more than 16,800 residential units transacted in September, a new record for the industry (see Residential Market Monthly - October). Its corollary, construction, accelerated to 2.5%, from 1.6% previously and with the construction PMI index broadly in line with H1 so far in the second half and substantial private residential developments and public project works underway the outlook for the coming quarters remains positive.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

Dubai’s economy is in a strong position to record faster growth in 2025, even amid a larger base and some increased external uncertainties. Ongoing government reforms and targeted investment has made Dubai a more attractive place for international investment, with FDI inflows into an increasingly broad spectrum of industries (see GCC: Trends in Foreign Direct Investment) supporting large levels of government investment into infrastructure (see Dubai: Expansionary budget will support GDP growth). Ongoing population growth, even if not at the same pace as the last couple of years, will also be supportive of increased output as the target of 5.8mn inhabitants by 2040 is neared. Easing interest rates as the Federal Reserve has embarked on its rate-cutting should also give a fillip to growth, especially if it encourages increased borrowing and investment by businesses.

We forecast 2024 growth at 3.2%, a modest downward revision from our previous 3.5% projection, with the expectation that growth will accelerate to 3.7% next year, supported by an expansionary government budget.