HH Sheikh Mohammed bin Rashid Al Maktoum has set ambitious economic goals for Dubai in the Dubai Economic Agenda D33. As part of the goals set under D33, the emirate aims to double its GDP from AED 400bn to AED 800bn by 2033. Foreign direct investment (FDI) is a key driver of Dubai's economic ambitions, with the D33 agenda specifically aiming to raise the level of FDI inflows to AED 60bn per year, between 2023 and 2033, from the average AED 32bn per year inflow seen in the preceding 10 years. FDI is key to the emirate’s ambitions because it fuels economic growth through capital accumulation, job creation, adoption of new technologies, and increased productivity. Many studies have shown that there is a positive correlation between FDI inflows and economic growth. The impact of FDI varies from one country to another based on a number of factors like the strength of institutions and policies.

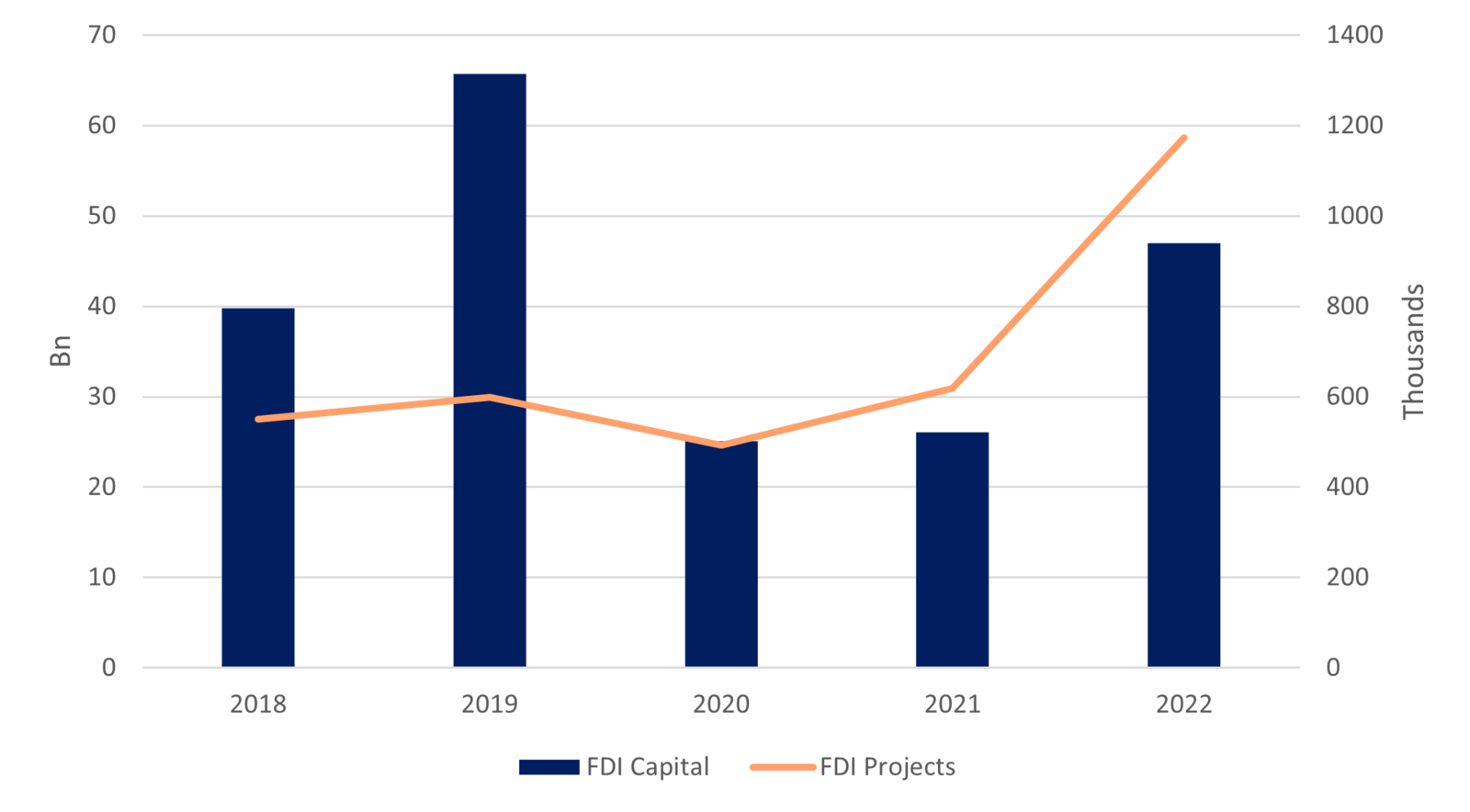

Consistent with these D33 goals, FDI inflows have seen an improvement since the Covid-era lows of 2020 and 2021. FDI increased by 80% y/y from AED 26.1bn in 2021 to AED 47bn in 2022, according to recently released data by DubaiFDI, a division of the Department of Economy and Tourism. Although the 2022 value of FDI inflows is 47% higher than the annual average inflow over the last decade, it remains 28% below the 2019 peak of AED 65.8bn.

The number of announced FDI projects reached a new high in 2022, increasing by 89% y/y from 619 to 1173. The United States was the largest source of FDI projects in 2022, with 235 projects. The United Kingdom was the second largest source, with 152 projects. India was the third largest source, with 141 projects. France was the fourth largest source, with 49 projects, and Switzerland was the fifth largest source, with 47 projects.

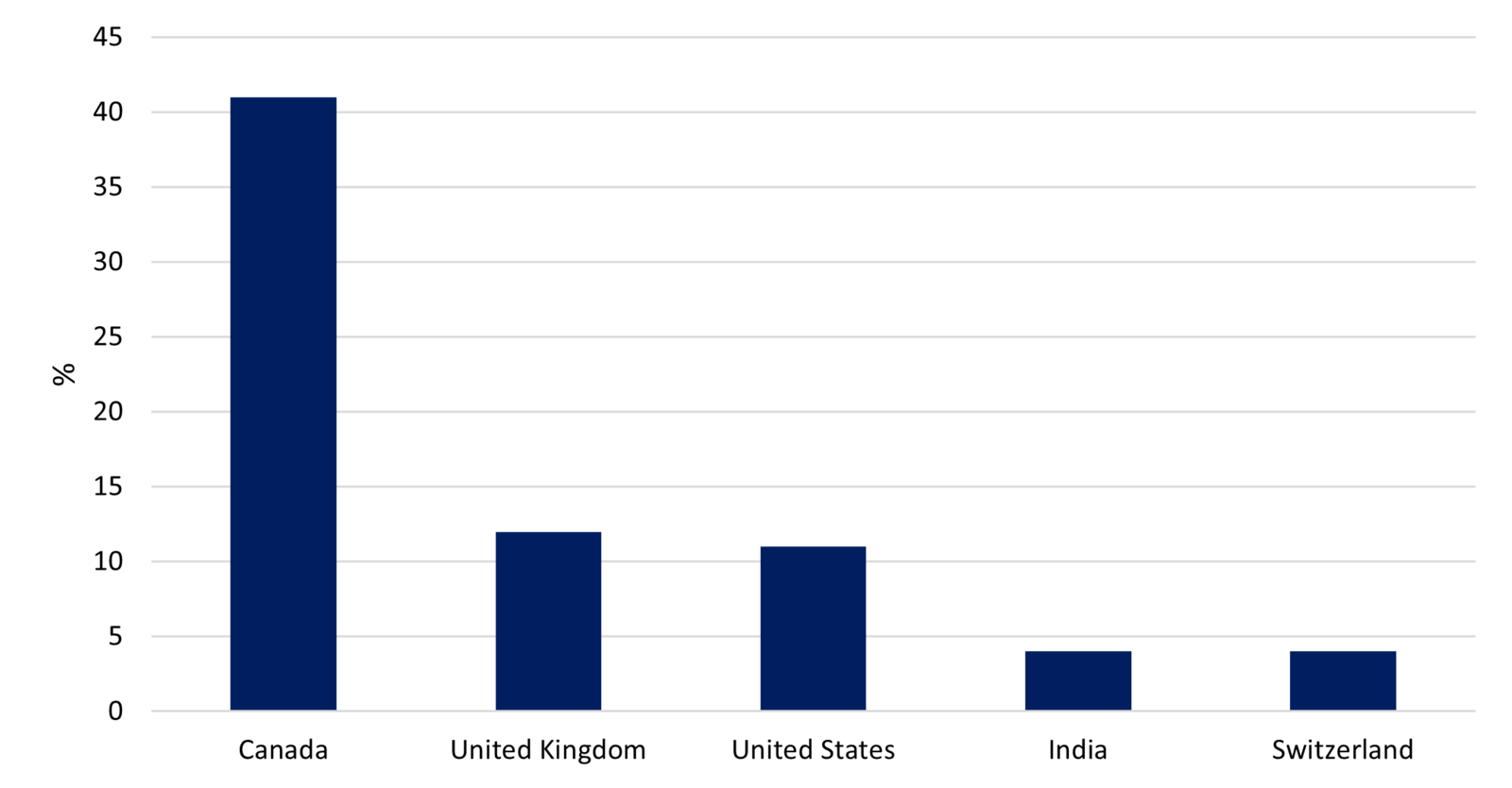

In 2022, Canada was the largest source of FDI inflows, accounting for 41% of the total value of investment flows. Canada’s first appearance in the top five sources of FDI inflows is driven by M&A activity. Canadian fund Caisse de Depot et Placement du Quebec (CDPQ) acquired a 22% stake in the three Dubai-based assets through a new joint venture with DP World for AED 18.4bn. The United Kingdom was the second largest source, with 12% of the total FDI inflows. The United States was the third largest source of investment flows, with 11% of the total FDI value in 2022, but the AED 1.4bn of investment last year is still below the high of AED 5.8bn committed in 2019. India and Switzerland were the fourth and fifth largest sources of FDI by value, respectively, each accounting for 4% of the total.

Importantly it is not just the aggregate value of FDI inflows that have risen in 2022, with a significant share of total FDI inflows going into greenfield investments. Greenfield FDI is characterized by a foreign entity establishing operations in a new country by building new facilities from the ground up. This makes greenfield investments the most significant type of FDI, as they drive economic growth by creating jobs, transferring technology and knowledge to the recipient country, and improving competition.

In 2022, greenfield FDI investments made up 63.4% of total FDI inflows, placing Dubai 7th globally by value of greenfield FDI. Dubai ranked first globally in the number of FDI projects in 2022 with 837 greenfield projects ahead of other major cities like London and Singapore who had 481 and 411 projects respectively, according to the Financial Times Ltd “fDi Markets”. Of these 837 greenfield projects, 56 were international companies’ global and regional headquarters greenfield projects, 148 were advanced information technology greenfield projects, and 24 were research and development FDI projects. Dubai’s share of greenfield FDI projects globally reached a new record at 4.7%, the highest since 2016

*New Forms of Investments refers to non-equity modes of investments, demonstrating market maturity in Dubai and the diverse non-equity-based partnership opportunities across joint ventures, strategic alliances, sub-contracting, licensing, production sharing, franchising, and turnkey projects in the Dubai market

Source: Dubai Economy and Tourism, Emirates NBD Research

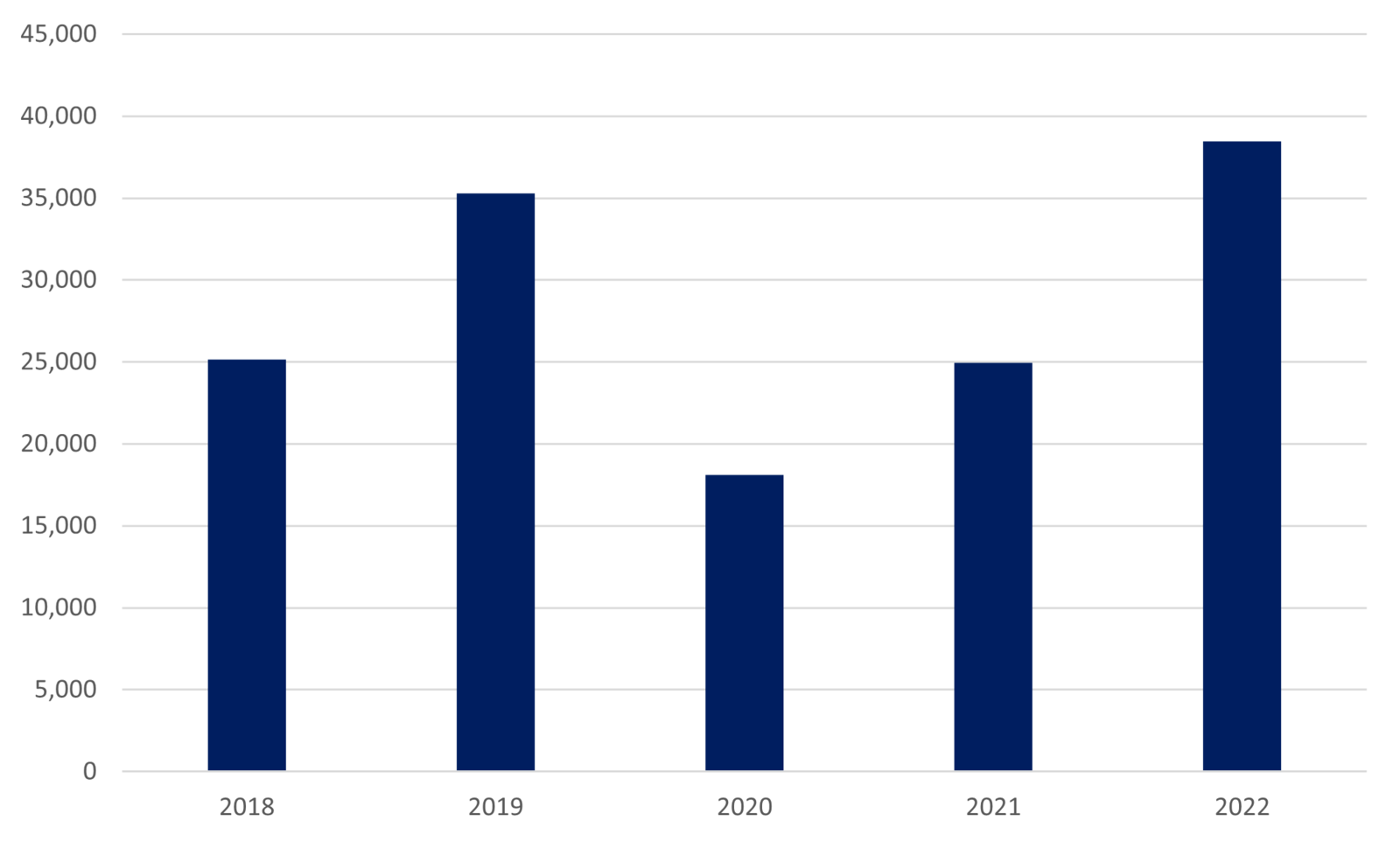

One of the major benefits of FDI is the number of jobs it creates. According to DubaiFDI, 38,447 jobs are likely to be created in Dubai on the back of the FDI announced in 2022, an increase of 54% y/y, surpassing the previous 2019 peak. The United States was the largest source of FDI-created jobs, with 8,766 jobs. The United Kingdom was the second largest source, with 4,498 jobs, followed by India with 3,729 jobs. France was the fourth largest source, with 2,038 jobs. Switzerland was the fifth largest source, with 1,538 jobs.

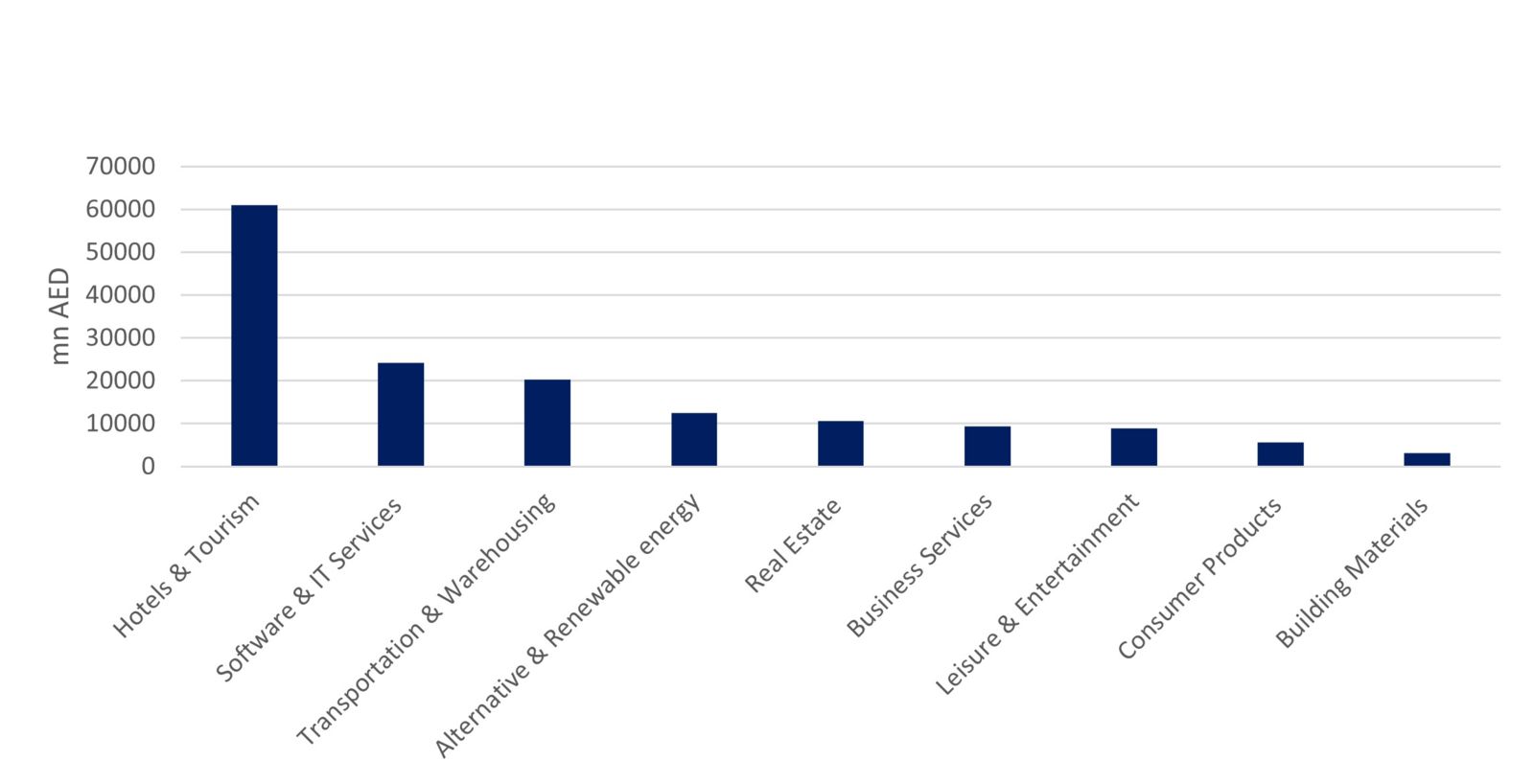

The hotels and tourism sector received the most FDI in the past five years, with AED 61.01bn invested in the sector. In 2022, Dubai ranked first globally in the number of greenfield FDI projects in the hotels and tourism sector, with 16 projects. The large investments in the hotels and tourism sector are not surprising, as Dubai has established itself as a major tourist destination. Dubai was ranked first on TripAdvisor as the most popular destination in 2022, ahead of Bali and London. The city attracted more than 14.36mn visitors last year.

Software and IT services came in second place, with AED 24.2bn in FDI capital invested over the past five years. The rapid growth of the software and IT services sector in Dubai reflects the emirate's ambition to establish itself as a global knowledge and innovation hub. In 2022, companies from 45 countries established software and IT projects in Dubai.

Transportation and warehousing came in third place, with AED 20bn in FDI capital invested over the past five years. Dubai is well-known for its world-class infrastructure, making it a transportation hub connecting east and west. Jebel Ali port is the largest port in the Middle East and the ninth busiest port in the world. Al Maktoum International Airport, the world's fifth busiest airport for international freight.

In 2022 alone however, 45% of FDI capital was invested in the transportation and warehousing sector, underlining Dubai’s importance as a global logistics hub. Alternative energy and renewables received 9% of total FDI value last year (AED 4.3bn), the same as was invested in the hotels & tourism sector. This compares with 4% of the value of FDi in 2019, highlighting Dubai’s commitment to boosting investment in renewables as part of the broader UAE net zero strategy.

Amidst the global headwinds of uncertainty, high inflation, and diminishing liquidity, the task of luring FDI is a huge challenge. However, Dubai is well-positioned to remain an attractive proposition for FDI inflows, thanks to its strategic location as a crossroad for major trade routes, favorable tax rates, strong policies and institutions, and recent robust economic growth.