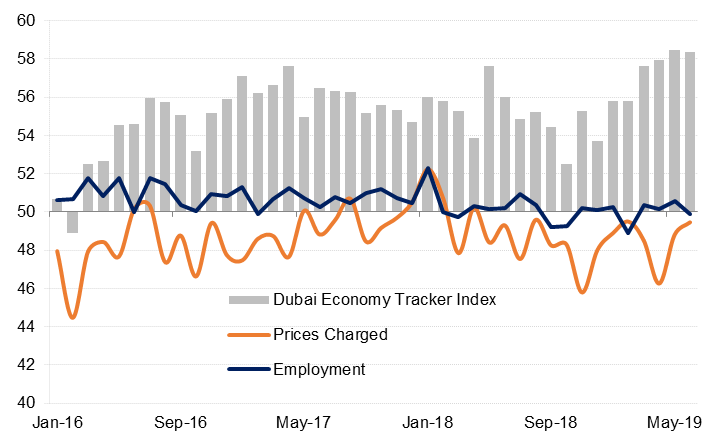

The headline Dubai Economy Tracker (DET) Index was fractionally lower in June at 58.4 but remains near the four-year high recorded in May (58.5). Output and new work rose sharply again last month, and while the selling price index remained in contraction territory, the rate of price discounting in June was slight. The survey data suggests that Dubai’s non-oil economy grew at the fastest rate since early 2015 in Q2 2019.

However, the employment index dipped to 49.9 in June, the lowest reading since February, despite the strong growth in the volume of activity recorded last month, as firms remain reluctant to boost headcount. Nevertheless, panellists remained very optimistic about their output in a year’s time although the degree of optimism was slightly softer than in April and May.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The wholesale & retail sector index eased to a still high reading of 59.9 in June, reflecting slightly softer growth in new work last month. The output index was broadly unchanged from May, and the rate of price discounting was the weakest in nearly a year, suggesting relatively robust demand. The Eid-ul-Fitr holiday was longer this year than it was in 2018 and may have helped boost retail demand at the start of June.

Despite the sharp rise in activity and new work in June, employment in the sector was only marginally higher, with just 1% of firms indicating increased hiring last month, the least since December 2018. This was despite around half of businesses surveyed reporting increased activity and new orders in June. Wages in the sector were also unchanged last month.

Stocks of inventories rose at a slower rate in June, even though the quantity of purchases remained near a record high. Firms in the sector were extremely optimistic about the coming year, with 92% of panellists expecting their output to be higher in a year’s time, and only 1% expecting their output to decline.

The travel & tourism sector index slipped to 58.9 in June, but remains near the record high posted in March (59.8). Overall, the average for Q2 2019 was the highest since the survey began in 2015, which suggests the sector saw the fastest growth in more than four years in Q2 2019. We stress that the sector index is a proxy for GDP in that it measures the volume of activity or value added in the sector, not profitability.

Business activity in the travel & tourism sector rose to a new record high in June and new work growth remained strong, albeit slightly slower than in May. However, selling prices in the sector declined for the third month in a row, albeit only fractionally. Moreover, employment in this labour-intensive service industry remained in contraction territory all through Q2 2019. This is symptomatic of the margin compression that has been evident over the last two years in this sector, and firms’ focus on reducing costs and increasing efficiency.

Output rose at a record pace in June, which helped to push the headline index to a seven month high. We had expected, and continue to expect, strong output growth from the construction sector this year and H1 2020, as contractors aim to finish projects before Expo 2020. What has been more surprising for us is the recent (Q2 2019) acceleration in new orders, which again rose at a faster rate in June 2019. Selling prices declined for fourth month in a row, which may have contributed to the rise in new work.

However, despite a rebound in new work and a sharp rise in activity in June, employment in the construction sector declined for the third month in a row. Again, this highlights the focus on efficiency and productivity in an environment of declining selling prices and margin compression for many businesses. Nevertheless, firms in the construction sector remain extremely optimistic about their output over the next year.

Click here to download the full report.