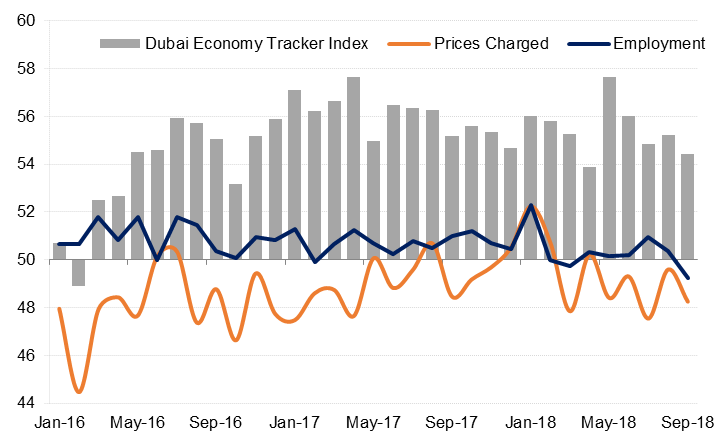

The headline Dubai Economy Tracker Index (DET) declined to 54.4 in September signalling the slowest rate of expansion since April. Both output and new work increased in September but at a slightly slower rate than in August.

However, employment declined on average (49.2) in September, particularly in the travel & tourism sector. Selling prices in Dubai’s private sector declined for the fifth consecutive month, despite a modest rise in input costs. This suggests that firms increased promotional activity and discounts in order to boost demand (ie output and new work).

Stocks of pre-production inventories also rose at the slowest rate since July 2016, indicating less willingness on the part of firms to hold inventories. Firms remain highly optimistic about future output however, with many citing Expo 2020 projects and marketing initiatives as reasons for expected higher output in one year’s time.

The sector surveys showed continued softness in the travel & tourism sector in September, with this sector index falling to the lowest level year-to-date. Momentum in the wholesale & retail and construction sectors also moderated last month.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The travel & tourism sector index showed the weakest growth in the sector year-to-date, declining to 51.3 in September from 52.9 in August and a 2018-high of 57.3 recorded in May. Output and new work grew more slowly last month and jobs in the sector fell for the second consecutive month, as firms cut costs in a challenging environment. Average selling prices also declined in September, the third month in a row of sub-50 readings, even as input costs increased.

Growth in visitor numbers has slowed this year, as the strong USD weighs on demand from key emerging markets such as India and China. The total number of international guests in Dubai grew less than half-a-percent in the year to August, compared with the same period in 2017. In comparison, growth in Jan-Aug 2017 was up 8.2% on the prior year.

Meanwhile, the supply of hotel rooms in Dubai has grown nearly 10% y/y in August (data from STR Global), which has weighed on pricing and is reflected in a -7.1% y/y decline in RevPAR in the year-to-August.

The wholesale & retail trade sector index eased slightly to 55.5 in September, but remained firmly in expansion territory, with both output and new orders holding up well. However, the growth in the volume of activity components appears to be driven by steeper price discounting in September. The output price index fell to 47.8 last month from 48.0 in August, and marked the fifth consecutive month of lower average selling prices in the sector. Input cost inflation remains relatively muted however, providing some relief for firms.

Employment in the wholesale and retail sector also declined slightly in September, after being broadly unchanged for most of this year.

The construction sector index slipped to 53.8 in September from 55.3 in August, the lowest reading since March. While output rose sharply, new work growth slowed in September, despite a decline in average selling prices as some firms offered discounts to gain new business. Jobs growth in the construction sector was the softest since March as well.

However, firms in the sector remained highly optimistic about their future output, with the business expectations index rising to a record high in September. Expo 2020 projects were cited as a key reason for optimism in the construction sector.

Click here to download the full report